Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

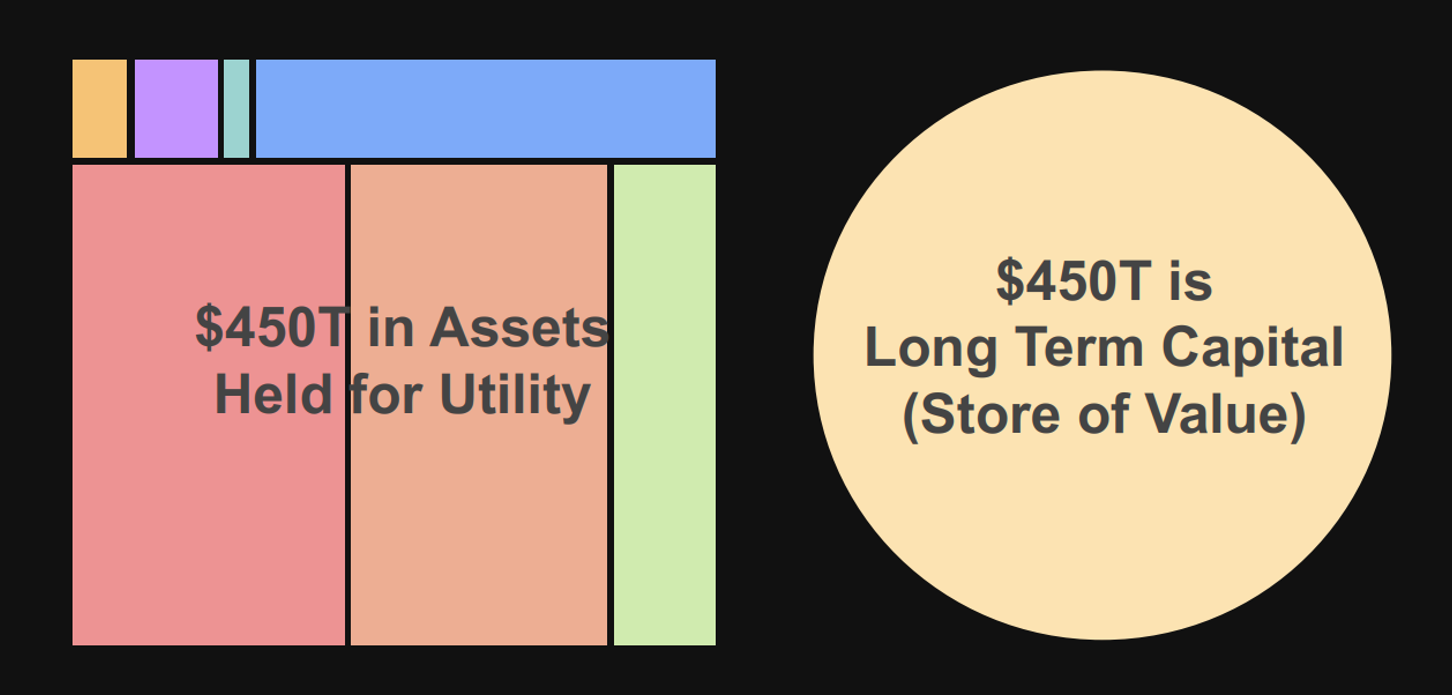

Understanding the size and composition of global assets is key to grasping Bitcoin's potential. Michael Saylor analyzes the scale and flow of wealth worldwide in detail, using this to predict Bitcoin's future value.

Saylor systematically analyzes the total size and composition of global assets. He particularly distinguishes assets by their purpose, using this to identify Bitcoin's potential market.

"There's about $900 trillion of wealth in the world. About half of that, $450 trillion, is assets held for their utility value. For example, this house for having this interview, or a dock where you can park a yacht in the backyard, a plane, a chair. The yacht is utility, the jet is utility, the chair is utility, the art can be utility.

The other $450 trillion is assets held as a store of value. This is important – it's half of everything. Why do people own sports teams? To sit courtside and cheer for the team. Why own Apple? To root for Apple and maybe for dividends.

You own a bakery because you like the idea of creating cool things with the bakery. You own a restaurant because you love the restaurant business. You own a resort in Hawaii because you want to invite your friends to the resort in Hawaii. There are a lot of things in the world that are held for their utility.

You hold a bond because you want to clip the coupons. You want fixed income in a secure currency. In a world without digital capital, without perfected capital, we have to monetize real estate, monetize bonds, monetize stocks, monetize art, monetize everything under the sun."

