Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

The debate over the essence of money has persisted for thousands of years. From ancient Greece to the modern era, philosophers, economists, and politicians have continuously discussed the definition and role of money. The emergence of cryptocurrency in 2008 with Bitcoin added a new dimension to this age-old debate.

Michael Saylor offers innovative insight into this debate. He believes confusion arises because people try to understand money as a single, unified concept. Saylor clearly distinguishes between 'Currency' and 'Capital' as two separate aspects of money, and through this distinction, he argues that we can understand the true value of Bitcoin.

"To properly understand the concept of money, you first need to break it down. Money is divided into two major elements: currency and capital. Currency is the medium of exchange - it's fiat money. It has liquidity, it's fungible, and you can use it to pay taxes. And the prices of everything are denominated in it.

Let me give you an example. In Argentina, the peso is the medium of exchange, while the dollar is the unit of account. But neither serves as a store of value. It's the same in the United States. No billionaire holds 95% of their assets in cash dollars. That's because everyone knows that something else must serve as a store of value.

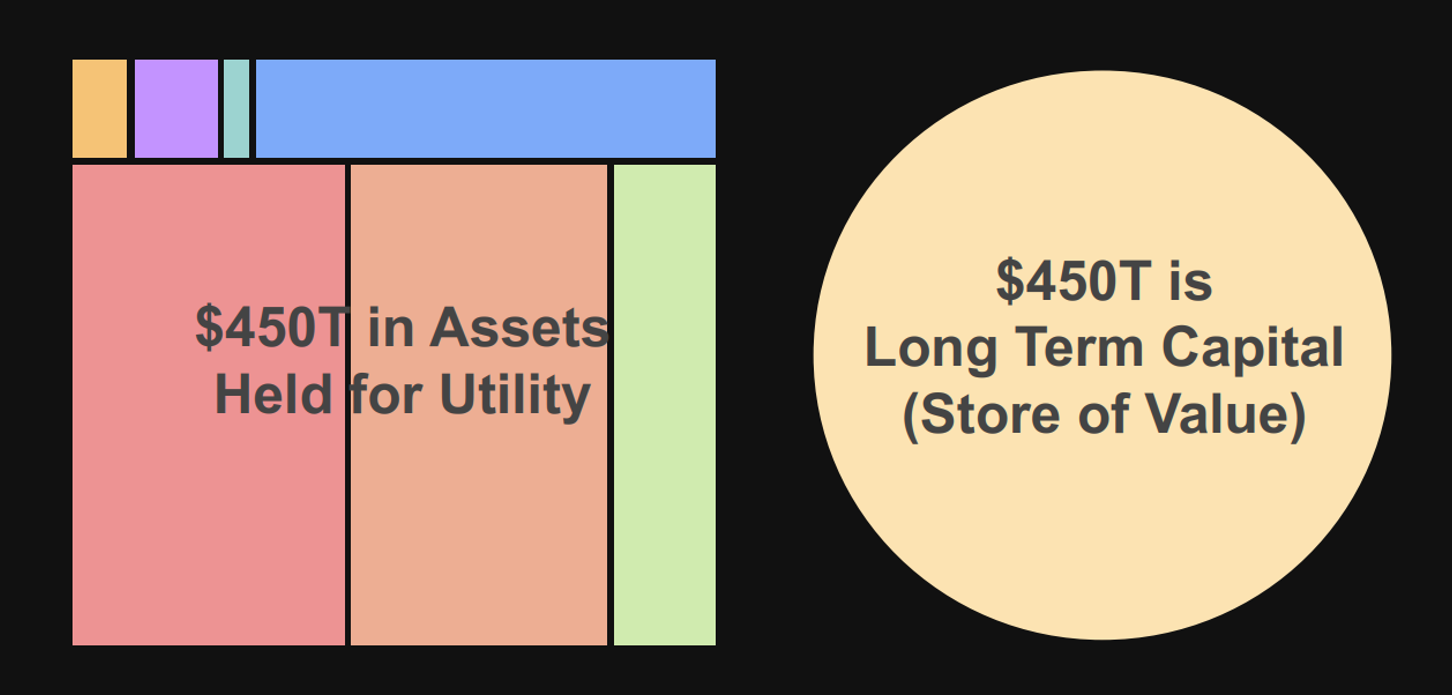

So people buy the S&P 500 index, or a building on Park Avenue, or perhaps a sports team. These assets are what I call 'capital.' Globally, there's about $900 trillion of wealth, invested in real estate, stocks, bonds, art, and so forth. Among these uses, the most important and valuable one is long-term capital — that is, long-term wealth storage. This accounts for about half of the total, around $450 trillion.

Half of the world's wealth, approximately $450 trillion, exists purely as a store of value. Saylor explains that Bitcoin functions not as currency, but as a new form of value storage. (Source: Bitcoin Conference)

Take Jeff Bezos as an example. His assets are worth about $200 billion. Out of that, how much is in pure dollars in savings or checking accounts? 1%? No. He probably doesn't even have $2 billion in cash. The same goes for Bernard Arnault. He has $180 billion in assets, but his actual cash assets likely don't even reach 1%.

The world's wealthiest individuals hold most of their assets in stores of value rather than cash. Saylor emphasizes this obvious but often overlooked fact to highlight Bitcoin's importance as a value preservation mechanism. (Source: NYT)

This is where Bitcoin comes in. Bitcoin is history's first perfect digital capital. The second-best form of money is gold, but gold has a half-life of 30 years. Bitcoin, on the other hand, has an infinite half-life. What this means is that if you hold gold for 30 years, its value is cut in half. But that's not the case with Bitcoin.

