Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

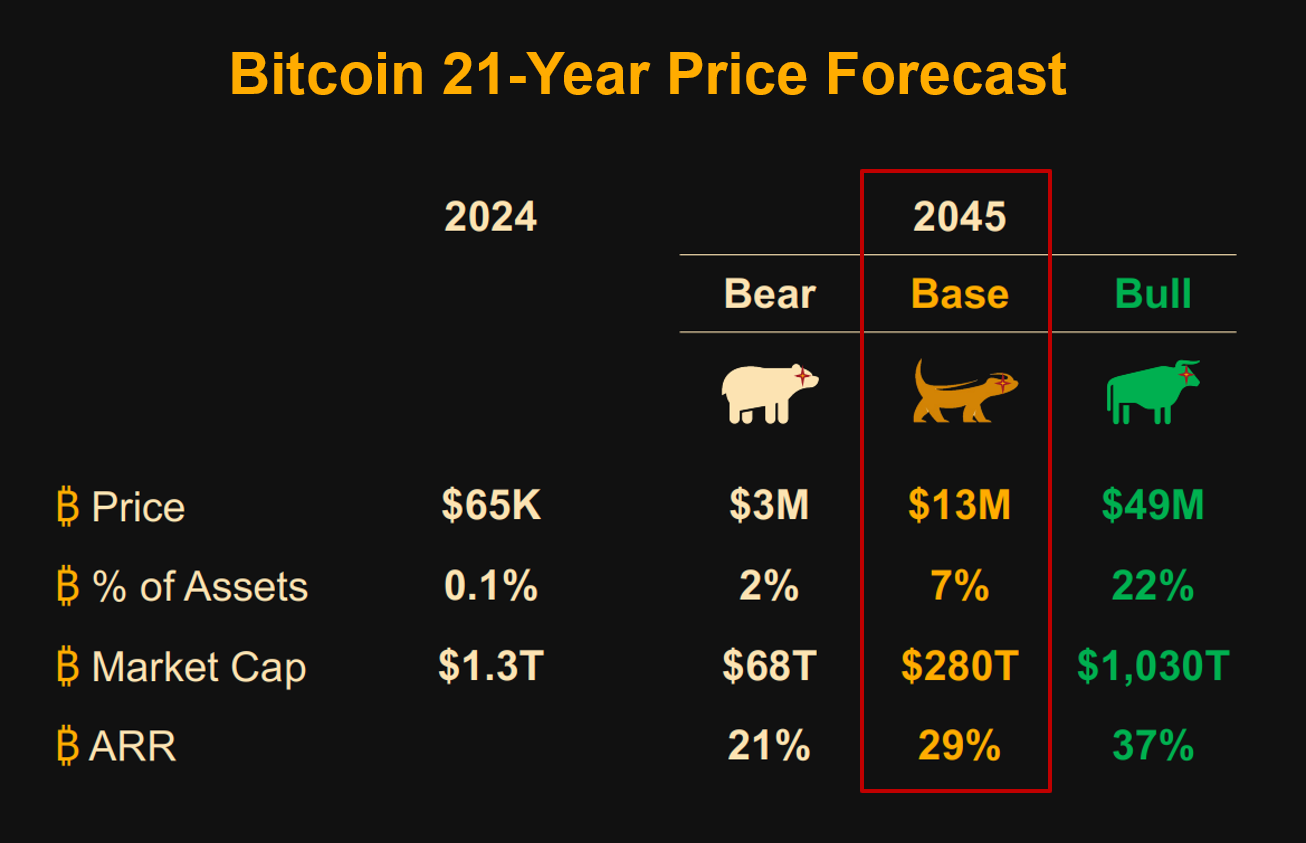

In July 2024, during his speech at the Bitcoin Conference, Michael Saylor revealed his price forecast for Bitcoin through 2045. He projected that Bitcoin would grow at an annualized rate of 29%, reaching $13 million per coin by 2045. While this may seem like an extraordinarily ambitious prediction, Saylor argues that it's based not on mere speculation but on physical and economic principles.

