Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

After the Red Wave that swept across America in November 2024, Saylor believes the United States has begun a journey to secure global leadership in digital assets. He explains that this goes beyond mere regulatory changes within the US; it marks the beginning of building an entirely new global financial system.

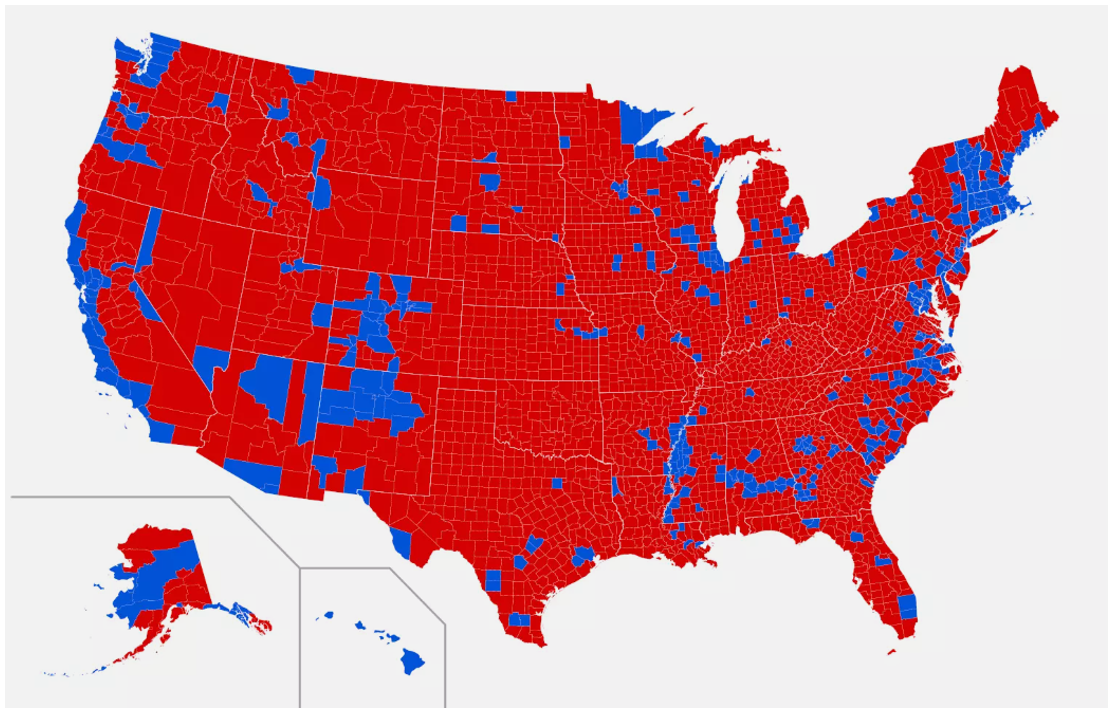

County-level map of the 2024 US presidential election results. Republican s won the presidency and both chambers of Congress on November 5, 2024, having granted full mandate to implement its policies. (Source: Freedom Quest)

Saylor predicts that US digital asset regulation will fundamentally change starting in 2025, the first year of Trump's second term. In particular, he expects a shift away from the previous administration's hostile stance toward cryptocurrency, toward a much more progressive and innovative regulatory framework.

"I think the US is now actually becoming the worldwide leader in digital assets. We're leaping from a position where we were perhaps 25-30% behind, right in the middle of the pack, to now becoming number one. This is happening because the rest of the world fears innovation and fears getting ahead of the United States.

So even when they had good ideas, like a new digital asset framework, other countries were afraid to adopt them when the US was taking a more conservative stance. But now that the US is taking the lead, the rest of the world will follow. When the US creates a digital asset framework, the entire world will adopt this as the standard. This is the beginning of a new financial hegemony.

Progressive ideas about digital assets will now be adopted by the United States, and the US has the economic capability, financial power, political power, and technical power to commercialize all of these innovations.

If we had seen a Blue Wave on November 5th, we wouldn't have gotten a digital asset framework, and the US would have grudgingly accepted Bitcoin but refused to embrace other ideas. But after the Red Wave, it's now much more likely that we'll get a digital asset framework. We'll see digital tokens, digital securities, digital currencies, digital capital, and digital exchanges, and the US will be the big winner in all of these markets."