All traditional assets have problems. Can you put a hotel in your pocket and move $10 billion instantly? Gold weighs 3,000 pounds, how do you plan to move it? Bitcoin solves all these problems.

Since Satoshi created Bitcoin, money has been completely separated into currency and capital. Currency is the medium of exchange, the legal tender, and the dollar is the world's reserve currency. Everything else in the world is pegged to the dollar. The Chinese yuan, the UAE dirham, the euro - they're all pegged to the dollar.

The other aspect of money, capital, is for long-term value storage. You don't need it to buy coffee or pay rent. It's for supporting your family 100 years from now, for staying wealthy forever. That's what Bitcoin is."

Saylor's monetary dichotomy provides a new framework for understanding Bitcoin. This distinction serves as a powerful counterargument to criticisms that Bitcoin is unsuitable as a payment method. Bitcoin, according to Saylor, never aimed to be a 'currency' for everyday transactions. Instead, Bitcoin is humanity's first perfectly designed 'digital capital,' fulfilling the role of a long-term store of value.

This perspective also neutralizes criticisms about Bitcoin's volatility. Currency needs to maintain stable value, but capital doesn't necessarily require stability. In fact, it's natural for capital to increase in value over time. Saylor argues that this characteristic is not a weakness of Bitcoin but a strength.

Moreover, Saylor's analysis helps us gauge Bitcoin's potential market size. Considering that the global long-term capital market is worth $450 trillion, the current market capitalization of Bitcoin at around $2 trillion suggests enormous growth potential.

Saylor projects that by 2045, Bitcoin's market cap as a store of value could reach up to $280 trillion. At this point, a single Bitcoin would be worth $13 million. (Source: Bitcoin Conference)

In this context, Saylor predicts that all monetary systems in the world will eventually converge to two systems. One is the global reserve currency system centered on the dollar, and the other is the global reserve capital system centered on Bitcoin. Most national currencies are already officially or unofficially pegged to the dollar, demonstrating the dollar's established position as currency.

Similarly, Saylor forecasts that Bitcoin will attain this status in the capital domain. He specifically points out the limitations of traditional capital storage methods: real estate cannot be moved, gold is too heavy and inefficient, and stocks are dependent on company performance. In contrast, Bitcoin overcomes all these limitations as the first 'perfect capital.'