The fact that half of global wealth exists as a store of value forms the core foundation of Saylor's Bitcoin philosophy. While Bitcoin has limitations as a payment method due to its volatility and processing speed, its true potential lies in value storage. (Source: Bitcoin Conference)

Saylor's asset analysis provides a fresh perspective for understanding Bitcoin's potential market. Traditionally, assets are divided into financial and physical assets, but he categorizes them by purpose: 'assets for utility' and 'assets for value storage.' This isn't just a classification method but an important criterion for gauging the market Bitcoin could occupy.

The fact that half of the $900 trillion in global assets is used for value storage is particularly notable. This isn't just about specific investors or institutions but indicates that people worldwide are seeking secure ways to preserve wealth. Traditionally, gold, real estate, and government bonds have served this purpose, but Bitcoin offers distinct advantages in portability, transparency, and limited supply. Considering Bitcoin's current market cap is around $2 trillion, compared to the $450 trillion value storage market, Bitcoin has captured only a tiny fraction of its potential.

Through this analysis, Bitcoin's growth isn't mere speculation but reflects a global demand for wealth preservation. People want assets that maintain value over time, and historically, these assets have changed with the times. Bitcoin is likely to become the optimal value storage medium for the digital age, and more people will recognize this as time passes.

Ultimately, Bitcoin isn't just a financial product but can fulfill the role of complete value storage that was lacking in the existing economic system. As Saylor emphasizes, the transition of wealth storage to digital is an inevitable trend, and Bitcoin will be at the center of this new paradigm.

Saylor particularly points out that many assets carry a 'monetary premium' beyond their actual utility value. This is a distortion that occurs in the absence of a perfect value storage medium.

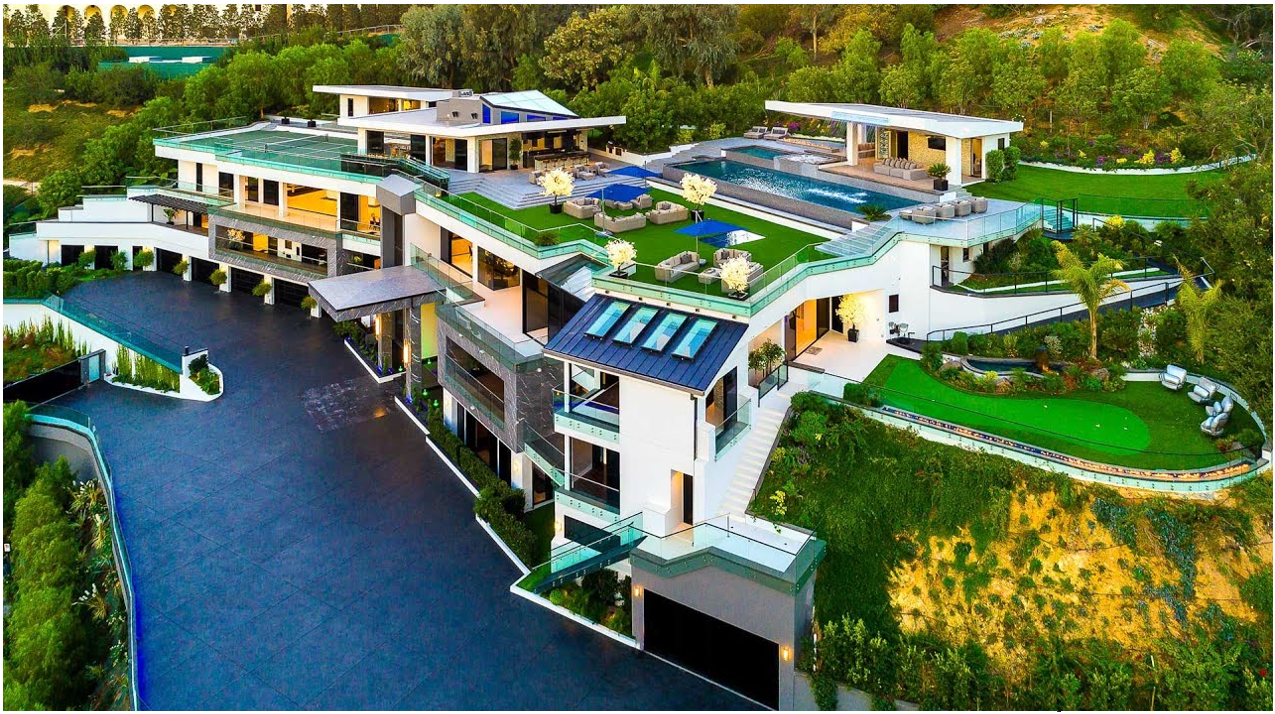

"I know a lot of wealthy people. They own 16 estates on the Eastern Shore, but they only live in two of them. Why? They're land banking. What does that mean? The guy makes a lot of money every year, and he doesn't want to put it in a savings account, so he just buys a cool piece of property, and then he buys another one.

