Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

Understanding Bitcoin is proportional to the time and effort invested. Saylor emphasizes that a deep study is necessary to truly grasp Bitcoin, believing that this will lead people to see it not as a speculative asset but as a historic innovation.

One of Michael Saylor's most famous maxims is "No one who has studied Bitcoin for more than 100 hours is a critic." This isn't mere rhetoric but reflects his deep insight into the time and effort required to truly understand Bitcoin's essence.

"Those who understand Bitcoin buy Bitcoin, and those who don't understand it criticize Bitcoin. This is what always happens during a paradigm shift.

There's a clear progression in understanding Bitcoin. Most people study it for about 10 hours and say, 'This is gambling.' After about 100 hours, they start thinking, 'This could be a good investment.' After 1,000 hours, they realize, 'This is one of the most important inventions in human history.' You need to invest at least 100 hours to properly understand Bitcoin.

Every Bitcoin critic I've met has one thing in common: they've never spent more than 100 hours studying Bitcoin. Did Warren Buffett spend more than 100 hours researching Bitcoin? What about Charlie Munger?

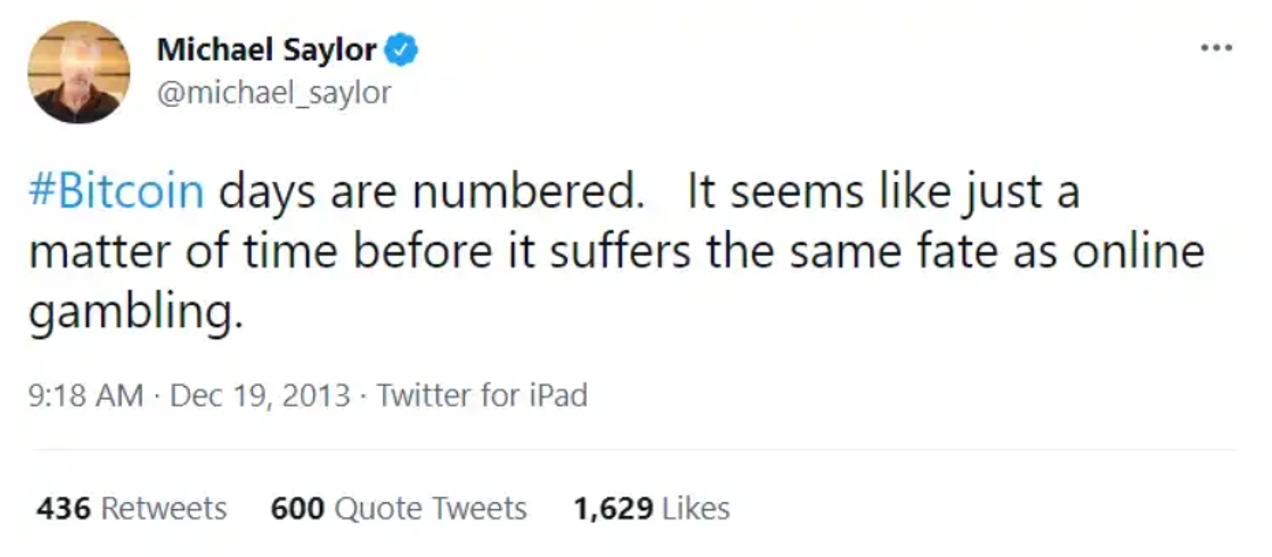

I was extremely skeptical about Bitcoin myself at first. In December 2013, I even tweeted that 'Bitcoin's days are numbered' and that it would 'meet the same fate as online gambling.' Bitcoin was worth $892 at that time. I received the price I deserved because I didn't understand it."

