Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

Saylor's perspective on Bitcoin extends beyond simple investment strategies. It represents a profound philosophical framework that offers new ways to understand digital capital and value in the digital age. This chapter explores the core philosophical concepts that Saylor frequently references and their deeper implications.

The "laser eyes" meme has become an iconic symbol in the Bitcoin community, but for Saylor, it transcends simple humor. He reinterprets it as a symbol of the focus and discipline that investors should maintain.

Laser eyes, a meme that became popular during the bull market in early 2021, symbolizes the strong belief that Bitcoin will surpass $100K. This meme has become a symbol of passion and unity of the Bitcoin community. (Source: X)

"Many people think laser eyes are just a meme — like 'Bitcoin to $100K!' But this isn't a meme. Laser eyes protect you from endless lies.

Who do I feel sorry for? People who put on laser eyes, watched Bitcoin rise $20,000, then declared victory and took off the laser eyes. Don't remove your laser eyes. The laser eyes signify that you should avoid distractions.

When Bitcoin goes from $10,000 to $100,000 and you declare victory, then launch sixteen useless businesses and fourteen stupid industries because you think you're a genius — you've taken off the laser eyes. Pride comes before a fall.

There have been 2.8 million mobile apps created for the iPhone, but you probably can't name a dozen that worked. There are 1.8 million extensions for Chrome, but you probably don't use even two of them. 99.9% of new business ideas fail, but you're sure yours will work.

Laser eyes represent humility. Everyone else will try to deceive you. They'll all tell you they have a better idea than Bitcoin, that Bitcoin has had its run. Then you lose focus and get distracted. Maybe because you made a lot of money buying Bitcoin at $100 and selling at $5,000, you think you're a genius. Then you'll start sixteen worthless businesses like everyone else."

Saylor's interpretation of laser eyes offers profound insight beyond superficial meme culture. For him, laser eyes symbolize focus and humility — essential qualities for long-term investors. This represents a deeper philosophical message about maintaining perspective amid short-term successes.

His analysis particularly addresses the dangers of early success. Many early Bitcoin investors who experienced significant gains developed overconfidence, leading them to pursue less promising ventures. Laser eyes serve as a reminder to resist this temptation and maintain focus on the essential.

The warning against diversification into dubious projects reflects Saylor's engineering mindset. Just as engineers focus on perfecting one system rather than creating multiple flawed systems, investors should concentrate on the highest-quality asset rather than spreading resources across inferior alternatives. This represents a profound counterpoint to conventional portfolio theory, which often emphasizes diversification without sufficient attention to asset quality.