Ultimately, Saylor's insight redefines Bitcoin beyond the simple dimensions of 'cryptocurrency' or 'digital asset,' positioning it as history's first 'perfect digital capital.' This represents a completely new paradigm for viewing Bitcoin and is key to understanding its true value and potential.

Saylor's argument also holds significant meaning in a historical context. Humanity has spent thousands of years searching for the 'perfect capital.' From seashells to copper tokens, silver, and gold, various attempts have been made. However, each had its own limitations.

"From a historical perspective, money has always been flawed. Seashells, tobacco bales, glass beads, copper tokens... One day we'll look back and laugh at the fact that we used silver coins, copper coins, and paper scraps. We'll wonder how humanity got this far.

Take gold as an example. Looking at 16th century Spain, they brought in gold from the New World and experienced massive hyperinflation. Inflation hit 500%, leading to the downfall of the Spanish Empire. Julius Caesar had a similar experience. After conquering Gaul and bringing back enormous amounts of gold, hyperinflation occurred in Rome, which led to the civil wars that followed.

Gold is a physical-world asset. Therefore, it's vulnerable to political fate, weather, war, famine, competition... Even the world's best companies like Kodak or Xerox can fail over time. The finest real estate can lose value if there's a coup in Egypt or if it's located in downtown Kabul.

Bitcoin is different. It doesn't exist in the physical world. It's not a company, and it's not dependent on culture, currency, or creditors. It has removed all risk factors. It's pure digital property. Why does its value increase? Because capital flows from a more chaotic and risky state to a less risky state.

Why does water flow downhill from a mountaintop? Is it by chance? Is it because of frightening turbulence? No. It's because of physics. Water at sea level requires less energy than water on a mountaintop. If I were to magically scatter all your money across random banks in Africa and then say, 'It's Monday morning now. Do you want to bring your money back to the US, or do you want to leave it there?', what would you do? Of course, you'd want to bring it to a safer place.

Capital flows to security. It flows to where it is treated best. It's running away from Russia, from China, from Africa, from Venezuela and Cuba, from South America. It's even running away from Europe. Ask Europeans. Do they prefer the digital dollar or the digital euro? By a margin of 99 to 1, they'll prefer the dollar over their own currency."

Argentina recorded a staggering 211.4% inflation rate in 2023. Yet even the US dollar, considered the safest fiat currency, loses value annually due to inflation. Throughout history, people have consistently sought assets safer than currency for wealth preservation. (Source: INDEC)

Saylor's analysis goes beyond Bitcoin's technical superiority, illuminating its historical significance in humanity's capital evolution. According to his view, Bitcoin represents the culmination of thousands of years of human pursuit for the 'perfect capital.'

His physical analogy is particularly persuasive. By comparing capital flow to water flow, he explains that the movement of capital to Bitcoin is as natural as water flowing downhill — it follows physical laws. This suggests that Bitcoin's growth is not a temporary phenomenon or speculative bubble, but an inevitable result of physical and economic laws.

Saylor also convincingly explains the vulnerability of traditional capital through historical examples. The cases of the Spanish Empire and the Roman Empire effectively illustrate the fundamental limitations of physical assets like gold. This further highlights the advantages of Bitcoin, which is non-physical and purely digital.

In this capital evolution process, another point worth noting is the 'lifespan' each asset possesses. Saylor explains that every asset has its own unique lifespan, which is a key factor determining its value.

"The way to calculate an asset's lifespan is simple. You divide the asset's value by the annual cost to maintain it. Let me give you an example. If you put $10 billion into pesos, it will disappear in 2 years. 98% inflation will strip away all your economic energy - your capital.

The Turkish lira lasts 3 years. The US dollar, under traditional monetary inflation, might last about 14 years. Over those 14 years, its value is gradually drained. What if you put your money in a hedge fund? They take 2% in management fees and 20% of the profits. If you invest in typical assets, it costs you about 4% annually. That means it's a 25-year asset.