Saylor forecasts that Bitcoin's price will increase approximately 130-fold over the next 20 years. According to his bullish scenario, one Bitcoin will be worth about $49 million by 2045. (Source: Bitcoin Conference)

Saylor explains that Bitcoin's scarcity — its capped supply of 21 million coins — is the fundamental characteristic that makes Bitcoin what it is. He forecasts that Bitcoin's value will increase over the long term based on limited supply and growing demand.

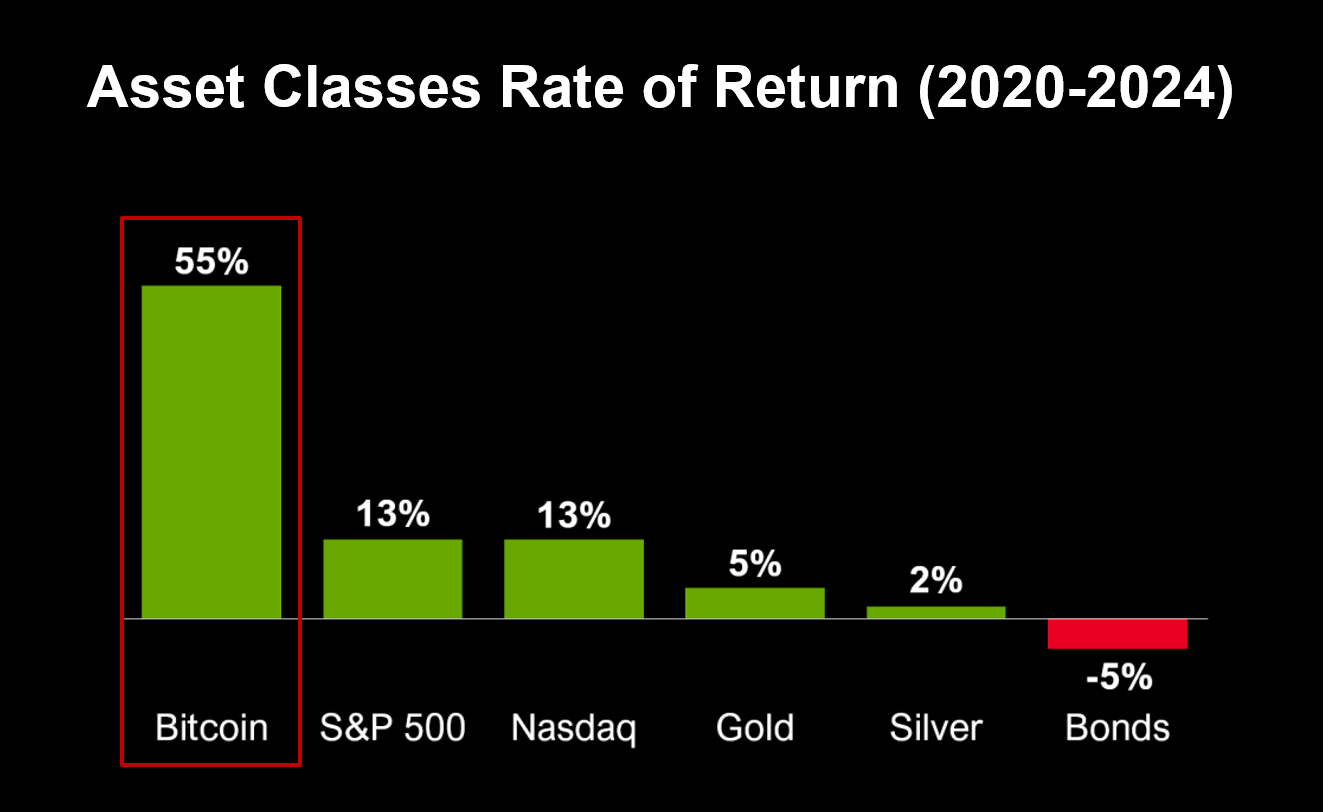

"For the last 10 years, Bitcoin has been appreciating at an average of 60% per year. For the past four years, it's been 60% as well. The S&P index has increased about 15% per year over the past four years, and the dollar supply is increasing somewhere between 7% and 10% per year, maybe 10% per year for the past four years.