Okay, it sounds good. But here's the problem: the guy buys up all the beautiful pieces of property, so you can't afford it. If the rich guy wasn't buying up all the beautiful houses, they would cost half as much, and you could live in a beautiful house.

So here's what happens: some rich dude has 27 houses that are empty. You don't have a beautiful house. Your family, your kids, your dog could use the beautiful house. The rich dude doesn't even want the house; he just wants a long-term capital preservation strategy.

That's a perverse incentive and a distorted economy that's broken. That's broken money. That's because the rich dude is using an estate on the eastern shore of Maryland as a piggy bank. But the estate doesn't get renovated. The house is falling down. There's a beautiful pool on the water, and you could have a great family picnic there every Sunday, but it's not going to happen because the rich dude has 16 other houses. He just bought that house because he thought it was a good investment."

Malibu's California coastline is lined with vacation homes worth billions that sit empty most of the year except during holidays. These properties exist more as stores of value for the wealthy than for utility purposes. (Source: Sotheby's)

Saylor's analysis clearly shows the economic distortions caused by the absence of a proper value storage medium. People's attempts to preserve wealth by purchasing unwanted assets isn't just an individual choice but an inevitable result created by the current financial system. Without a perfect value storage medium, capital accumulates in forms unrelated to its original purpose, leading to inefficient resource allocation.

Bitcoin can be an alternative to this problem. If people can preserve wealth without relying on physical assets, the need for assets to forcibly serve as value storage diminishes. This can help essential resources like real estate return to their original function and allow capital to be allocated more efficiently across the economy.

Ultimately, Bitcoin isn't just an investment asset but can guide capital flow in a healthier direction. As Saylor emphasizes, if Bitcoin solves the wealth preservation problem that the existing financial system couldn't address, this would be more than a technological innovation – it could transform the economic structure itself.

Traditional financial analysis evaluates assets in terms of return and risk. Saylor, however, offers a completely different perspective, analyzing each asset's characteristics in terms of energy. He views each asset as a physical energy system.