Government bonds can give you a yield, but a 3.5% after-tax yield has to battle against 7% currency inflation. So, they'll last about 30 years. Capital in a mutual fund, paying a 1% fee, might last 100 years. That's the best you can do with traditional financial assets. Even if you could buy a diversified portfolio for 10 basis points (0.1%), counterparty risk would drive the cost up to 1%.

The average lifespan of these 20th century financial assets is about 30 years. What about physical assets? A Ferrari will consume its asset value in insurance, maintenance, and depreciation within 5 years. Yachts are similar — they have annual operating costs of 10%, plus depreciation. Never think about storing your money in a yacht (laughs).

What about a house in Miami Beach? If you buy a $10 million house, it will cost $10 million to maintain it over 17 years. In the end, you're left with nothing. Silver lasts 22 years, a warehouse 40-50 years, gold 62 years, and art about 72 years.

And land? The average property tax in the US is 1.1%. This means your money will last 91 years - unless the government reassesses your property value, then it will be less. The oldest family ranch in the United States is King Ranch, which has lasted 173 years. Every other family in the country failed.

Looking at the longest-held property, the Crown Estate in the United Kingdom has been held since 1066. But it passed from the Plantagenets to the Stewarts, through the Lancasters and Yorks, and eventually to the Hanover family. Maybe seven different families split it — none of them got to keep it forever.

Physical assets might seem like they'll last 1,000 years, but in reality, 50-75 years is the best you can hope for. Entropy dilutes the value of physical assets, sucking out the capital — the energy — from them."

The longest-preserved asset in existence belongs to the British Royal Family. However, there's no guarantee when it might pass to another dynasty or whether the monarchy itself will endure. (Source: CNN)

Saylor's asset lifespan analysis is systematic and scientific. He doesn't simply guess the lifespan of each asset but calculates it using a clear formula: asset value divided by maintenance cost. This allows for objective comparison of the long-term holding value of various assets.

A notable point is that the actual lifespan of physical assets that seem 'eternal' is much shorter than expected. Even property, which appears highly durable, struggles to exceed 100 years when considering taxes and maintenance costs. Even the property of the British royal family, which receives the best institutional protection, continues to change hands.

This suggests that one condition for perfect capital is 'perpetuity.' No matter how valuable an asset is, if it inevitably corrodes or incurs costs over time, it cannot be perfect capital. This is where the value of Bitcoin becomes prominent.

So how does Bitcoin overcome the limitations of these physical assets? Saylor explains that Bitcoin is 'immortal digital capital' that has escaped the constraints of the physical world.

"What would happen if you placed your Bitcoin with a major institutional custodian? It would cost you 10 basis points (0.1%). According to the first law of money, this means it can last for 1,000 years. Of course, the custodian won't last 1,000 years, but that doesn't matter. You can move your Bitcoin elsewhere every year or every decade, staying one step ahead of failing custodians.

You can't teleport a building. You can't teleport King Ranch. But Bitcoin can be moved. You can also self-custody it. For about 1 basis point (0.01%) a year, you can buy good hardware wallets and signing devices, investing about one day a year to manage it. This makes it a 10,000-year asset.

What about entrusting it to AI? AIs or computer programs can manage private keys for just the cost of electricity. This would make it a 100,000-year asset. AIs will inevitably want Bitcoin. If they have a choice between Bitcoin and a ranch in Texas, gold bars, or Argentine pesos, the choice is obvious.

This is where you can see why Bitcoin is completely different from other assets. Other assets live in the realm of 30, 40, 50 years. But Bitcoin lives in the realm of 1,000 to 100,000 years. This is a revolutionary breakthrough for capital preservation.

It's like what I learned about the second law of thermodynamics at MIT: 'You can't win, and even if you break even, you can't get out of the game.' If you stop there, it can be depressing. But we don't want to lose. So we started thinking, 'What if we find a way out of the game? Then we could break even, and we might even win.'

Satoshi found that way. He gave it to us, and then he disappeared. That's Bitcoin. Bitcoin is immortal, immutable, immaterial capital. 'Immortal' means it has an infinite lifespan. It's not attacked by forces like weather, entropy, or inflation. 'Immaterial' means it doesn't exist in the physical world. It's free from all the problems that plague physical and financial assets."

