Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

On November 5, 2024, Donald Trump, who positioned himself as the "Crypto President," won reelection, ushering in a completely new future for cryptocurrencies and Bitcoin. Shortly after Trump's victory, Saylor sat down for an interview with former ABC anchor Natalie Brunell.

In this interview, Saylor shared his thoughts on the Strategic Bitcoin Reserve policy that the new Trump administration was expected to pursue. He didn't just discuss the feasibility or prospects of the U.S. Bitcoin reserve, but also provided his interpretation of what this policy means in the context of American and world history, and how it would impact the future of the world.

Saylor anticipated Bitcoin's price appreciation regardless of the 2024 election outcome, but he predicted that the "Red Wave" will elevate the future of Bitcoin and cryptocurrencies to an entirely different level. (Source: Natalie Brunell Youtube)

Saylor explains the connection between America's history of territorial expansion and the Bitcoin reserve policy. According to him, cyberspace is the new frontier that America must venture into in the 21st century.

The Bitcoin Reserve Act, introduced by Senator Lummis in July 2024, outlined a specific plan for the U.S. government to acquire 1 million Bitcoin(approximately 5% of the total supply) by purchasing 200,000 coins annually over five years. (Source: LA Times)

"I think the Strategic Bitcoin Reserve will be on the agenda as soon as the new administration is seated in late January. Senator Lummis has an ambitious agenda to put it before Congress in the first 100 days. I think we'll actually see action on it in 2025, and with a supportive House, supportive Senate, and supportive White House, something will happen. The only question is to what extent — will it be the Lummis bill, will it be max, will it be double max, will it be a Trump max strategy.

The logic of the Strategic Bitcoin Reserve is simple: buy the future. Once upon a time, the British looked to the new world. When they realized the future was the new world, they came to the new world. It was actually the new world that powered the British Empire — that's why they won the Napoleonic Wars, that's why they were the greatest empire of the 17th, 18th, and 19th centuries. They were fueled by the power of the new world, just like the Spanish Empire was fueled by the gold of the new world.

Eventually the 13 colonies realized they needed to go west, and as they expanded west, the United States grew into a formidable power. With the Louisiana Purchase, we doubled the land mass of the United States. Napoleon was selling Louisiana to fund a war that he lost, and the U.S. doubled. What happened next was the acquisition of Texas, Nevada, the western territories, and California. Again, going west turned out to be a good trade. It created Hollywood, it created Silicon Valley. It gave America Apple and Google and Facebook and Amazon and movies and music and the Eagles and LA, and made us the cultural capital of the world.

And then we acquired Alaska from the Russians, and it turned out that there were trillions of dollars of minerals and energy underneath Alaska. But now there's nowhere further west to expand. The new frontier is cyberspace. You can't go west; you need to go up. You need to go into cyberspace. And Bitcoin is cyberspace."

In 1803, the U.S. government purchased the Louisiana Territory from France for $15 million. Considered one of America's greatest acquisitions, this expansionary move doubled the nation's territory overnight. (Source: Library of Congress)

From Saylor's perspective, America's current situation is similar to the era of territorial expansion in the 19th century. Now that physical expansion westward has ended, America must expand into a new realm: cyberspace. This framework cleverly connects territorial expansion, which the core narrative of American history, with the current digital revolution.

Saylor supports his logic with historical examples. He places colonization of the New World by Britain, America's purchase of Louisiana, and the acquisition of Alaska — historically successful cases of territorial expansion — on the same level as expansion into Bitcoin. This elevates the Strategic Bitcoin Reserve from a simple investment to an essential geopolitical move for the nation's future.

His definition of Bitcoin as the "cornerstone asset of cyberspace" is particularly significant. It implies that Bitcoin is not merely a digital currency, but a strategic asset for maintaining American dominance in the new world order. Just as the dollar is the reserve currency of today's global financial system, Bitcoin could play that role in cyberspace.