Saylor's 2013 tweet claiming that the era of Bitcoin would soon end. Saylor began embracing Bitcoin around 2020, starting his Bitcoin education even later than many retail investors. (Source: X)

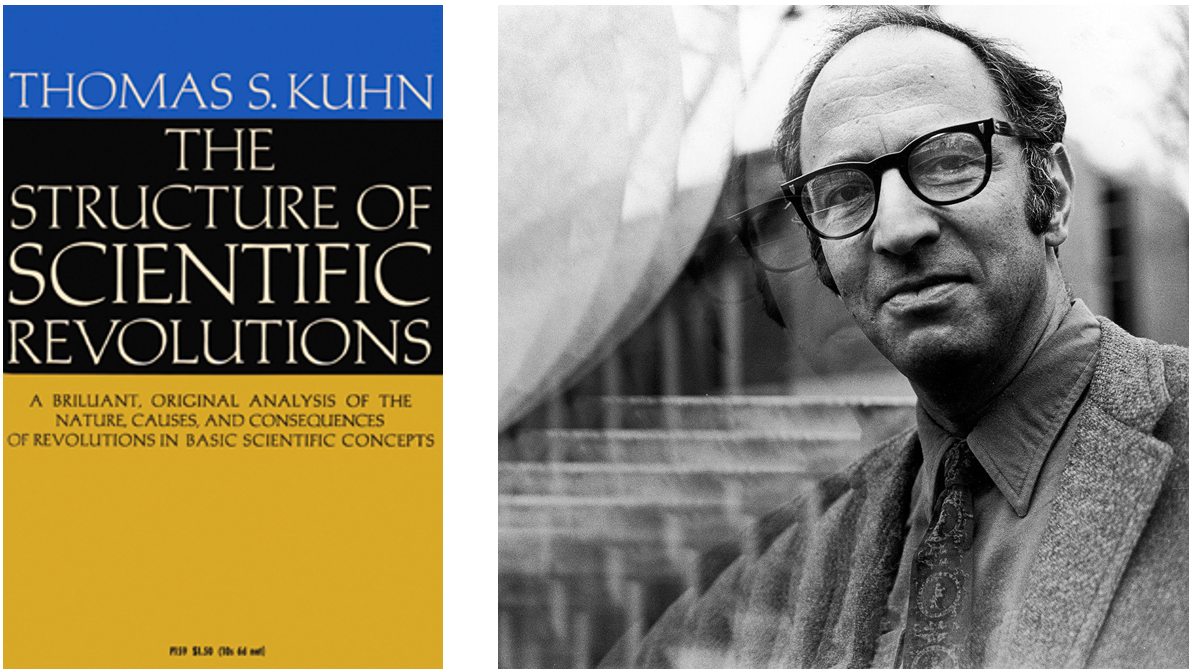

Saylor's "100-hour rule" precisely captures the essence of the Bitcoin learning process, which bears similarities to Thomas Kuhn's theory of paradigm shifts. During paradigm shifts, people initially try to understand new phenomena(Bitcoin) through existing paradigms(traditional money and financial systems), which inevitably creates resistance.

Eventually, people must accept new paradigms, and they come to understand them through staged learning. Like other paradigm shifts, as one's understanding of Bitcoin deepens, perspective evolves from seeing it as a "speculative vehicle" to an "investment asset" and finally to a "civilization-changing innovation." This progression occurs because Bitcoin isn't merely a financial product but potentially a pivotal innovation in humanity's monetary evolution.

Saylor's own experience perfectly illustrates this evolutionary understanding process. He initially criticized Bitcoin but later came to understand it deeply, eventually investing his entire corporate treasury in it. This demonstrates how accumulated knowledge can lead to fundamental shifts in perspective.

American science historian Thomas Kuhn explained through his seminal work, "The Structure of Scientific Revolutions," that scientific progress does not occur gradually but revolutionarily through paradigm shifts. (Source: Britannica)

For 100 hours of Bitcoin study to be effective, a systematic approach is necessary. Drawing from his own learning experience, Saylor offers a methodology for effectively studying Bitcoin.

"In 2020, I began researching Bitcoin very systematically. First, I identified the five most influential Bitcoin experts on the internet and watched all their YouTube videos and podcasts. I read 'The Bitcoin Standard' and also read Andreas Antonopoulos's books.

I went further and analyzed the Bitcoin debates between Eric Voorhees and Peter Schiff, examining the arguments of both proponents and opponents to understand their logical foundations. After completing the theoretical understanding, I shifted to execution mode. I researched how to create accounts, make purchases, complete KYC processes, and more.

