Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

The biggest misconception about Michael Saylor is seeing him as a trader or investor. He defines himself as an engineer, and this identity forms the foundation of how he understands and approaches Bitcoin.

Saylor explains that there's a significant gap between how people perceive him and his actual identity.

"People think I'm a trader, and I'm not a trader. I'm an engineer. They say things like, 'How's this trade going? Saylor's made billions on this trade, he's down billions, he's up billions.' I'm not trading. I'm engineering. I'm engineering a better world.

I want Bitcoin to spread because I think it's going to engineer a better world for 8 billion people. I'm engineering a better company at MicroStrategy. MicroStrategy is a better company today than it was four years ago.

Of course, I like making money for my shareholders. I like making money for my employees. I like actually providing a better product for the customer. But people on the outside who don't get Bitcoin think, 'Oh, well, it's a speculative asset.' I was on television yesterday, and they asked, 'When's it going to go down to $30,000?' How can you even ask that question? You don't understand how this works.

People who don't understand engineering don't understand that Bitcoin is perfect money. It was engineered to win. How do you know it's going to win? It's like, how do you know the plane's going to fly? How do you know the gun's going to fire? How do you know the stairs are going to work? Because I'm an engineer. That's what engineers do — we build stuff, we build rockets."

Saylor is an engineer to the core. He has lived his entire life as an engineer and IT entrepreneur. Bitcoin is simply the solution and tool he adopted to solve problems for himself, his company, and the world. (Source: Into The Impossible)

Saylor's self-definition as an engineer provides insight into the source of his deep conviction about Bitcoin. While traders focus on price fluctuations, engineers concentrate on the fundamental design and operating principles of systems. This is similar to how an aircraft designer focuses on the physical principles of flight rather than temporary changes in weather or air currents.

His analogies to airplanes, guns, and stairs are particularly revealing. These tools, once properly designed, function inevitably according to physical laws. Saylor views Bitcoin as a system with the same kind of inevitability. This supports his core argument that Bitcoin's success isn't dependent on speculation or luck, but is inherent in its fundamental design.

This engineering perspective also determines how he responds to crisis situations. Traders panic when prices fall, but engineers remain unshaken as long as the system's basic principles remain sound. This explains why Saylor is completely unconcerned about Bitcoin's volatility.

Saylor explains that like all human creations, the financial system is engineered, and its value and limitations are determined by how it was engineered.

"The financial system itself should be viewed from an engineering perspective. The current traditional financial system has serious design flaws. The main issue is the lifespan of assets.

All assets decay over time. Physical assets require maintenance, equities face competition and regulatory risks, and bonds are vulnerable to inflation. This is measured by the useful life of an asset, or how much it costs to maintain its value.

For example, a Ferrari costs as much in maintenance and insurance as its worth in 5 years. A yacht loses most of its value in 10 years. A home in Miami Beach will cost its purchase price in maintenance costs within 17 years. Gold has a useful life of about 62 years, after which it loses half its value.

Modern financial assets face similar issues. The peso loses 98% of its value in 2 years. The US dollar has a useful life of about 14 years, but decays linearly during that period. Investing in a hedge fund gives you an effective life of about 25 years due to 2% management fees and 20% performance fees.

As an engineer, the problem with this system is painfully obvious. We needed to design a better system, and that's what Bitcoin is. Bitcoin is the first immortal asset. Rather than decaying over time, it actually becomes stronger."

Some criticize financial engineering as mere number manipulation rather than genuine engineering. However, financial engineering is a discipline and tool capable of creating greater added value and wealth than any other type of engineering. (Source: Colombia IEOR)

Saylor's analysis clearly identifies the fundamental design flaws in the modern financial system. Like an engineer calculating a machine's lifespan, he precisely calculates each asset's lifespan and points out its limitations. This represents a dimension of analysis that traditional financial analysts typically overlook.

His perspective introduces a new evaluation criterion: the "lifespan" of assets. While most financial analysts focus only on returns or risks, Saylor emphasizes how long an asset can preserve its value. This is similar to how an engineer considers not just a machine's performance but also its durability.

Furthermore, Saylor's analysis suggests that the modern financial system has built-in planned obsolescence. All traditional assets are designed to inevitably decline in value. This is not a sustainable system and requires a new design — his argument leading to Bitcoin.