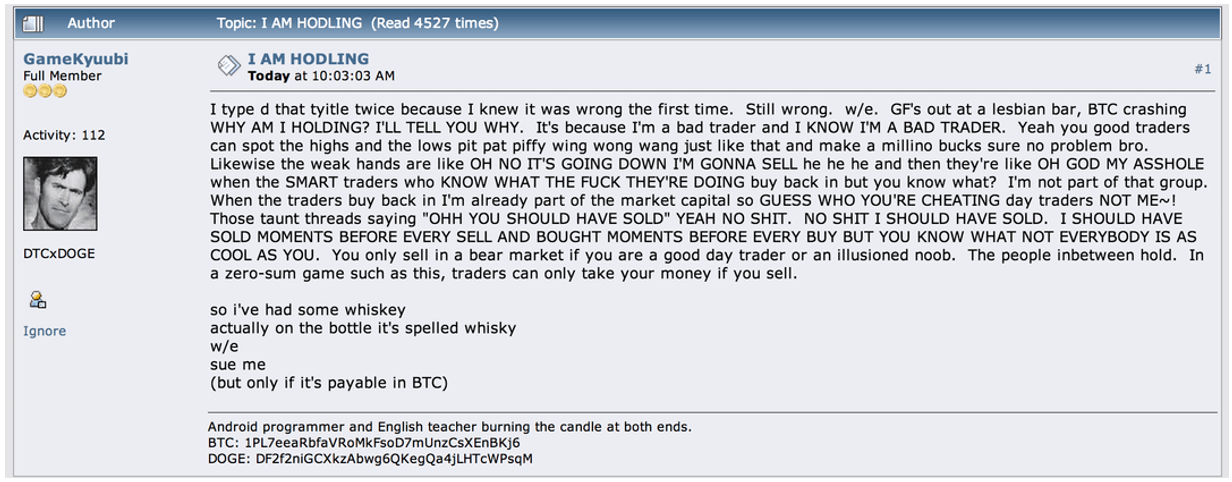

Saylor's "HODL" philosophy is one of the strongest beliefs in the Bitcoin community. He explains this not as a simple investment strategy but as a principle of energy conservation.

In 2013, a user posted a message titled "I AM HODLING" on Bitcoin forum. The content was about not selling Bitcoin and holding through volatility, but the user mistyped "HOLD" as "HODL," which became a meme. Subsequently, HODL was established in the cryptocurrency community to mean "holding long-term without selling." (Source: Bitcoin Forum)

"Bitcoin is energy. Bitcoin is life. Don't waste your energy. Don't waste your life. Don't let the fire go out when the fire is what keeps your family from freezing.

Your life is beautiful — you can do beautiful things with it. Don't throw yourself off a cliff. Satoshi gave us economic energy that we can capture, own, and preserve. Don't throw it away.

Economically, Bitcoin has increased 50% annually for the past four years. Every time you sell the best-performing asset in the world, what are you exchanging it for?

Diversification means selling winners to buy losers. When should you sell your Bitcoin? When your family is facing death. When you need it to preserve your life or the lives of those you love — that's when you should trade your Bitcoin.

The entire world is designed to convince you to sell your Bitcoin. Everyone wants you to trade your Bitcoin for their hedge fund, stock, idea, or whatever. But remember, no one has ever gotten rich by telling you not to give them your money."

Saylor's "HODL" philosophy contains deep wisdom beyond simple investment advice. He views Bitcoin not as a mere financial product but as "economic life force" with fundamental value that shouldn't be easily surrendered. This perspective challenges traditional trading mentalities that focus on timing markets.

His comparison to life and energy is particularly insightful. Just as we wouldn't voluntarily give up vital energy or life force, Bitcoin represents stored economic potential that should be preserved rather than traded. This reframes the act of holding Bitcoin from passive inaction to active preservation of value.

His critique of diversification also represents a significant challenge to modern portfolio theory. While traditional investment theory emphasizes risk reduction through diversification, Saylor argues that this often means diluting superior assets with inferior ones. This philosophical position suggests that once you've identified the optimal asset, concentration rather than diversification becomes the logical strategy.

Saylor's analysis also reveals how modern financial systems subtly encourage continuous trading rather than long-term holding. This systemic characteristic primarily benefits financial intermediaries rather than investors, suggesting that "HODL" isn't just an investment strategy but resistance against extractive financial practices.

Saylor emphasizes that deeper understanding of Bitcoin should lead to greater humility rather than certainty. This reflects his insight into Bitcoin's complexity and evolutionary potential.

"The moment you think you understand Bitcoin, you don't understand it. When you truly understand Bitcoin, you realize you can never fully understand it. This sounds paradoxical, but it's true.

Bitcoin isn't just a protocol or software. It's like a virus — an economic virus, a monetary virus, an ideological virus. It will ripple through time and space. You need to understand how users will interact at Layer 2, Layer 3, Layer 4, Layer 5.

Think about what 10 billion people will be doing with Bitcoin in 10 years, 50 years, 100 years, through 3 million different institutions that haven't even been created yet, via protocols that haven't even been conceived. How will an AI created in 10 years, living in cyberspace 50 years from now, integrated with a million other AIs, use Bitcoin?