Once you understand that Bitcoin is simply more thermodynamically sound than an equity portfolio... Bitcoin is the world's first perfect monetary asset, and by perfect I mean hard capped at some fixed amount. Every other monetary asset you could use as a long-term store of value has some leakage or inflation in it, whether it's gold or silver or real estate or art or whatever it is. There's entropy, there is degradation.

So the ideal perfect monetary asset would be some fixed amount of something for the next thousand years or 10,000 years, and Bitcoin is the first thing like that.

Why does it go up in value? It goes up because the supply of dollars is increasing 7% a year for the past 100 years, and the supply of weak currencies is more like 14% a year. That means the dollar loses 99.9% of its value over 100 years, and a weak currency would lose 99.9% of its value sometimes over 20 years.

The reason the value of scarce, desirable stuff goes up is because it's difficult to manufacture with a factory. If you've ever gone to Hershey, Pennsylvania, you see a factory that spits out candy bars at 50,000 an hour in a box. You can't create 50,000 candy bars, but they did it very well — that's why they created a company. If a factory can make it, the price is going down. If a politician can print it or declare it, the price is going down. If technology or if a robot can create it, if a technologist can make it cheaper, if it's subject to Moore's law, if AI can spit it out, you don't want to store your monetary wealth in anything that human ingenuity or politics creates more of."

Saylor frames Bitcoin's value proposition through the lens of scarcity and entropy. He argues that all traditional store-of-value assets suffer from a fundamental problem: they cannot maintain their value over long periods due to either physical degradation or increased supply. By applying concepts from physics, particularly thermodynamics, Saylor positions Bitcoin as the only asset that truly solves the entropy problem that affects all other monetary systems.

His central argument is that Bitcoin's 21 million coin cap creates an unprecedented type of scarcity that makes it fundamentally different from all previous monetary assets. While gold has been considered scarce, new mining techniques can increase its supply. Real estate, though limited in certain desirable locations, can be expanded through development. Even equity in companies is subject to dilution through additional share issuances.

This analysis positions Bitcoin not just as another speculative asset, but as the solution to a problem that has plagued human monetary systems throughout history. According to Saylor, Bitcoin isn't growing in value arbitrarily — it's simply maintaining its purchasing power while all fiat currencies systematically lose value through inflation. This perspective reframes the narrative around Bitcoin's price appreciation from one of speculation to one of mathematical and physical inevitability.

Saylor doesn't assume that Bitcoin's price will rise indefinitely at the same rate. He predicts that Bitcoin's growth will gradually slow down, eventually reaching a new equilibrium point.

"Bitcoin is currently growing at 60% annual return. It will gradually decline to 58%, 55%, 52%, 50%, 35%, 33%. The traditional world, which is $150 trillion of traditional equities, is basically a 15 percenter, or 12 to 15 percenter.

Traditional assets will try to catch up to Bitcoin, but they'll also struggle with all the entropic risk and competition and weather and war and famine. So they're always going to struggle.

Bitcoin is going to become half the size of equity. It'll start to head up toward the size of equity. And then there's $300 trillion of fixed income—bonds, preferred stocks, all sorts of ETFs that hold fixed income instruments, currency-equivalent sovereign debt — that yields about 5% right now, 5% before tax, maybe 3 or 4% after tax.

As people get more comfortable with Bitcoin, they're going to move money toward Bitcoin. And then companies like MicroStrategy, we're going to create an equity that pulls capital from the equity capital markets, from the Magnificent 7, from the S&P. It'll flow into MicroStrategy stock. And then we will create bonds, and the bonds will pay you twice as much or three times as much as the bonds in the traditional capital market.

Over time, you've got $500 trillion of this traditional capital. Think of it as sitting up on that mountaintop, and it wants to go to ground. It wants to go to a simpler, more elegant, less risky, less disordered state, a lower energy state.

Water goes from steam to water, and you go from water to ice. Every time you change that phase, an enormous amount of energy gets given up. And if you want to go the other way, you have to put energy into it. You have to cook the ice to get it to be water; you have to boil the water to get it to be steam."

