Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

In January 2024, the SEC's approval of spot Bitcoin ETFs completely changed the landscape of the Bitcoin market. This went beyond the simple launch of a financial product — it signified that institutional investors worldwide could now officially enter the Bitcoin market.

"It's now very clear that Bitcoin has been institutionalized. Bitcoin has crossed the last hurdle with SEC approval. This is a very important signal. Particularly, the fact that the SEC approved Bitcoin as an ETF means that Bitcoin has now met all the requirements of institutional investors.

Bitcoin ETFs like BlackRock's IBIT trade on regular exchanges. This is extremely important. It means that all retirement funds and institutional money can now invest in Bitcoin. Previously, these institutions couldn't directly purchase or custody Bitcoin. But now there's a product that satisfies all their legal and regulatory requirements.

Look at BlackRock's success. From day one, they recorded tremendous trading volume. This shows how much pent-up demand there was from institutions. They had wanted to invest in Bitcoin for a long time, but lacked the appropriate vehicle. Now they have it.

Even more importantly, BlackRock's logic explained Bitcoin from a completely new perspective. They didn't describe Bitcoin as 'digital gold' or 'cryptocurrency,' but as a pure capital asset. They explained Bitcoin in language that institutional investors could understand."

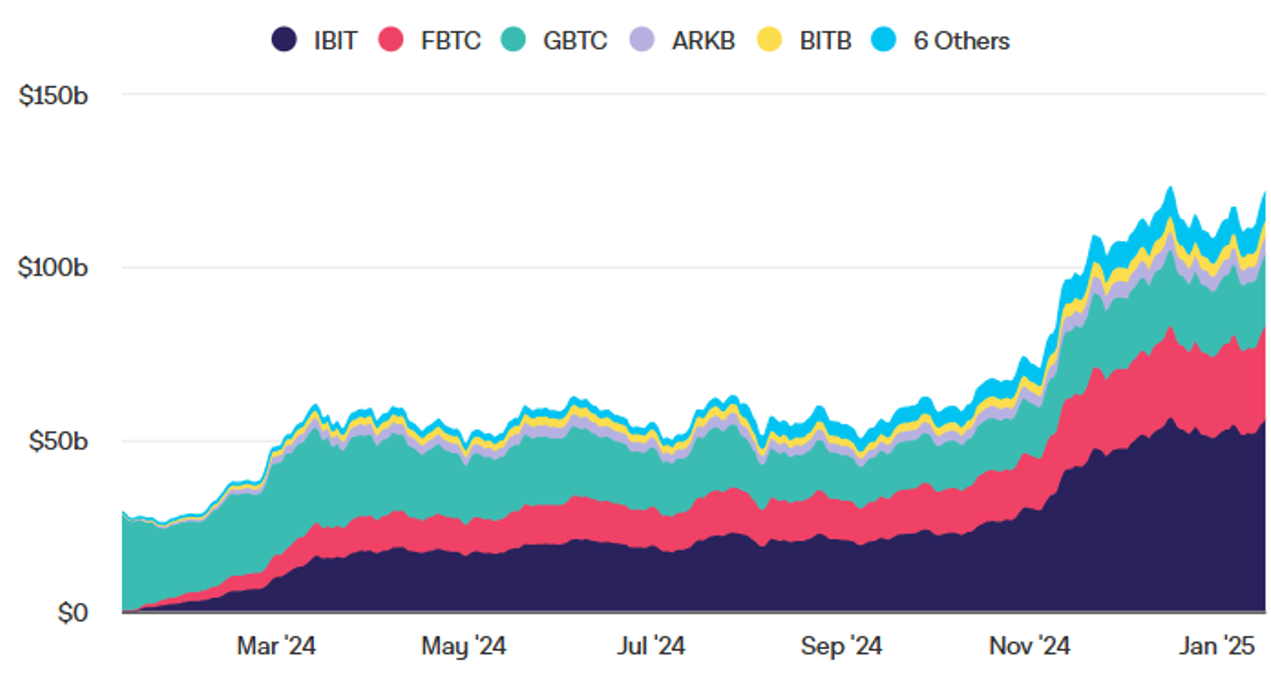

Bitcoin ETFs attracted $28 billion in their first month, with total assets under management reaching $120 billion by January 2025. (Source: Into The Block)

The approval of Bitcoin ETFs marks Bitcoin's irreversible incorporation into mainstream finance. Particularly significant is that BlackRock, the world's largest asset manager, launched a Bitcoin ETF, signifying Bitcoin's recognition in traditional finance.

More importantly, this development removes all legal and regulatory barriers to Bitcoin investment by institutional investors. Now pension funds, insurance companies, and asset managers can all invest in Bitcoin. This potentially opens the door for trillions of dollars of new capital to flow into the Bitcoin market.

