Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

MicroStrategy was the first publicly traded company to adopt Bitcoin as part of its corporate treasury strategy. When Michael Saylor made this decision as the head of MicroStrategy in August 2020, it was considered radical. Now, four years later, MicroStrategy has outperformed the S&P 500 with the highest returns, validating the effectiveness of this strategy. This chapter explores how MicroStrategy achieved this innovation.

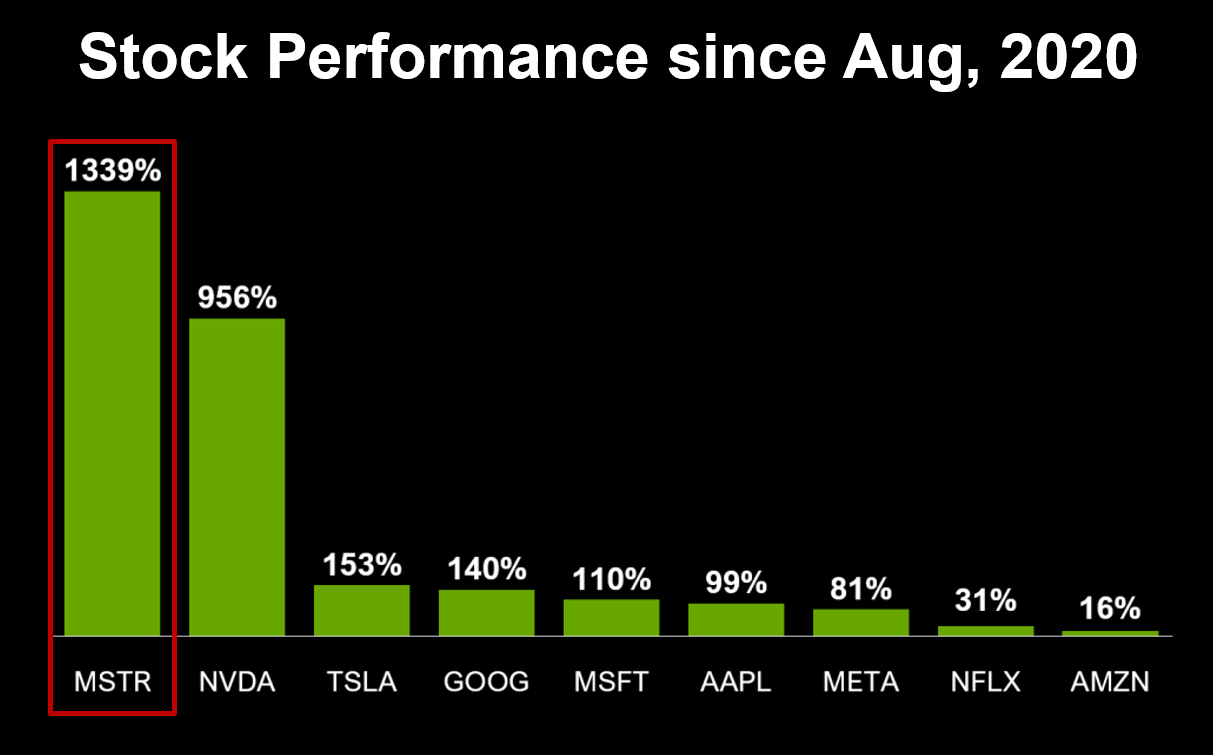

Stock returns for MicroStrategy, the Magnificent 7, and Netflix from August 2020 to July 2024. Saylor's Bitcoin strategy transformed MicroStrategy from a fading company on the periphery to the center of the global stage in just four years. (Source: Bitcoin Conference)

Like many innovations, MicroStrategy's Bitcoin strategy began in a desperate situation. Saylor reflects on the circumstances as follows.

"In mid-2020, we were running a $500 million business with $500 million in cash. We were generating $75 million in annual cash flow with 0-5% growth, competing against Microsoft.

Our stock had zero options trading volume and only $2 million in daily liquidity. The options were worthless, the stock was worthless, and investors showed no interest. We were trapped in a competitive situation with no way out.

We had $500 million in cash earning 4% interest when Jerome Powell suddenly dropped it to 0%. With everyone locked down during COVID-19, the Magnificent 7 stocks doubled in value.