Saylor argues that through a Strategic Bitcoin Reserve, the United States can address its national debt and reshape the global economic order. He explains that this policy carries the significance of "Strategic Expansion" rather than just "Strategic Reserve."

"The logic of the Strategic Bitcoin Reserve is simple: buy the future. If the United States acquires 20% of cyberspace, then all of the capital from the past — from the 20th century, from the 19th century, the gold of the 19th century, the real estate, the bonds, the stocks of the 20th century — they're going to flow into the 21st century, and that's the money that's going from traditional money to Bitcoin.

And all of the capital from China and Russia and Africa and South America and Europe is going to flow into cyberspace, it's going to flow into Bitcoin. The geopolitical logic of the "Strategic Bitcoin Reserve" — which kind of understates it, it makes it sound like we're just buying it in case we need it — it's really the "Strategic Bitcoin Expansion." We're putting a flag in cyberspace where all the money in the world is about to head, and the logic is we might as well get there before the rest of the world decides they need to settle in the Manhattan of cyberspace.

If we do that, it makes us rich. The Lummis bill is worth 16 trillion dollars to the United States in its current form. If they up that, it could be worth double or triple or quadruple that much. We can address the national debt, reduce the national debt, retire the entire national debt. That's obviously a good idea. Getting rich is obviously a good idea. Retiring the national debt with other people's money is a good idea. And of course, if you're a neocon, the best idea would be to retire the national debt with your enemy's money."

Saylor presents the Strategic Bitcoin Reserve as the only viable solution to America's $36 trillion national debt problem. What makes this approach innovative is that it doesn't rely solely on traditional methods like austerity or tax increases to address debt, but adopts a growth strategy through asset acquisition and value appreciation.

The creation of $16 trillion in economic value goes beyond mere numbers; it suggests a fundamental change in the structure of the American economy. Particularly, Saylor's mention of "resolving America's debt with the capital of its adversaries" shows the potential impact of Bitcoin on international political dynamics. The scenario where countries adopting Bitcoin benefit from capital outflows from non-adopting countries demonstrates how digital assets could redefine economic relationships between nations.

And the "Strategic Bitcoin Expansion" Saylor proposes is the concept that makes all this possible. America's expansion into cyberspace by stockpiling Bitcoin goes beyond simple asset storage to an active expansion strategy, reflecting a view of Bitcoin as a tool for national security and geopolitical influence.