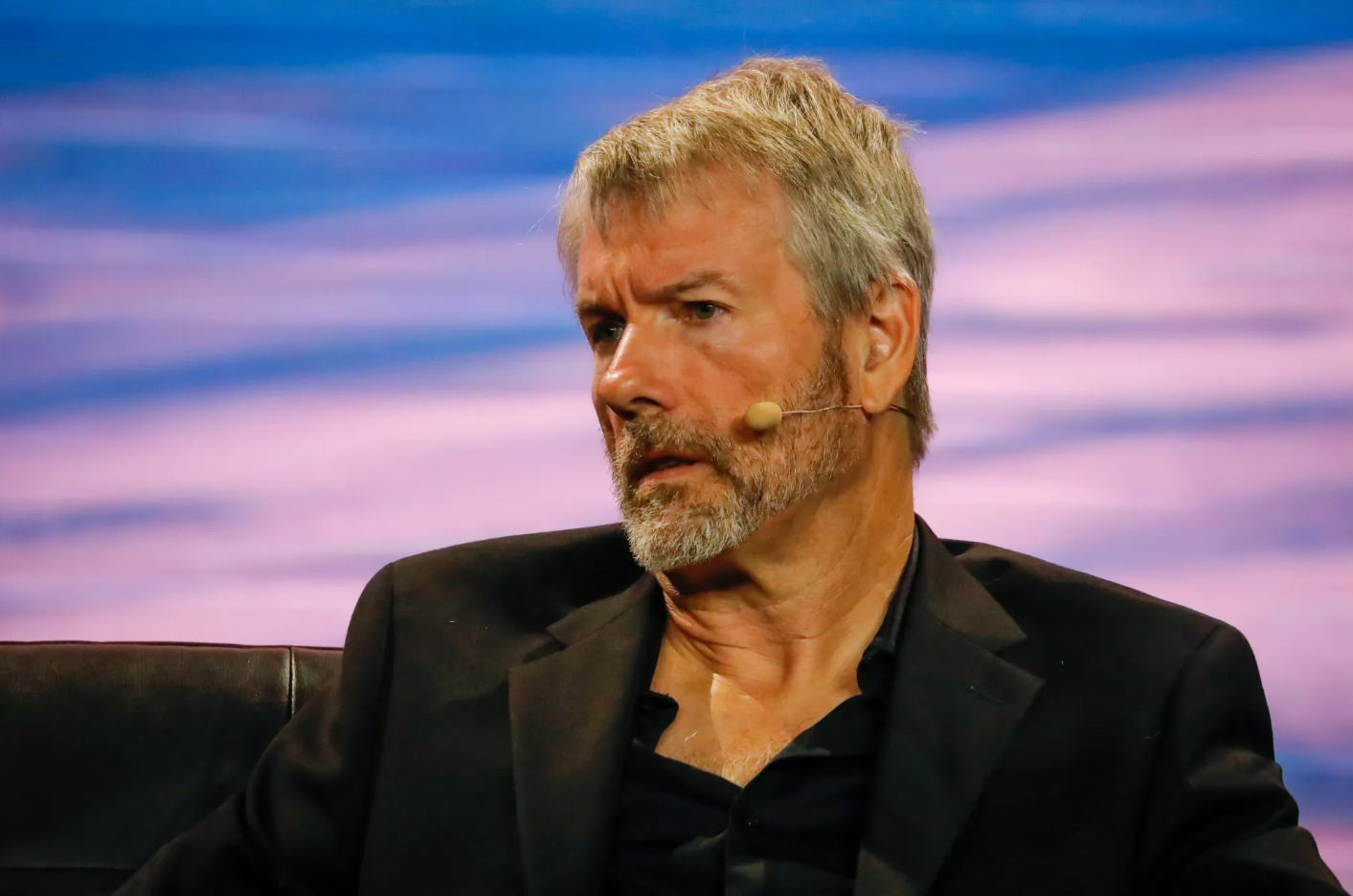

When MicroStrategy first purchased Bitcoin in August 2020, most institutions did not trust Bitcoin. But the situation has completely changed.

"January 2024 wasn't just another month. It marked the end of an era when Bitcoin couldn't establish itself as an asset class. From the second week when the SEC approved spot ETFs, a completely new era began. Some people cynically remarked, 'Well, MicroStrategy won't be needed anymore — it was just a clumsy substitute for ETFs.'

But simultaneously, the halvening was approaching, and investors were experiencing major changes. Options traders in particular began moving away from Bitcoin mining stocks, looking for something else. In Q1 and early Q2 of 2024, there was a significant shift in liquidity in both the options and equity markets. Volatility and options traders left dozens of Bitcoin mining companies for MicroStrategy because Bitcoin miners were facing the halvening, which meant their revenues would be cut in half.

This change caused our options trading volume to explode, and we became the market leader in options. When the SEC approved ETFs, they didn't approve options on them. Today, our options market is around $95 billion, matching our market cap."

Saylor's analysis shows that the ETF approval didn't simply introduce a new investment vehicle but caused a structural change in the entire Bitcoin ecosystem. Particularly noteworthy is the capital movement between existing Bitcoin-related companies. The capital migration from mining companies to MicroStrategy indicates that the market now prefers more stable and sustainable business models.