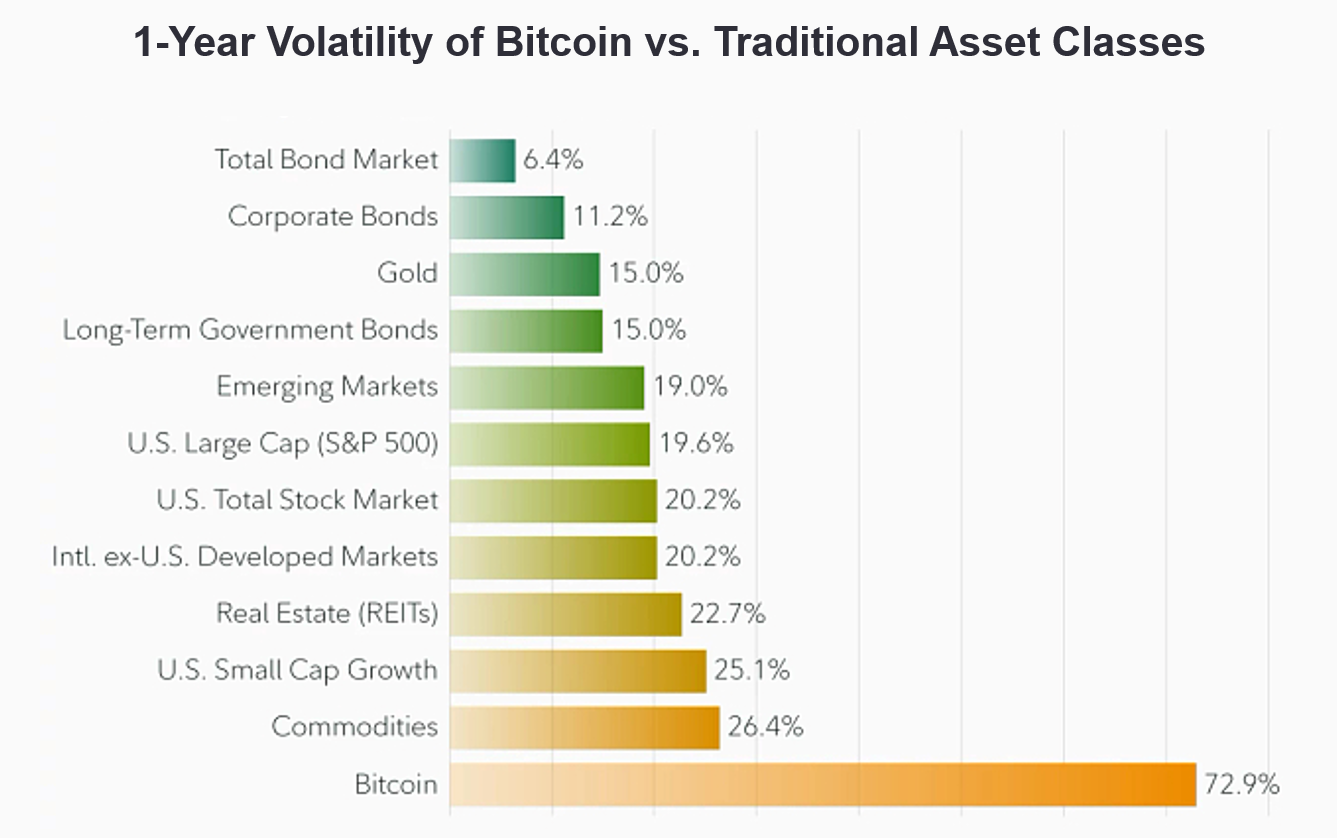

"The dollar has 0% ARR(Annual Return Rate) and 0% volatility. That means the dollar goes up 0% against itself each year, and it has 0% volatility against itself. If you're using dollars, you're living on flat land. You're a pedestrian standing on a plane.

Bitcoin, on the other hand, has been going up 60% a year against the dollar. For how long? Since MicroStrategy made its first investment four years ago. But if you stretch back 6, 8, 10 years, I think it's also 60%. And it's exhibited 60% volatility against the dollar too.

You should think of Bitcoin as an asset. It's like you're on a speeding train going 60 miles an hour, and you've got a flywheel spinning at 60 RPM. The pedestrian on flat land is standing on the plane watching the train go by, thinking, 'This is scary, it's going to suck the oxygen out of my lungs.' And they're thinking, 'My money isn't an asset because it goes up 0% a year.'

When you hold the S&P index with the volatility of 15%, you might get paid 12 to 15% interest to take the risk of holding one share of SPY, the index. When you hold a share of Bitcoin via IBIT or Bitcoin itself, the volatility is 60. You might get paid 70-80% to hold that million dollars in Bitcoin. You're taking the downside risk, but you're getting paid that call rate."

Bitcoin's volatility makes investors question its value. Paradoxically, this same volatility serves as evidence of Bitcoin's potential and possibilities. (Source: Bloomberg)

Saylor's energy-based analysis offers a fresh perspective on asset evaluation. In traditional financial markets, assets are judged within a framework of return and risk, but Saylor interprets this as a structure similar to physical energy systems. Viewing assets through an energy lens clarifies whether an asset simply serves as a safe storage or functions as a tool for wealth multiplication with powerful kinetic energy.

Bitcoin, in Saylor's view, transcends being merely a value storage medium – it's like a flywheel maintaining strong rotational force at a constant speed. While fiat currencies like the dollar remain stationary and gradually lose value, and traditional assets like the S&P 500 move at a moderate pace, Bitcoin grows rapidly with high volatility, making it a powerful asset.

Saylor advises embracing Bitcoin's "dual energy" characteristic. The "Bitcoin train" has both forward velocity(return rate) and flywheel rotation speed(volatility). While most investors perceive volatility as risk, Saylor sees it as an additional energy source. Just as a high-speed rotating flywheel stores additional kinetic energy, Bitcoin's high volatility provides opportunities for additional value creation.

This approach offers important insights for investors. If stability is your priority, you might choose fiat currencies or low-return assets, but their value will likely decrease over time. If you can tolerate certain volatility, Bitcoin can provide long-term sustainable growth momentum. Avoiding Bitcoin solely due to its volatility means missing an asset with powerful growth potential.

Saylor predicts Bitcoin will become the new global capital standard. He argues this isn't just a possibility but an inevitable result as long as the physics of capital operates.

"Bitcoin represents the emergence of the first perfect digital capital standard in history. Let me explain why I use the word 'standard.' John D. Rockefeller created Standard Oil, standardizing the energy industry. His company became so influential that it became a household name. In fact, almost every oil company in America and half the oil companies in Europe came from Rockefeller's company.

We all zoned out and thought 'oil,' and we forgot about the 'standard' part. But the 'standard' part was critical. It meant this oil won't blow up in your face and set your house on fire. It meant the oil actually had clean, consistent chemical properties.

Standardizing energy was the most powerful idea in the 20th century. It made the richest man in the 20th century and created every single energy company. Bitcoin is the same thing. Bitcoin is standard capital, standard wealth for 8 billion people.