When it comes to Bitcoin programming and development, Saylor takes a very cautious and conservative position. This stems from his engineering experience and his deep understanding of the risks of changing well-functioning systems.

"I'm very conservative on programming and development. I think we should go forward very carefully, very carefully with consensus and think hard. I will go on the record: I think the biggest threat to Bitcoin is overfunded, enthusiastic developers that want to do something cool, that want to make it better.

If you look at the history of every empire and the fall of every empire — Rome, Greece — they always reach a peak and they collapse from within because a bunch of overfunded lawyers write laws to make things better. In this particular case, the developers are the lawyers, and the code they're writing are the laws.

99.9% of ideas fail, and only one out of a thousand is a good idea. If you have all these good ideas, launch a company, risk your own capital, risk your own credibility. There's a 99% chance you'll fail, and there's a 0.1% chance you'll be an Instagram or a Meta or Google and you'll succeed.

And then there's a 100% chance that when you succeed, people will criticize you. Think about the great successes — Microsoft, Facebook, Instagram, Apple — after they've succeeded, there's always an unintended consequence that comes from that great success. And 99.999% of the people that tried to do that, they all failed."

Saylor's conservative attitude toward developers comes from his engineering experience. An engineer who has worked with complex systems knows how dangerous it is to arbitrarily change a well-functioning system. Especially with a system like Bitcoin, which stores trillions of dollars in value, small changes could lead to irrevocable disaster.

Through his analogy of collapsing empires, he warns of Bitcoin's potential threats. Historically, most empires fell not from external attacks but from internal excessive improvement efforts. This provides an important lesson for the Bitcoin ecosystem: well-intentioned efforts to "improve" the system could endanger the entire system.

His perspective also offers interesting insights about innovation. True innovation isn't forcing improvements to existing systems but creating new systems and letting the market validate them. This explains why he considers Bitcoin an engineering masterpiece that has passed market validation, while projects that attempted to copy it will struggle to succeed.

Saylor explains that his confidence in Bitcoin is based on engineering analysis. He explains that Bitcoin's design is mathematically and cryptographically perfect, the result of careful calculation rather than chance.

"Many people ask me, 'How can you be so certain Bitcoin will succeed?' This is like asking an engineer, 'How do you know that bridge won't collapse?'

An engineer can tell by looking at the blueprints. Satoshi's design of Bitcoin is perfect. Mining rewards halve every 210,000 blocks, and the total supply is limited to 21 million. This isn't accidental. It's mathematically and cryptographically perfectly designed.

This is why I say 'There is no second best.' Bitcoin is a perfect design. All other cryptocurrencies tried to 'improve' this perfect design and failed. Look at Ethereum's roadmap. They want to put every seemingly good idea into the protocol. This is forced mutation, which only leads to deformity.

Bitcoin, on the other hand, is simple yet robust. It's like building an airplane with aluminum. You don't make an airplane safer by mixing aluminum with copper, bronze, and steel. In an engineering solution, you find the most suitable material and use only that. If you try to include everything, the system breaks down.

It's the same with a nuclear reactor. You don't put 16 different radioactive elements into it. You find the appropriate material, design the reactor for it, and use the correct fuel. If you put dirty fuel in a yacht engine, it fails. If you put dirty gasoline in a car, it fails. The system must be engineered correctly, and the right fuel must be used."

Aluminum is light, strong, and durable, making it highly suitable for aircraft construction. In engineering, selecting the most appropriate material or technology is more important than adding complexity, and Bitcoin should maintain stability and reliability by adhering to core principles rather than adding complex features. (Source: CNN)

Saylor's engineering analogies provide crucial insights into the essence of Bitcoin. His concept of "perfect design" means removing unnecessary complexity and focusing on core functionality. This aligns with the modern engineering principle of "KISS(Keep It Simple, Stupid)."

His airplane and nuclear reactor analogies particularly help our understanding. In advanced technological systems, simplicity and purity are advantages, not defects. Bitcoin's "simple" design may actually be the optimal solution reached after countless considerations and calculations. This is similar to how aluminum became the material of choice for aircraft construction.