I realized that capital was being siphoned off to the Magnificent 7, and our human capital was being drained too. Even with a good product, all our engineers would leave within five years.

We had three choices. First was death – selling the company. In fact, 99 of our 100 competitors did exactly that. Second was slow death – using our $500 million to pay massive cash bonuses to employees so they wouldn't leave. But eventually the cash would run out, and we'd never escape the hole.

The third option was to take a risk – a transformational acquisition. Either buy a monster company growing 20-40% annually like VMware, or acquire another company with stock or cash to gain a new lease on life."

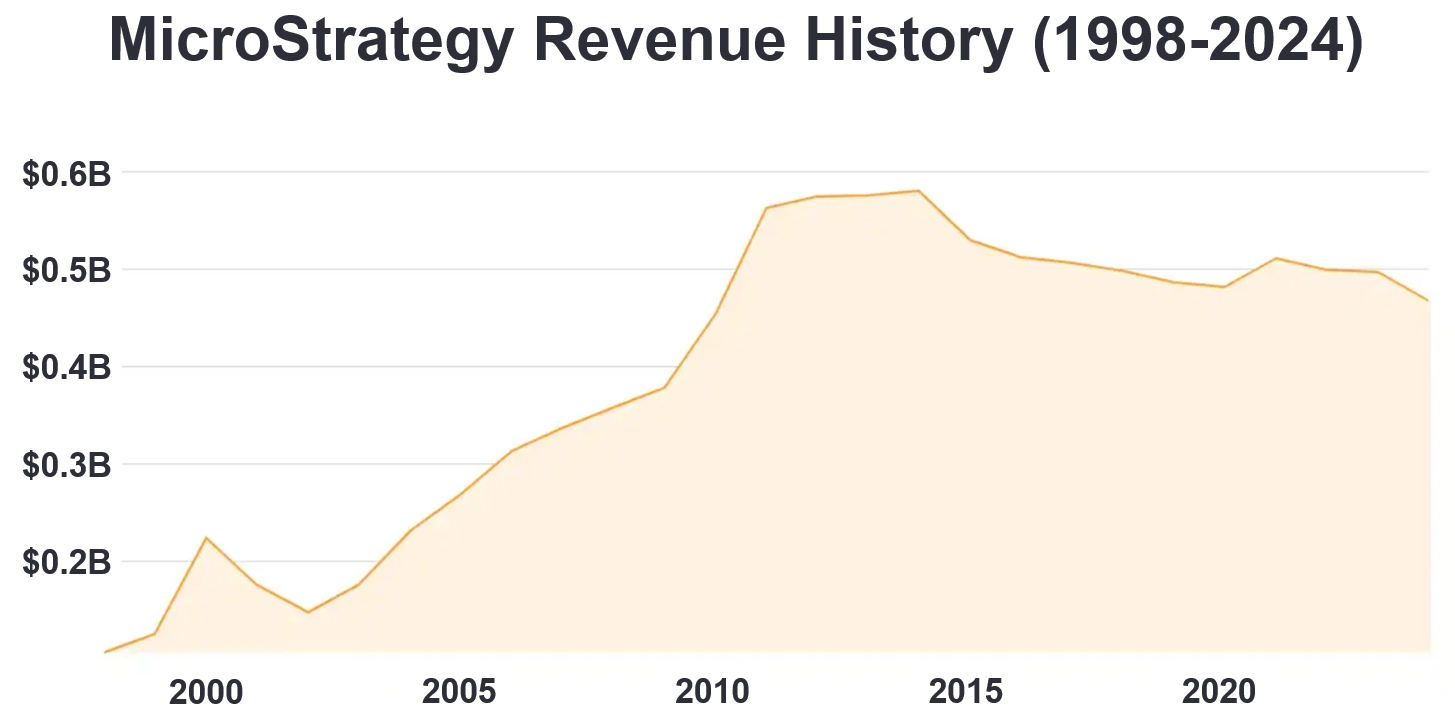

MicroStrategy's revenue peaked at approximately $580 million in 2014 before consistently declining to $480 million by 2020. Saylor, who deeply identified with his company, desperately wanted to find a breakthrough. (Source: NYT)

MicroStrategy's case demonstrates how innovation can arise from desperate circumstances. Amid the economic uncertainty triggered by the COVID-19 pandemic and rapid changes in the tech industry, Saylor concluded that survival was impossible with the existing business model. Instead of extending the company's life through cost-cutting or expanding the existing business, he sought a fundamental solution.