This is why we can't grasp Bitcoin's full scope. It's a fire spreading through time, through space, through humanity. Once you understand this, you realize you can never know everything, and that's when humility emerges."

Just a decade ago, Bitcoin and AI were subjects of research and culture for only a minority, with poor technology and infrastructure. However, these two technologies are now the most important drivers of human advancement. No one can gauge how much more impact these technologies will have on us in 10 or 50 years.

Saylor's humble approach to Bitcoin reflects deep wisdom. He views Bitcoin not as a static technology but as an evolving ecosystem whose full potential exceeds our current understanding. This evokes Socratic wisdom — true knowledge includes recognizing the limits of our understanding.

His virus analogy is particularly powerful. Just as biological viruses evolve and spread through environments in ways that cannot be fully predicted, Bitcoin represents a self-propagating idea that will continue to evolve across various dimensions — technological, economic, and social. This suggests that Bitcoin's current form represents just the beginning of its development trajectory.

This philosophical position also provides important perspective on Bitcoin's future development. Rather than claiming to predict exactly how Bitcoin will evolve, Saylor acknowledges the inherent unpredictability of complex systems while maintaining conviction in their fundamental direction. This balances confidence with humility — a nuanced perspective rarely found in technology discussions.

The temporal dimension of Saylor's analysis is especially noteworthy. By considering how Bitcoin might function across various timeframes — from 10 to 100 years — he adopts an intergenerational perspective that contrasts sharply with the short-term thinking that dominates much of contemporary finance and technology discourse.

The mysterious disappearance of Bitcoin's creator, Satoshi Nakamoto, puzzles many, but Saylor interprets this as a key element that completes Bitcoin's value proposition.

"Do you know the only reason Bitcoin can be recognized as a digital commodity? It’s because of its "Immaculate Conception". Satoshi created it, gave it away to the world, and disappeared. That's the key.

No major company in the world was ever created this way. No one ever created a company, gave it to the world, and walked away.

If you look at all other crypto assets, they don't have a Satoshi. In fact, the way you know they're not commodities is that they're all arguing that they are commodities. Satoshi isn't arguing anything — Satoshi just left.

If something is going to be a commodity, there can't be a beneficiary. Satoshi gave up control of the protocol, gave up the Satoshi coins, and stopped trying to influence the network. It was a gift to the world. That's why it's an asset without an issuer.

Look at the next 100 cryptos and go down the list. You'll be hard-pressed to find this characteristic. The simplest test is this: if you created something, did you give it all away? Did you never sell it? And are you gone, no longer arguing about it? If so, maybe it's a commodity."

Saylor's concept of "Immaculate Conception" provides a crucial key to understanding Bitcoin's fundamental value. He illustrates how Satoshi's anonymity and disappearance aren't merely incidental but constitute essential elements of Bitcoin's nature. This represents a profound insight that the absence of a central authority isn't just a feature but the foundation of Bitcoin's claim as a truly decentralized asset.

This analysis draws important distinctions between Bitcoin and other cryptocurrencies. While many projects claim decentralization, the continued presence and influence of their founders fundamentally undermines this claim. Saylor suggests that true decentralization requires complete separation from creator influence — a standard that virtually no other cryptocurrency meets.

Satoshi's disappearance also has important implications for Bitcoin's ethical dimension. By walking away without profit-taking, Satoshi established Bitcoin as a genuine public good rather than a vehicle for personal enrichment. This creates a moral foundation that shapes Bitcoin's development culture, emphasizing collective benefit over individual gain.

The greatest significance of Satoshi's disappearance lies in its long-term, or even eternal, impact. The absence of a founder laid the groundwork for Bitcoin to evolve into a true public good. Just as internet protocols are not owned by any specific company or individual, Bitcoin has the potential to develop into a shared digital infrastructure for humanity.

Did Satoshi plan his exit from the beginning when he created Bitcoin? Whether intentional or coincidental, Satoshi's departure was the final touch that made Bitcoin an immortal digital asset.