Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

Bitcoin's high volatility is often cited as one of the biggest concerns for traditional investors. However, Michael Saylor views this volatility from an entirely different perspective. He reinterprets volatility not as a risk but as an opportunity, not as a weakness but as a strength. This chapter examines how Saylor understands and utilizes Bitcoin's volatility.

Saylor often uses various analogies to explain Bitcoin's essential characteristics. To explain Bitcoin's volatility, he draws on NBA superstar LeBron James as a reference point. By examining LeBron's growth as a professional basketball player, he explains that volatility is a natural phenomenon in the maturation process of things.

"Many people fear Bitcoin's volatility because those who lived through the first decade of Bitcoin were scarred by their experiences with extreme volatility. But this is misleading because the system has evolved and institutions have entered the marketplace. Since January 2024, it's become a completely different asset class.

If you look at the chart since March, it goes up 50%, down 25%, up 50%, retraces 20%, up 60%, retraces 25-30%, up 50%, retraces 25%. It's simply growing in this pattern.

The way I explain it to people is to think about LeBron James's career from age 9 to 18. He was talented but volatile. However, it would be a mistake to extrapolate from those first nine or ten years to the next ten years.

From age 18 to 28, LeBron James was the greatest athlete in the sport with virtually no volatility — except in a good way. If you're watching a basketball court, he's actually making everything happen. He's the volatile game-maker destroying everybody. But it's not bad volatility. You want to get rid of volatility? Put a lump of rocks on the basketball court. You'll have no volatility then.

I'm not terribly concerned with volatility. I think there will be accelerations and pullbacks, but institutions are supporting the market on both sides now. The capital isn't coming from leveraged day traders anymore — it's coming from insurance companies and large public companies buying to hold forever.

Where we once had volatility created by consumer speculative trading, we're now looking at a completely different kind of volatility. It's like having a turbine spinning with tens of tons of weight. Volatility is essentially energy. And what matters is how you harness that energy."

The debate over "the greatest basketball player of all time" between LeBron James and Michael Jordan remains unresolved. Both LeBron and Jordan were able to become the world's best players because they were both highly volatile yet consistent. (Source: Sports Illustrated)

Saylor's LeBron James analogy offers a fresh perspective on understanding the evolution of Bitcoin market. It reframes early, unstable volatility as a development phase transitioning into mature dynamism. By comparing Bitcoin's market evolution to a sports star's growth, he transforms volatility from a risk indicator into a growth metric.

The shift marked by January 2024 is particularly noteworthy. Institutional investors' participation didn't simply increase funding scale — it fundamentally changed the market. This resembles how LeBron James evolved from a promising talent with raw ability to a superstar with refined skills.

Saylor also views volatility through an energy lens. Just as engines or generators can't function without vibration, Bitcoin's volatility represents market vitality. This suggests volatility isn't a risk to avoid but a resource to utilize — a paradigm shift in how we view market fluctuations.

Saylor argues that volatility can create real economic value beyond being a market phenomenon. He explains this from a mechanical engineering perspective, showing how volatility can be converted into energy.

"Volatility is like RPM in an engine — the difference between spinning at 100 RPM instead of 10 RPM. If you plug volatility into the Black-Scholes equation, options on highly volatile assets become much more valuable.

MicroStrategy stock has the highest volatility among S&P 500 companies. We're oscillating at 100 Vol, while the S&P index is about 15 Vol. Traditional investors fear volatility, but it's like energy in an engine.

If I spin a small toy propeller at 50 RPM, it's just a child's toy. But if I spin a baseball bat at 100 RPM, it becomes a weapon. If I spin a 20-ton flywheel at 100 RPM, it becomes a turbine capable of moving a ship across the Atlantic.

Now we have $40 billion of capital spinning at 100 Vol. That's 20 times faster than Treasury bills and 8 times faster than the S&P index. With 100 Vol, you can generate over 100% annual interest just by selling calls.