Saylor recognized that his company's struggles weren't simply poor performance, but the result of a massive trend concentrating capital and talent in large technology companies. The Magnificent 7 and similar giant tech firms were creating structural disadvantages for smaller tech companies. Realizing he couldn't compete using conventional methods, Saylor began to view Bitcoin not merely as an investment asset but as a tool for capital preservation and corporate restructuring.

MicroStrategy's Bitcoin strategy wasn't fully formed from the beginning. This approach conceived by Saylor developed gradually through trial and error.

"Initially, it was a strategic move born from frustration and desperation. We had no choice. We had to do something and there were no alternatives. When we made our first Bitcoin purchase, it was our last idea.

Then Bitcoin began to rally toward what was then the all-time high of $19,000. We moved into an opportunistic phase when we discovered we could raise money in the convertible bond market for less than 1% interest. What CEO would turn down billions of dollars for free to pursue their business strategy?

So we issued our first convertible bond, then a second, third, and fourth. We also issued several billion dollars in ATMs (At-The-Market offerings). Then on October 30, 2024, we announced a $21 billion equity shelf registration and $21 billion fixed income plan over three years. This was the largest equity shelf registration in capital market history.

We could do this massive fundraising for a simple reason. For the first time in human history, we had a commodity that returned higher than the S&P with higher volatility. Bitcoin provided 60 Vol(volatility) and 60 AR(annualized return). The S&P was 15 Vol, 15 AR.

It was like turning on a nuclear reactor, or putting an internal combustion engine in a horseless carriage. We installed a crypto reactor in the middle of our company, and Bitcoin was the fuel."

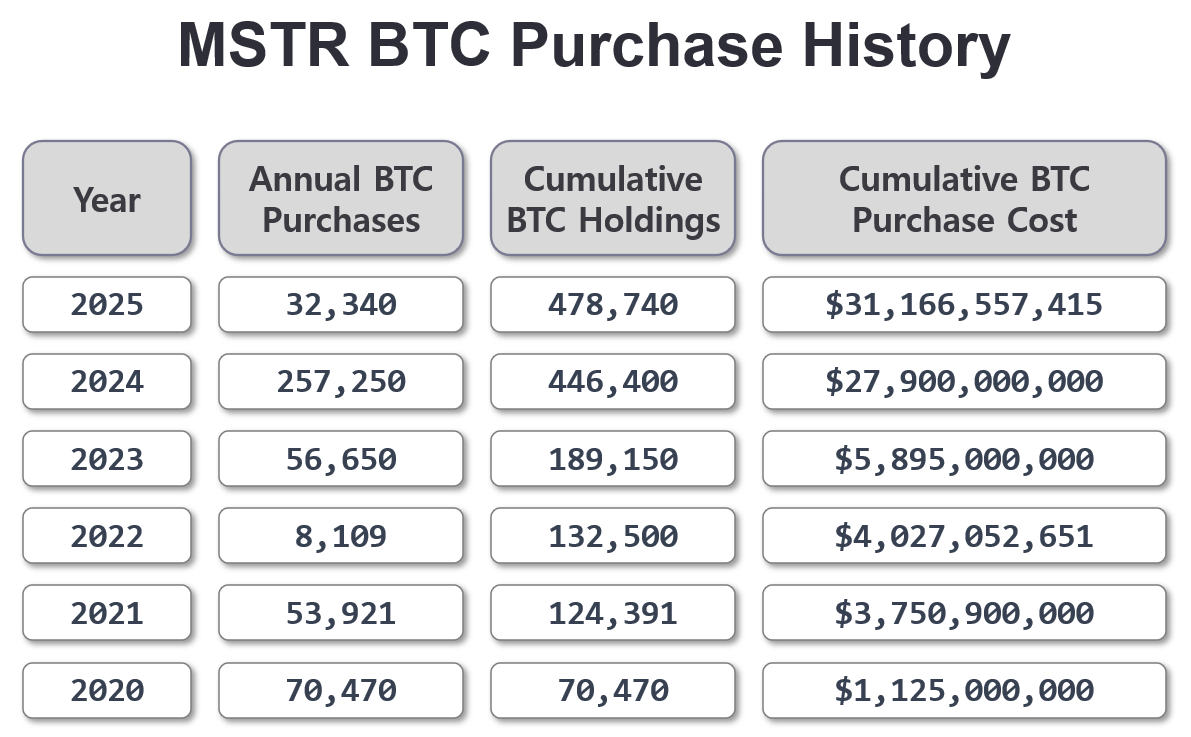

Between August 11, 2020 and February 10, 2025, Saylor's MicroStrategy purchased 478,740 Bitcoin. This represents the largest holdings outside of cryptocurrency exchanges and asset managers like BlackRock. (Source: Bitcoin Treasuries)