His analysis also offers important insights about innovation's nature. True innovation isn't trying to include everything but solving fundamental problems most efficiently. From this perspective, Bitcoin's "limitations" that critics point out might actually be its strengths.

Saylor views Bitcoin not as a mere investment asset but as a foundational technology for a new financial system. From an engineer's perspective, he explains how Bitcoin can solve current financial system problems.

"As an engineer, I focus on solving problems. The biggest problem we face today is that $450 trillion of capital experiences 3% entropy annually. This means $13.5 trillion disappears every year. The existing financial system can't solve this problem.

What we've built at MicroStrategy is a kind of transformer. We take energy from Bitcoin, which is like a nuclear power plant, and convert it into various forms to supply to the market. Through bonds, we provide low-risk, low-return products to investors who want that, and through stocks, we offer high-risk, high-return products to those who want something different.

Many people see Bitcoin's volatility as a problem, but it's energy. It's like an engine's RPM. What matters is how we control and utilize this energy. We're channeling this energy to redesign the global financial system.

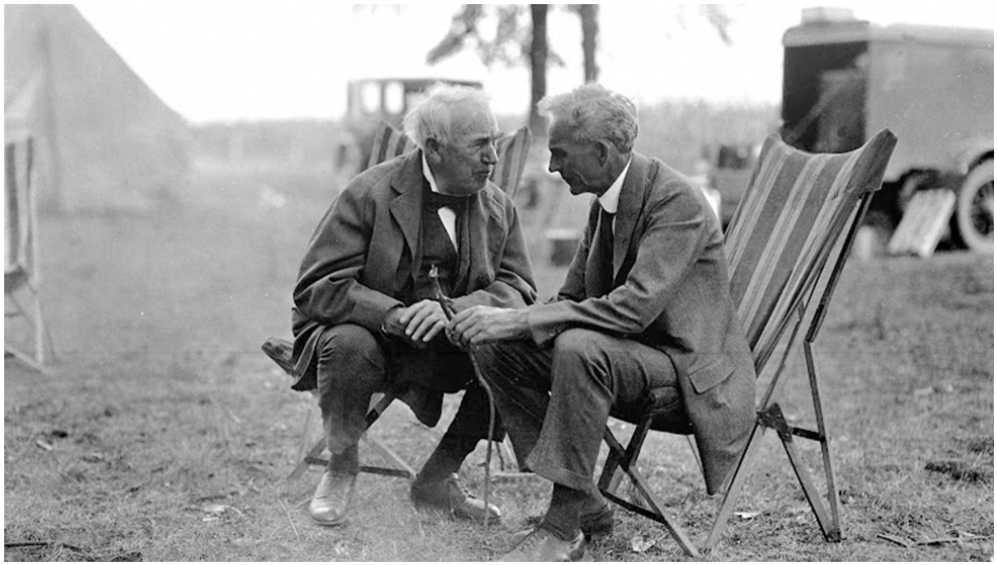

This moment is similar to the early 1900s. People were dependent on steam engines then. But Edison brought electricity, and Henry Ford introduced the assembly line and internal combustion engine. I believe we can create a more efficient and sustainable financial system through Bitcoin. This isn't about destroying the existing system, but designing a better one."

Thomas Edison and Henry Ford, who built humanity's new future based on great inventions and innovations, were lifelong mentors and friends. Humanity has always built new futures through new engineering. We simply cannot predict when and what new engineering will emerge. (Source: Ford)

Saylor's vision shows that Bitcoin is not just an investment asset but a foundational technology to redesign the global financial system. From his perspective, Bitcoin is like electricity or the internal combustion engine — a fundamental innovation upon which various financial services and products can be designed.

He particularly views Bitcoin as the source of new financial energy. Just as electricity is produced at power plants and converted to various voltages through transformers, Bitcoin's economic energy can be transformed into various forms to meet each user's needs. This provides important insights into how the Bitcoin ecosystem might develop in the future.

Saylor's analysis also teaches important lessons about how innovation occurs. True innovation isn't unconditionally rejecting existing systems but designing more efficient alternatives and gradually implementing them. This suggests that Bitcoin will complement and improve the existing financial system gradually rather than replacing it radically.