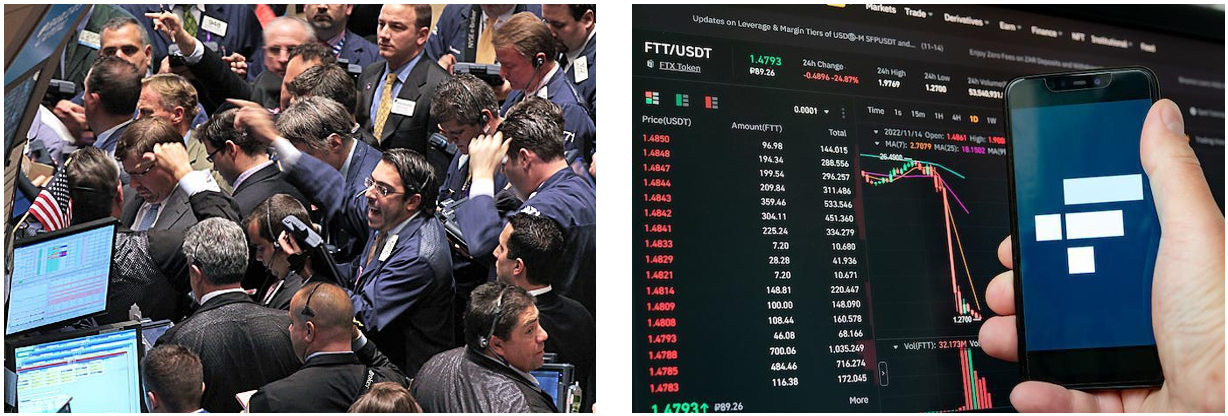

What would Bitcoin's outlook be if Harris had won and Gary Gensler had continued leading the SEC? Could forces that consistently suppressed the cryptocurrency industry throughout the Biden administration have quickly changed course? (Source: Politico)

Saylor isn't simply making predictions; he's explaining the structural reasons why America will dominate digital assets. He sees this not only as a strategic choice but as the inevitable outcome of America's unique position at the intersection of global finance, technology, and regulatory power.

The United States is already asserting itself as the world leader in digital assets, and this is a strategic, inevitable development. America combines economic might, a sophisticated financial system, technological innovation capabilities, and global regulatory authority. When these factors converge, it's natural for the US to establish global standards for digital asset regulation.

What's particularly noteworthy is how the regulatory approach to digital assets will define the entire global market. Until now, most countries have viewed digital assets with fear and suspicion, prioritizing restrictive regulation. But once America adopts a forward-looking stance with a clear framework, other countries will have no choice but to follow suit. This represents not just a departure from the existing financial order but the formation of a new global financial system where digital assets operate within legitimate, institutionalized channels.

This shift will allow digital assets, including Bitcoin, to grow within a legally sanctioned ecosystem, which could accelerate their adoption by mainstream institutions and investors who were previously deterred by regulatory uncertainty.

Ultimately, the Red Wave's new digital asset framework represents more than just a change in financial policy; it's a tool for America to establish a new form of global economic hegemony. If America successfully implements this approach, global capital and innovation will flow increasingly toward the United States, further strengthening America's financial dominance.

Saylor predicts that stablecoins will play a crucial role in the future financial system. He particularly believes that the stablecoin market, currently around $150 billion, could grow to $15 trillion under proper regulation, further strengthening the dollar's global dominance.

"Under a clear regulatory framework where companies can issue stablecoins backed by US dollars or US dollar equivalents like short-term Treasury bills, that would be good for the world, not just for America. If Tether is going to issue stablecoins, we should have Tether relocate to the United States, give them a license in the US, and let them operate here.

But we shouldn't stop there. JP Morgan and Goldman Sachs should be allowed to issue stablecoins too. Circle should be allowed to continue. There should be competition in the market. If it turns out that Tether and Circle are better than JP Morgan and Goldman Sachs, then Tether and Circle should issue all the digital currency in the world.

From the US perspective, you don't want just $150 billion of digital currency; you want $15 trillion of US digital currency circulating globally. Right now, the stablecoin market is only about $150 billion. But if the US establishes the right regulatory framework, this market could grow to $15 trillion. This would make the dollar the medium of exchange in North Korea, South Korea, Cuba, China, Russia, Africa, South America, and probably most of Europe as well."

Stablecoin market cap surpassed $200 billion in January 2025. The new Trump administration is prioritizing stablecoin regulation, generating expectations for growth in the stablecoin-centered cryptocurrency industry. (Source: Into The Block)

Saylor identifies stablecoins as the cornerstone of America's global financial strategy. He sees them not merely as digital payment tools but as critical instruments for maintaining and enhancing the dollar's global hegemony. With the right regulatory framework, the current $200 billion stablecoin market could expand to $15 trillion, fundamentally reshaping the global financial order.

In today's global financial market, an increasing number of countries prefer the dollar due to their own currency instabilities. Stablecoins represent the most efficient way to meet this dollar demand. Previously, people needed to hold physical dollars or maintain accounts connected to the US financial system, but with stablecoins, anyone with internet access can utilize dollar-based financial services, accelerating the expansion of dollar-denominated assets.