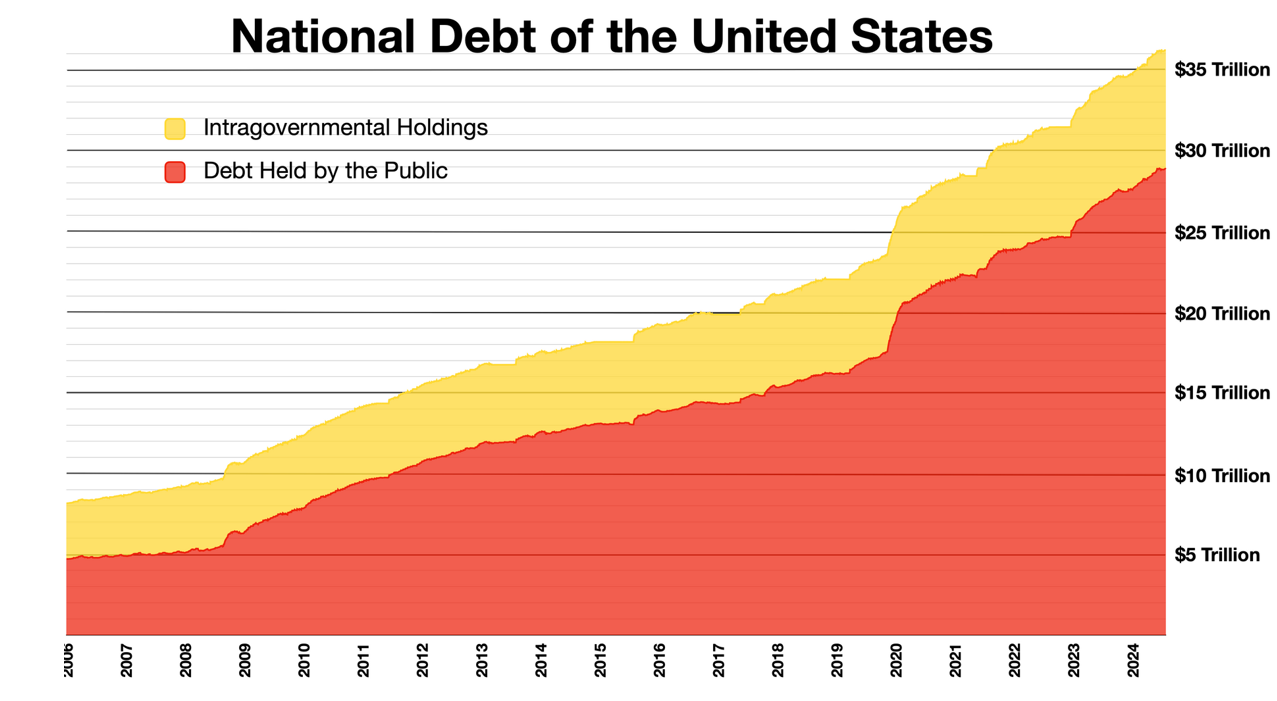

The U.S. national debt began rising sharply after the 2008 subprime crisis and grew exponentially following the COVID-related quantitative easing in 2020. Currently, the country pays over $1 trillion annually just to service interest on this debt. (Source: fiscaldata.treasury.gov)

Saylor argues that Bitcoin will develop into a 'World Reserve Capital Network' and that the United States should be the first to secure it. He predicts that while the dollar is the world's reserve currency, Bitcoin will become the world's reserve capital.

"Another logic of the Strategic Bitcoin Reserve is that if any company or country decides to recapitalize its assets with something other than U.S. Treasury bills, the alternative will inevitably be Bitcoin, and at that point, the United States should also own that alternative. Currently, even Russia and China hold U.S. treasury bills. Our enemies, including all countries and companies, use America's bonds. But if they had to find an alternative, they couldn't go back to gold or silver or seashells or past assets. And they can't choose their own fiat currencies as alternatives because every fiat currency is weaker than the U.S. dollar. So they would have no choice but to choose an asset that's stronger, faster, and smarter — that's Bitcoin. In this sense, Bitcoin has become the future World Reserve Capital Network.

The U.S. Strategic Bitcoin Reserve means that the United States will control this World Reserve Capital Network. Bitcoin miners will run the World Reserve Capital Network, and Bitcoin holders will own this network. A Bitcoin reserve is the best strategy the United States can devise for prosperity in the 21st century. The U.S. already has the world's reserve currency, and now it will own the World Reserve Capital Network as well. If the world starts replacing sovereign debt with Bitcoin, this will bring enormous benefits to the American economy, corporations, and way of life."

Saylor's concept of a "World Reserve Capital Network" is highly innovative and helps us understand the role Bitcoin will play in the global economy. He clearly separates currency and capital, arguing that while the dollar is the world's reserve currency, Bitcoin will be the world's reserve capital. This distinction presents a new paradigm for asset holding in the digital economy.

Saylor's strategy is to maximize U.S. dominance in the global financial system by adding the status of reserve capital(Bitcoin) to the current status of reserve currency(dollar). This can be seen as an attempt to reinterpret and expand the Bretton Woods system for the digital age.

From a realist perspective on international relations, Saylor anticipates that competitors like Russia and China will eventually try to break away from the U.S. dollar system and will have no choice but to choose Bitcoin as an alternative. Therefore, the U.S. should secure Bitcoin first to lead this change. This approach presents a new framework for 21st-century monetary geopolitics.