After finishing my personal education, I began organizational education. I sent a text message to all company officers and directors asking them to watch three specific YouTube videos and read John Pfeffer's paper 'An Institutional Investor's Take on Cryptoassets.' After they read these materials, I had one-on-one meetings with each of them. Gradually, we formed a consensus, created teams, and began moving forward."

The debate between Erik Voorhees and Peter Schiff is the most famous Bitcoin debate in the industry. Voorhees and Schiff have been debating the value of Bitcoin since 2014, while Schiff remains a Bitcoin skeptic. (Source: Soho Forum)

Saylor's learning methodology demonstrates the multidimensional approach needed to understand Bitcoin. He covered technical, economic, and philosophical aspects in a comprehensive study. His balanced approach of reviewing arguments from both sides was particularly important for developing an objective understanding of Bitcoin.

His learning method also emphasizes the harmony between theory and practice. He began with conceptual understanding through books and videos, then progressed to practical understanding through actual trading experience. This reflects how Bitcoin may be theoretically complex, but its practical use is becoming increasingly straightforward.

The fact that even Saylor, now considered one of the foremost authorities on Bitcoin, began his education through readily accessible YouTube videos and books makes an important point. Claiming lack of knowledge as a reason not to invest in Bitcoin may ultimately prove to be merely an excuse. If Bitcoin's price increases by 130 or 710 times in the next 20 years as Saylor projects, who could one blame for missing the learning opportunity that was available to everyone?

Ironically, the catalyst for Saylor's deep exploration of Bitcoin was the crisis facing MicroStrategy. At a moment when survival seemed impossible, Saylor discovered Bitcoin and repositioned his company at the center of the tech world.

"The process of personal learning followed by organizational education and consensus-building took place from March through August 10, 2020. On August 10, we announced our purchase of $250 million in Bitcoin while also offering a share buyback opportunity. Our stock was around $120 at the time, and we offered to buy shares at a premium. This allowed shareholders who didn't like our Bitcoin strategy to exit.

Over 20 days, only about $60 million in shares were tendered, leaving us with $175 million in cash, which we used to buy more Bitcoin. The stock rallied, generating more cash from stock option exercises, and we bought another $50 million in Bitcoin. And we just kept moving forward like this.

Why haven't other companies followed our lead? They haven't experienced looking over the edge of the abyss. They haven't been in a situation where they had to choose between quick death, slow death, or taking a risk. I spent 10 years trying every conventional approach possible. I worked with hundreds of brilliant people and rebuilt our products multiple times, but nothing worked.

Then COVID-19 hit, our stock price was cut in half, and Jerome Powell announced he was dropping interest rates to 0%. Trapped at home, unable to work, our cash became worthless, our stock collapsed, and big tech companies were poaching our employees. In this situation, we had nothing to lose. We had tried everything else, and Bitcoin was our last hope.

Most companies don't face these extreme circumstances. They follow traditional paths — selling the company or going private. But we were different. After more than 100 hours of research, we deeply understood Bitcoin and realized it was our only hope."

Saylor has always craved "more." Though he had led a company with annual revenues of around $500 million for over 20 years and earned industry respect for foreseeing new eras like mobile and cloud computing, he was not ready to accept a "slow death." (Source: Washington Post)

MicroStrategy's case brilliantly illustrates how crisis can transform into opportunity. Their adoption of Bitcoin wasn't simply an investment decision but a desperate survival strategy. Saylor's situation evokes Schumpeter's concept of "creative destruction." When confronted with the limitations of existing systems, one becomes ready to embrace innovative alternatives. Through crisis, Saylor discovered and embraced a fundamental innovation opportunity.

This also explains why other companies haven't adopted Bitcoin. They haven't experienced sufficiently desperate situations to motivate deep research into Bitcoin.

More broadly, this provides important insights about Bitcoin adoption's future. As the current financial system faces greater crises, more individuals, companies, and nations will seriously study Bitcoin. Crisis may serve as a catalyst accelerating Bitcoin adoption.