Let me give a simple example everyone can understand. If you're running a restaurant in New York, and a customer says, 'This steak is not up to standard,' you know what they mean. A standard is something everyone agrees upon.

Bitcoin will be the standard for digital capital. What's the next standard going to be? Is there another asset that goes up in value instead of down, that's perfectly standardized, and is open to everyone in the world? The answer is there is no second best."

Standard Oil, founded by Rockefeller in 1870, monopolized American oil production and distribution, becoming the industry standard itself. However, its monopolistic position led to an antitrust lawsuit from the US government, resulting in its dissolution in 1911. (Source: UCSD Library)

Saylor's 'standard' concept is powerful. He views Bitcoin not merely as a digital asset or speculation vehicle but as a new global capital standard, similar to how Standard Oil became the energy industry standard.

He particularly emphasizes the powerful network effect of standardization. Once a standard is established, it creates a self-reinforcing virtuous cycle. This suggests that once Bitcoin establishes itself as the global capital standard, its position will only strengthen.

Moreover, Saylor emphasizes that the concept of a 'standard' goes beyond mere technical superiority. As seen in the Standard Oil example, a true standard provides trust and stability. This is precisely what Bitcoin offers – a reliable and trustworthy standard for digital capital.

This perspective presents a highly optimistic outlook for Bitcoin's future. If Bitcoin truly becomes the new global capital standard, its current market cap is minuscule compared to its true potential.

Saylor ultimately predicts that Bitcoin will fundamentally change the concept of wealth itself. He argues this isn't just a change in asset class but a civilizational turning point.

"This isn't just opinion or speculation. It's the laws of physics and entropy. Currently, $900 trillion of capital is trapped at near-zero interest rates, experiencing 10-15% monetary inflation annually. This situation is unsustainable. We're going to witness the largest capital migration in history.

Looking at the world's monetary systems, there are only three types. First, currencies explicitly pegged to the dollar, like the UAE dirham. Second, currencies that nominally float but are actually pegged to the dollar, like the Swiss franc or euro. These move about plus or minus 5% against the dollar. The monetary authorities intervene if they get too strong or too weak to maintain balance with the dollar.

Finally, currencies that have given up trying to peg to the dollar, like the Nigerian naira or Venezuelan bolivar, the Lebanese pound, or the Turkish lira. These all fall into the category of collapsing, failing currencies. Basically, every currency that works reasonably well is pegged to the dollar, and every other currency is failing.

That's why in a country as powerful as China, if people were given a choice, most would choose the digital dollar. That's why the Chinese government has made crypto trading illegal. Everyone wants it too much — they'd all buy it.

This isn't just about asset change. This is a redefinition of wealth. For the first time, we have truly global capital — pure digital energy as capital that no borders, governments, or central banks can control. Just as the internet liberated information, Bitcoin is liberating capital. This isn't about competition between currencies anymore. This is the emergence of a new form of capital for the digital age."

China completely banned all cryptocurrency transactions and mining in 2021 to prevent capital flight and maintain control of the yuan. However, it remains uncertain when the Chinese government might reverse these prohibitions. (Source: CFR)

Saylor's analysis sharply points out the structural contradictions in the current global financial system. According to his insight, the current global financial system is functionally on the verge of collapse. Capital of astronomical scale — $900 trillion — is suffering from the double burden of low interest rates and high inflation. This capital is effectively enduring negative returns, demonstrating the fundamental inefficiency of the modern financial system.

More seriously, the world's currency system is essentially operating on a dollar-centric basis. Saylor's analysis shows that all the world's currencies are either dependent on the dollar or failing. This structure may appear stable on the surface, but is actually extremely vulnerable. China's ban on cryptocurrency trading exemplifies this vulnerability. Even China, one of the world's most powerful economies, fears its citizens freely moving capital.

In this context, Bitcoin isn't just an alternative asset or speculation vehicle but a completely new form of capital. Saylor describes it as "pure digital energy." In physics, energy represents the ability to do work. Similarly, Bitcoin is the first capital that can instantly transmit value anywhere in the world without being constrained by borders or government control.

Saylor compares this change to the information revolution. Just as the internet fundamentally changed how information is produced, stored, and transmitted, Bitcoin is fundamentally changing how wealth is produced, stored, and transmitted.

We stand at a historic turning point. This is as significant as when humanity transitioned from barter to monetary economics, or from the gold standard to the fiat currency system. The difference is that this change is occurring not through the decision of a specific country or government, but through the natural evolution of markets and technology. This is the essence of what Saylor calls the 'new paradigm of wealth.'