Our options market is currently $95 billion — about equal to our market cap. If you sell a 30-day call option on MicroStrategy at market price, you can generate a 220% interest rate. For comparison, the S&P 500 might get you 15%, and real estate or gold would be even lower. That's the economic value of volatility."

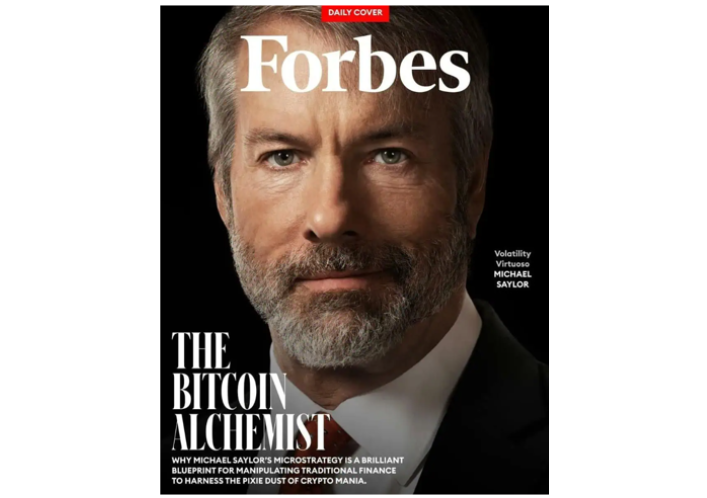

Saylor was selected as a Forbes cover model in 2025. Forbes described him as "Bitcoin's Alchemist" and a "Volatility Virtuoso." (Source: Forbes)

Saylor reinterprets volatility not as a risk indicator but as an economic value generator. His mechanical engineering analogies are particularly intuitive. Just as an engine's vibrations or a turbine's rotations generate energy, market volatility can create financial returns through properly structured instruments.

MicroStrategy's case demonstrates this theory in practice. High volatility increases option premiums, creating additional revenue streams. This proves volatility doesn't necessarily increase risk — it can actually create new profit opportunities.

Global financial markets are increasingly accepting Bitcoin's volatility. The scale of volatility is naturally forming in the market, indicating market participants place high value on Bitcoin-related volatility. This suggests Bitcoin's volatility is being reinterpreted not as a risk premium but as a liquidity premium.

Building on his new understanding of volatility, Saylor has developed innovative strategies to actively leverage it. His approach has opened new horizons in modern financial engineering.

"We're using volatility to meet the needs of different types of investors. For example, convertible bond investors want safe returns with low volatility. Stock investors want high volatility and high returns. We can provide both.

Bitcoin is a commodity with 60% returns and 60 Vol. We put it through the MicroStrategy transformer and convert it. On one side, we create high-voltage Bitcoin at 120-140 Vol, and on the other side, we provide safe, low-volatility Bitcoin.

When we issue a $1 billion convertible bond, the interest rate is 0%. But investors want to buy it because our stock's volatility makes the conversion right very valuable.

Using this approach, we've borrowed $4.2 billion to buy Bitcoin. If Bitcoin appreciates at 50% annually, it doubles every 14-18 months. So $4.2 billion becomes $8.4 billion, then $16.8 billion, then $33.6 billion. We're creating a $32 billion leverage effect."

Saylor's volatility utilization strategy represents the pinnacle of modern financial engineering. Rather than simply managing or avoiding volatility, he actively leverages it to create various financial products. This shows how Bitcoin as a new asset class can integrate with traditional financial markets.

His transformer analogy perfectly captures volatility's nuances. Just as electricity is converted from high to low voltage for different applications, Bitcoin's volatility can be transformed to match various investors' risk preferences. This mechanism allows the Bitcoin ecosystem to accommodate a wider range of investors.

This strategy also suggests possibilities beyond the traditional risk-return tradeoff. By creating additional returns through high volatility while still offering stable investment products, MicroStrategy and Bitcoin have opened new frontiers in financial innovation.