Saylor believes that the Bitcoin reserve policy will fundamentally restructure the American banking system and economy. He predicts that this change will have significant ripple effects not only in the United States but worldwide.

"The reason Senator Lummis's bill goes beyond simply 'let's buy some Bitcoin' is right here. This is about fundamentally restructuring the U.S. banking system and economy. It's opening the way for U.S. companies to recapitalize through Bitcoin and ensuring that the banking system doesn't collapse. In the past, wealthy individuals and institutions had the freedom to choose Bitcoin, but banks and companies didn't have that choice. Now it's becoming possible.

Ultimately, once the United States adopts this strategy, the whole world will follow. Just as when the United States introduced airplanes and electricity and the world adopted them. Just as when John D. Rockefeller made oil widely available and the world wanted it, if the United States leads with Bitcoin and digital assets, other countries will follow.

The current movement led by Trump, J.D. Vance, and Elon Musk is not just a political change; it's a turning point for America toward technology, freedom, and innovation. The choice on November 5, 2024, has led America into a new world of possibilities, opened the way for the Strategic Bitcoin Reserve to become a reality, and paved the way for the recapitalization of global assets. This is the historic change we're witnessing, and that's why this has been such an important week."

Trump's return to power represents more than just an individual's comeback. It marks the ascendance of a coalition that strongly advocates for technology, freedom, and innovation, resulting in the practical embrace of new technologies and ideas like cryptocurrencies and Bitcoin. (Source: NPR)

Saylor emphasizes the importance of restructuring the financial system through the Bitcoin reserve policy. He sees this policy not as replacing the traditional dollar-centered financial system, but as complementing and strengthening it. In particular, by providing banks and companies with the opportunity to recapitalize through Bitcoin, he argues that the structural vulnerabilities of the current dollar-centered system can be overcome.

This approach reflects the principle of financial diversity — a strategy to utilize various storage assets to increase the resilience of the U.S.-led financial system. Saylor also refers to the historical pattern where the United States expanded its global influence by pioneering key technologies like airplanes, electricity, and oil, seeing Bitcoin as part of this historical continuum.

His characterization of the Trump-Vance-Musk alliance as "not just a political change but America's turning point" is a crucial insight also. This reflects his view that Bitcoin adoption goes beyond a mere economic decision to a fundamental redefinition of American values and future vision. From this perspective, the 2024 election became a watershed moment determining what role the United States will play in the 21st-century digital economy.

In summary, in this interview, Saylor defines the U.S. Bitcoin reserve policy as a "Futuristic Expansive Strategy." He explains that historically, all empires or hegemonic powers have maintained and strengthened their position and power through continuous expansion. In the case of the United States, it built its national power through westward expansion in the 19th century under the ideology of "Manifest Destiny," establishing itself as the world's strongest nation. From Saylor's perspective, the Strategic Bitcoin Reserve is an extension of this expansion policy, with the only difference being that the target has shifted from physical territory to cyberspace.

Saylor interprets the U.S. Strategic Bitcoin Reserve as an inevitable event in the natural flow of American history. In fact, after his reinauguration, Trump has resumed American territorial expansion that had been halted since the 20th century, pushing for the acquisition of Greenland and the return of Panama Canal operation rights. Furthermore, he is trying to expand American influence to a new domain — cyberspace—through the Strategic Bitcoin Reserve.

Saylor's insight shows how America's expansion strategy is evolving into a form fitting for the digital age. The Strategic Bitcoin Reserve will be a key strategy for maintaining U.S. hegemony in the 21st century and a historic attempt to establish American dominance in the new frontier of cyberspace. This could be seen as the beginning of a new form of imperialism in the digital age.

"American Progress" by John Gast, 1872. "Manifest Destiny" was a slogan symbolizing American expansionism during the frontier era, embodying the belief that territorial expansion into the New World was America's divinely appointed destiny. (Source: Britannica)