MicroStrategy's Bitcoin strategy wasn't perfectly designed from the start. It evolved gradually from an initial decision born of desperation. Saylor initially sought simply a way to use cash as a value store, but over time realized that Bitcoin could be a more sophisticated strategy for innovating the company's financial structure. This shift in perception allowed MicroStrategy to move beyond mere survival to creating a new type of corporate model.

Saylor particularly noted the opportunity to leverage Bitcoin's volatility and liquidity. Recognizing that capital could be raised in the convertible bond market at less than 1% interest, he used this approach to continuously acquire Bitcoin and maximize corporate value. Rather than simply holding, he maximized investment efficiency through active capital market utilization. This was an entirely different approach from how traditional companies tried to increase shareholder value through stock buybacks or dividends.

MicroStrategy's case shows how companies can create opportunities in new financial environments. While many companies consider volatility a risk, MicroStrategy actively utilized it to secure differentiated competitiveness. This innovative approach contrasts with traditional corporate financial strategies and may serve as a reference for more companies in the future.

MicroStrategy didn't stop at simply purchasing Bitcoin. They transformed Bitcoin's risk and return into various forms for different types of investors. Saylor calls this the 'Bitcoin Transformer.'

"Think of our company as a big Bitcoin transformer. High-voltage Bitcoin comes in the front, and on one side we turn it into even more extreme high-voltage. That's how we outperform Nvidia - by delivering 1.5x or 2x Bitcoin performance.

On the other side, we provide safe Bitcoin, low-risk Bitcoin, and low-volatility Bitcoin. Ironically, everyone gets exactly what they want.

In my backyard, there's 480-volt three-phase power suitable for industrial use. It can power a 500-ton yacht. But you wouldn't plug your hair dryer directly into that, would you? The power needs to be transformed. At the back of my property, there's a massive transformer that steps down the power.

There's great value in providing people with what they can consume in a form they can use, and in profiting from that conversion process. For example, people who convert power into batteries to sell for children's toys - do you know what their margin is? A thousand-fold.

Taking power directly from the dock would be cheaper. But if I connected my child's toy directly to dock power, my child would be electrocuted. That's what we're doing - the traditional market can't handle raw Bitcoin, so we transform it for them."

Saylor's MicroStrategy created the function of a corporate Bitcoin transformer. This represented unprecedented innovation in traditional, conservative corporate finance by utilizing the novel invention, Bitcoin. (Source: Hitachi Energy)

MicroStrategy went beyond simply holding Bitcoin to discover new value creation opportunities by converting it into various financial products. Saylor calls this the "Bitcoin Transformer," emphasizing that companies can do more than merely hold assets - they can transform them into structures that meet diverse market demands. In existing financial markets, various products are offered according to investors' risk appetites, but Bitcoin was originally perceived as a single asset with inherently high volatility. MicroStrategy transformed this within its corporate structure to simultaneously offer low-risk/low-volatility products and high-risk/high-return products, functioning as a financial engine.

The core of this strategy lies in Bitcoin's financial engineering applications. MicroStrategy divided and transformed Bitcoin's performance through convertible bonds(CBs), senior bonds, and equity issuance. This allowed them to provide stable returns to conservative investors while offering high-risk/high-return products leveraging leverage effects to those seeking higher returns. While this approach was used in traditional financial markets, MicroStrategy combined it with Bitcoin as a new asset, bridging the existing financial system and the cryptocurrency market.

This case demonstrates that companies can maximize value by reconfiguring digital assets into financial products suitable for the market, rather than simply holding them. Bitcoin isn't merely a speculative asset; when used strategically, it can be a tool for companies to break from existing financial structures and create new opportunities. MicroStrategy has shown that companies can move beyond merely holding Bitcoin to utilize it as an underlying asset for various financial products.