This also suggests that the Bitcoin market is evolving from a first-generation model centered on 'mining-trading' to a second-generation model with more sophisticated financial products and investment vehicles. Especially, the growth of the options market indicates that institutional investors can now deploy various investment strategies with Bitcoin.

These changes demonstrate that Bitcoin is successfully integrating into mainstream financial markets while simultaneously fostering financial innovation. The emergence of ETFs is just the beginning; more innovative financial products are expected to emerge in the future.

Saylor claims that Bitcoin ETF approval marked the beginning of a 'Bitcoin Gold Rush,' after which no politician or financial institution could stop Bitcoin's growth. (Source: Bloomberg)

MicroStrategy continues to play an important role even after ETF approval. Saylor explains this from the perspective of 'capital market evolution.'

"ETF companies are 'investment trusts' under SEC Rule 40. This means they're special types of companies that can only hold assets in trust, nothing more. If you want to buy gold, you might purchase GLD or IAU, the gold ETFs. They take your money, buy gold, and the asset just sits there in custody. It becomes a kind of 'dead asset.'

If you sell or redeem your ETF shares, they have to sell the gold and return your cash. Think of them as banks that take overnight deposits. I could deposit $100 billion in that bank, but it's just an overnight deposit. I invest it in gold, soybeans, or oil, and when you want to redeem, they sell the soybeans, oil, or gold to return your money.

In contrast, MicroStrategy is an 'operating company' under SEC Rule 33. We can raise permanent capital. For example, we can raise $1 billion in capital to take risks. If we raise $1 billion and buy $1 billion worth of Bitcoin, it's not an overnight deposit. It becomes a permanent investment. You'll hold the shares forever, and we'll hold the Bitcoin forever. There's no right of redemption. You can't just bring your MicroStrategy shares and say, 'Give me cash back.'

We don't have $40 billion of overnight deposits. We're not a bank making 10 basis points annually managing someone else's money. We have $40 billion, and it's ours."

Saylor's explanation clearly shows the fundamental difference between ETFs and operating companies. This isn't merely a legal distinction but represents the essential difference in the roles each plays in the Bitcoin ecosystem. While ETFs are passive asset custodians, operating companies like MicroStrategy are active capital deployers.

This difference also relates to the developmental stage of the Bitcoin market. If the emergence of ETFs represents Bitcoin's popularization and improved accessibility, the existence of operating companies signifies the development of a more sophisticated capital market. The two forms don't compete but enhance market depth and richness through their respective roles.

This is also similar to the evolutionary process of traditional financial markets. In the stock market, ETFs and operating companies coexist, each fulfilling its role. The Bitcoin market is developing in a similar direction, indicating increasing market maturity.

Saylor argues that various financial innovations are needed to meet the needs of institutional investors. He particularly emphasizes the potential of new investment products utilizing Bitcoin's volatility.

"Imagine someone gives you an option on a dollar bill. The dollar has zero volatility, so the value of an option to buy 10 more dollars for $1 for the next year is nothing. A stock option with no volatility is worthless. The Black-Scholes equation is the conventional method for valuing stock options, and when volatility is 15, there's a little optionality, at 60 it increases significantly, and at 120, the option value explodes.

Let me give you a practical example of value. Say you have $1 million. With zero volatility, you might receive SOFR (Secured Overnight Financing Rate). You're getting 4% for taking the risk of keeping money in a bank. With S&P index volatility at 15, you might earn 12-15% by holding one share of SPY.

With Bitcoin, holding $1 million through IBIT or Bitcoin directly has 60 volatility. You could earn 70-80% taking the risk of holding Bitcoin. If you held $1 million in MicroStrategy stock and sold calls on the market, with 120 volatility, you could generate 200% annual interest."

The launch of Bitcoin ETFs and the emergence of specialized operating companies like MicroStrategy have diversified Bitcoin investment options, while new derivatives such as futures and options continue to develop and mature the related investment market.

Saylor's analysis demonstrates that Bitcoin's high volatility can actually create new investment opportunities. Traditionally, volatility has been viewed as a risk indicator, but when properly utilized, it can become a tool for generating returns.

This can be very attractive to institutional investors. Institutions disappointed with traditional assets' low returns may be interested in investment strategies utilizing Bitcoin's high volatility. The ability to manage risk through derivatives like options while pursuing high returns is a significant advantage.

Moreover, these financial innovations can contribute to increasing the liquidity and stability of the Bitcoin market. The emergence of diverse investment products will attract more participants to the market, ultimately creating a virtuous cycle that enhances market maturity.

Larry Fink, BlackRock's CEO who claimed to have no interest in cryptocurrencies until 2018, later changed his position and launched a Bitcoin ETF. He projects that Bitcoin's growth depends on institutional adoption and could reach $700,000 if sovereign wealth funds participate. (Source: HBR)