As stablecoins become established, the influence of US financial policy on global markets will only grow. Just as Federal Reserve interest rate decisions and money supply adjustments currently impact the world economy, US-issued stablecoins will be used worldwide, directly reflecting US financial policy. This gives the US government greater control over global financial markets while potentially weakening the financial independence of competing nations like China or European countries.

The widespread adoption of stablecoins will inevitably pull the center of the financial order more strongly toward the United States. By embracing stablecoins within its regulatory framework and encouraging major financial institutions to issue official digital dollars, the global economy will become more deeply integrated into a US-centered digital financial network. Stablecoins thus offer America an opportunity to establish a new form of hegemony as the traditional financial system reconfigures itself through digital assets.

Saylor sees digital securities as an innovative solution that can overcome the limitations of traditional securities markets. He particularly emphasizes the possibilities of 24/7 trading and self-custody.

"If we create a digital securities framework, you could tokenize Apple stock and trade it as tokens on a digital exchange. You could even trade on weekends. You could even tokenize Apple stock and self-custody it on your iPhone.

If you can have your photos on an iPhone, your books on an iPhone, your files on an iPhone, and your Bitcoin on an iPhone, why couldn't you have your Apple stock on an iPhone? I think a digital securities framework is very compelling. People want to trade on weekends, they want to trade in the evenings.

Right now, there's only one company that can trade Apple stock. But what happens when there are 1,500 companies that can trade Apple stock? What happens when 6 billion people with Android phones can custody Apple stock? This isn't a complicated idea. Is it technically possible? Of course it is. With modern cryptography, we've solved this problem with Bitcoin."

The introduction of digital securities opens possibilities for new financial markets with 24-hour trading and self-custody without centralized intermediaries, providing more individuals and companies free access to capital markets. (Source: Business Insider)

Saylor's vision for digital securities proposes a fundamental transformation of the structural limitations in today's securities markets. The current market features restricted trading hours, centralized systems, and an inability for individual investors to directly custody their assets. Saylor's solution is to convert traditional assets like stocks into blockchain-based digital tokens, creating a market with 24-hour trading and self-custody capabilities.

This transformation would dramatically improve securities market accessibility. Currently, investors must go through specific intermediaries to trade stocks, but with digital securities, individuals could directly hold and trade stocks through their smartphones. This isn't merely a technological improvement but a shift toward decentralizing the concentrated structure of securities markets, allowing greater participation.

The competitive landscape of the financial industry would also change substantially. Currently, a small number of large financial institutions dominate the market, but the activation of digital securities would introduce more exchanges and service providers, increasing the efficiency of financial services and potentially reducing fees. This ultimately overcomes the closed nature and inefficiency of the existing financial system, developing it into a more open and flexible form.

Saylor argues that these changes aren't just improvements to the existing system but represent the birth of an entirely new financial system. He sees this as the beginning of a 'crypto renaissance.'

"After the Red Wave, we're going to see a crypto renaissance. This crypto renaissance will spark massive capital formation, and we won't live in a world where we only talk about 4,000 public companies and only 40 of them matter.

When I turn on CNBC, it's just Nvidia, Apple, Meta, Tesla, Microsoft. What about the other 99.9%? We have an antiquated oligopolistic structure based on 20th century ideas. It's time to move into the 21st century. It's time to do things smarter, faster, stronger.

We have 8 billion people trying to make a life for themselves through 4 million companies. We should hold out the promise of technology to them. The government's role isn't to say 'no.' It isn't to sue you when you try to do something aspirational. The government's role is to provide an ethically sound, technically sound, economically sound way out of poverty."

The combined market cap of Magnificent 7 reached $16.8 trillion by January 2025, accounting for approximately 33% of the entire S&P 500's market capitalization. (Source: Bloomberg)

Saylor points out that the current financial system operates inefficiently within outdated regulations and centralized structures, preventing most companies and individuals from easily accessing financial markets. A digital asset framework would address these issues and create an environment where more people can participate in capital markets.

This change isn't simply about existing financial institutions going digital. In the new financial system, anyone can issue and trade assets using blockchain technology, with intermediaries playing an increasingly diminished role. Previously, only a select few companies had opportunities for listing and fundraising, but digital securities and tokenized assets would open direct market participation to more companies and individuals.

Ultimately, Saylor's 'crypto renaissance' isn't about replacing the existing financial order but building a more open and inclusive financial environment. This represents more than technological advancement — it signifies the democratization of financial markets, allowing more people to access capital and marking the beginning of a new economic paradigm.