MicroStrategy's success has presented new possibilities for other companies. Saylor expects many companies will now adopt the Bitcoin Standard.

"What we've demonstrated is simple. If a company has access to capital markets, it can raise very cheap capital on good terms. We borrowed $4.2 billion at 0.82% and invested it in Bitcoin, which has returned over 24% annually.

Convertible bond investors can earn premiums by shorting the stock and buying the bonds. Bond investors bought our bonds and doubled their money in two months with no risk.

Our company has become a crypto converter. Raw Bitcoin comes in, and on one side we output a very high-volatility product, while on the other side we provide safe, low-risk Bitcoin.

This is the corporate Bitcoin standard. You could say we discovered it by accident. I didn't understand this in 2020, but now I understand it perfectly. I was a late bloomer, but a quick learner."

MicroStrategy's case shows how companies can use Bitcoin not simply as an investment vehicle but as a core element of financial strategy. In the past, when companies held idle cash, they typically invested in traditional assets like Treasury bonds, corporate bonds, and bank deposits, or returned it to shareholders through stock buybacks and dividends. However, Saylor determined that this approach was no longer effective. Particularly in an era of low interest rates and liquidity expansion, simply holding cash meant continuous value deterioration, potentially weakening a company's long-term competitiveness.

MicroStrategy's Bitcoin-based approach presents a new paradigm for corporate finance. Rather than simply holding Bitcoin, they leveraged the capital market connection to maximize corporate value. Issuing convertible bonds at low interest rates and investing in Bitcoin demonstrated how companies could create new opportunities while following existing financial system rules. This represents a new form of capital management where companies maintain liquidity while simultaneously growing their assets.

MicroStrategy's strategy will likely serve as an important reference case for other companies. It's becoming increasingly important for businesses to not merely preserve assets but to more actively optimize financial strategies and secure competitive advantages in new financial environments. MicroStrategy is proving that Bitcoin, when used strategically, can be a means to secure both long-term growth and financial soundness for companies.

Saylor authored a bestselling book in 2012 predicting a mobile-dominated world. A longtime colleague described him as 'someone with the insight to see the future.' (Source: Apple Books)

MicroStrategy's innovation extends beyond one specific company's strategy. Saylor is presenting a new paradigm for corporate financial management using Bitcoin.

"For the past 50 years, business schools have taught corporate finance like this: Remove all volatility from your P&L(profit and loss statement). Be like Microsoft – sign three-year enterprise agreements and renew them every three years. Microsoft's CFO can predict quarterly results 12 months in advance within 0.5-1% range.

Modern finance says a good CFO removes volatility from the P&L and returns all capital to shareholders through stock buybacks or dividends, even if it's tax-inefficient. If you want to be a truly outstanding CFO, borrow $50 billion and give that to shareholders too.

This is happening at Apple, at Meta, and most other places. Why? Partly because you need to increase EPS(earnings per share) by 12% annually. You need to beat the 12% cost of capital to make your stock a store of value, but it's impossible to grow organically at 12% when the economy is growing at 2-3% annually. The only way is to borrow money to buy back your stock and increase leverage.

But this makes companies vulnerable. One bad quarter and you could go bankrupt. The problem is that traditional financial assets have become toxic. They're killing companies. The average corporate lifespan is 10-15 years. We've accepted that companies will die within 20 years. But the truth is, companies are dying because they're injecting poison into their veins. If they stopped injecting that poison, they could live for hundreds of years."

Saylor points out that traditional corporate financial management is no longer sustainable. Companies reduce P&L volatility by establishing long-term contracts, returning all cash to shareholders, and maintaining stock values through buybacks and dividends. While this approach may guarantee stable performance in the short term, it can weaken a company's competitiveness in the long run. Companies have adopted debt-leveraged growth models in low-interest environments, but this has led to excessive debt dependency, making them more vulnerable in crisis situations.

Saylor sees holding Bitcoin as a core corporate asset as the solution to escape this paradigm. As a long-term value store and an asset whose scarcity increases over time, Bitcoin can contribute to maintaining corporate financial health in the long term despite accepting short-term volatility. While traditional fiat currency-based assets are likely to decline in value over time due to inflation, Bitcoin is establishing itself as an increasingly powerful value store through halving events and network effects.