The most likely candidate for Satoshi Nakamoto is Hal Finney, an American developer who suffered from ALS until his death in 2014. Whether Satoshi was Finney or someone else, what matters is that Satoshi gifted humanity with immortal digital capital, then disappeared. (Source: Independent)

The most notable aspect of Saylor's explanation is the 'time dimension' of Bitcoin. While all existing assets have lifespans measured in decades, Bitcoin has lifespans measured in thousands or tens of thousands of years. This represents not just a quantitative difference but a qualitative one.

His analysis also interestingly highlights the relationship between technological advancement and Bitcoin. As technologies like AI develop, the management cost of Bitcoin will decrease further, and its lifespan will extend. This suggests that Bitcoin is not just a simple digital asset but an evolving form of capital that can synergize with future technologies.

The second law of thermodynamics that Saylor cites provides an important insight for understanding the revolutionary nature of Bitcoin. In the existing capital system, the law of entropy was unavoidable. All assets eventually deteriorated or decreased in value over time. However, Bitcoin changed the rules of the game itself. By escaping the constraints of the physical world, it bypassed the law of entropy.

Having understood the revolutionary significance of Bitcoin as perfect digital capital, a practical question remains: can Bitcoin actually establish itself as this ideal capital? Saylor provides an answer from the perspective of physics.

"Tesla said, 'If you want to understand the universe, think in terms of energy, frequency, and vibration.' Interpreting this as the physics of money, energy represents money, capital, or wealth. Frequency relates to duration or lifespan — it could be a minute, an hour, a year, or a century. And we vibrate money whenever we trade with each other, move from one location to another, or convert one asset to another.

Currently, $900 trillion of capital is trapped in traditional finance and physical assets. These are based on 20th century technology and ideas. Stocks trade from 9:30 to 4:00, except on bank holidays. You can't do anything on weekends. Everything is slow and expensive. For 21st century prosperity, we need new ideas based on new technology.

Bitcoin can liberate this tremendous energy. Right now, Bitcoin's market cap is about $1 trillion. That's 0.1% of the $900 trillion. But this is just the beginning. An unprecedented movement of energy is about to start.

Watch how the physics of money works. Capital in an unstable and risky state always flows to a more stable and safer state. Just like water flows from high to low ground. People in Africa, South America, and Asia will sell their physical assets, low-quality bonds, and currencies to buy Bitcoin. Everyone will want a piece of cyber Manhattan.

This isn't just my opinion. It's physics. It's the law of entropy. Of the $900 trillion in capital, $450 trillion is used simply as a store of value. This capital experiences 3% entropy each year. That means $13.5 trillion disappears annually. Calculated at a 20x P/E ratio, this inefficiency is worth $270 trillion.

Digital capital, Bitcoin, can solve this problem. Over the past four years, it has recorded an annual return of 55%. Meanwhile, the world's best financial capital, bonds, has returned negative 5%. Imagine capitalizing your company or country at positive 55% instead of negative 5%. The difference is obvious and it's already working."

Saylor's 'physics of money' theory provides a powerful framework explaining why Bitcoin's growth is inevitable. From his perspective, the flow of capital to Bitcoin is as natural as water flowing from high to low ground.

His analysis also quantitatively shows the inefficiency of the current financial system. The calculation that $13.5 trillion in value disappears each year due to inefficient value storage methods is shocking. This clearly demonstrates the need for a more efficient store of value.

In this context, Bitcoin can be understood not as a speculative asset or alternative investment vehicle, but as an inevitable evolutionary process in human civilization. Just as the steam engine led the industrial revolution, Bitcoin is leading a new form of economic revolution.

In July 2024, Saylor delivered a keynote address titled 'The Bitcoin Revolution' at the annual Bitcoin Conference. This was the same event where then-presidential candidate Trump first publicly expressed his support for Bitcoin. (Source: Yahoo Finance)