MicroStrategy's case demonstrates not just an experimental strategy by one company, but a new possibility for corporate financial management. If companies operate assets according to traditional methods, value decreases over time, but strategic utilization of Bitcoin can help companies build robust financial structures that remain stable despite external shocks. Ultimately, companies need to consider not just short-term performance stability but long-term viability and sustainable growth strategies, making MicroStrategy's approach worth referencing.

One of MicroStrategy's most innovative aspects is converting Bitcoin's volatility into new business opportunities.

"We have the most volatile stock among S&P 500 companies. The S&P's VIX(volatility index) is around 15, and even the Magnificent 7 show volatility around 20-25. Bitcoin is at 50. We've leveraged Bitcoin to reach 100.

Traditional investors fear volatility. But volatility is like an engine's RPM - the difference between spinning at 100 RPM versus 10 RPM. When you plug volatility into the Black-Scholes equation, options on highly volatile assets become much more valuable.

The same applies when issuing convertible bonds. Investors want to buy convertible bonds from companies with high volatility, high liquidity, and durability. Liquidity is like energy. A Christmas hat spinning at 50 RPM is just a toy, but a baseball bat at 100 RPM becomes a weapon. A 20-ton flywheel at 100 RPM becomes a turbine.

We're spinning $40 billion in capital at 100 VIX. That's a huge opportunity for options traders. That's why we've developed a massive options market, tremendous liquidity, and high volatility. Currently, our options market is valued at $95 billion."

MicroStrategy created a new financial model by actively leveraging volatility that most companies try to avoid. Typically, companies prefer predictable financial flows and aim to reduce volatility through hedging strategies or maintaining stable cash flows. However, Saylor viewed volatility not as a risk factor but as an energy source. He recognized that higher volatility increases option premiums and expands the possibilities for financial instruments.

This strategy contrasts completely with traditional corporate finance methods. Most companies reduce volatility through share buybacks or provide investors with stable returns through dividends. MicroStrategy didn't follow this approach. Instead, they developed a strategy combining convertible bonds (CBs) and options that utilized Bitcoin's high volatility, maximizing leverage effects in the process. They innovated their financial structure by growing the options market and lowering capital procurement costs.

MicroStrategy's case presents a new approach that uses volatility as a driver of corporate growth rather than avoiding it. While Bitcoin's price volatility is generally considered negative, MicroStrategy successfully used it to increase corporate value. This demonstrates that companies can secure long-term competitiveness by strategically managing assets without following conventional financial practices.

Whether many companies will adopt MicroStrategy and Saylor's Bitcoin innovation remains to be seen. However, at the very least, MicroStrategy has presented one successful model for how companies can utilize Bitcoin.

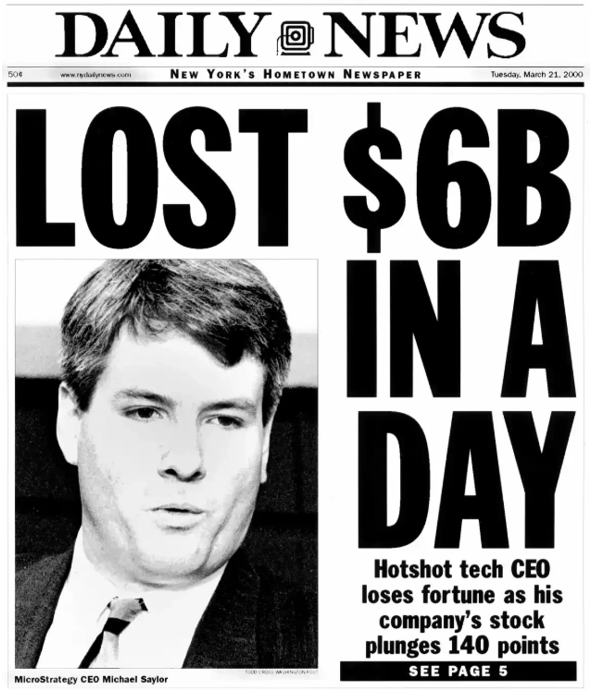

MicroStrategy, which went public in 1998, was implicated in an accounting scandal in 2000 that caused its stock to plummet 62% in a single day, costing Saylor approximately $6B overnight. Perhaps his tumultuous life as an IT entrepreneur prepared him to endure significant volatility. (Source: Daily News)