Bitcoin currently delivers an annual return far exceeding all other major global asset classes. (Source: Bitcoin Conference)

Saylor's forecast incorporates a gradual deceleration in Bitcoin's growth rate rather than assuming perpetual exponential growth. This nuanced view acknowledges that as Bitcoin matures and captures a larger share of global wealth, its growth rate will naturally slow down while still outperforming traditional financial assets.

This perspective is important because it addresses one of the common criticisms of Bitcoin — that its current growth rates cannot be sustained indefinitely. Instead of claiming that Bitcoin will continue growing at 60% annually forever, Saylor provides a more realistic model where Bitcoin gradually transitions from a high-growth emerging asset to a stable, dominant store of value.

By comparing this transition to phase changes in matter, Saylor uses a physical metaphor that helps explain why capital might naturally flow from traditional assets to Bitcoin. Just as water naturally flows downhill due to physical laws, capital tends to flow toward assets that provide better preservation of value with lower maintenance costs. In this framework, Bitcoin represents a more "thermodynamically efficient" state for capital — one that requires less energy to maintain its value over time.

This gradual stabilization model also explains how Bitcoin might interact with existing financial markets over the coming decades. Rather than suggesting Bitcoin will completely replace traditional financial assets, Saylor sees it becoming a complementary but increasingly dominant component of the global financial system, eventually reaching a state of equilibrium with other asset classes.

Saylor judges that Bitcoin has high potential for expansion as an alternative investment asset in the future, due to its different characteristics from existing asset classes.

"There's $900 trillion of capital in the world. Half of that, $450 trillion, is used simply as a store of value. This capital suffers from entropic loss of 3% annually. Whether it's a financial asset or a physical asset, inflation or entropy causes a loss of $13-15 trillion every year.

Bitcoin can be the solution to this problem. Over the past four years, it's delivered an annual return of 60%. Meanwhile, bonds, supposedly the world's best financial capital, have returned minus 5%.

Do your own survey. Ask 100 of your friends if they're fully invested in Bitcoin and if they understand it. 95% will say 'no.'

Financial advisors are always looking for alternative investments. Look at institutional investors and family offices. JP Morgan's family office survey shows they allocate 45% of their capital to alternative investments. They don't want to hold public equities. Commodities are the least popular — many institutions consider them off - limits. The other assets aren't much better. In most cases, beating inflation by 1% is considered a great result. Nobody has a great solution. People just fool themselves by thinking consumer inflation is the real inflation rate and feel smart about it."

Walton Enterprises, the family office managing the fortune of Walmart founder Sam Walton's family, oversees assets worth around $240B. This surpasses the $150B managed by Ray Dalio's Bridgewater Associates, the world's largest hedge fund. (Source: Simple)

Saylor's perspective on Bitcoin as an alternative investment highlights a critical disconnect in the current market: despite Bitcoin's historical performance, institutional adoption remains relatively low. This gap between performance and adoption suggests significant growth potential as more sophisticated investors begin to understand and accept Bitcoin.

The data Saylor presents about institutional asset allocation is particularly revealing. Most high-net-worth individuals and institutional investors allocate a substantial portion of their portfolios to alternative investments in search of uncorrelated returns and inflation protection. Yet Bitcoin, despite potentially offering both these benefits, remains underrepresented in most portfolios.

This discrepancy suggests that Bitcoin is still in the early stages of institutional adoption. As more financial advisors, family offices, and institutional investors become familiar with Bitcoin and develop the necessary infrastructure to invest in it, capital inflows could accelerate dramatically. The current low level of understanding and adoption among sophisticated investors, rather than being a weakness, actually represents significant headroom for future growth.

Saylor's point about the disconnect between official inflation metrics and actual capital preservation requirements is particularly important. Many investors benchmark their performance against consumer price indices, which may significantly understate the real rate of monetary expansion. This creates a scenario where investors believe they're preserving wealth when they're actually losing purchasing power — a situation that could eventually drive more capital toward Bitcoin as awareness grows.

Finally, Saylor provides concrete figures in his long-term forecast scenario regarding Bitcoin's price and global capital market size, lending credibility and realism to his projections.

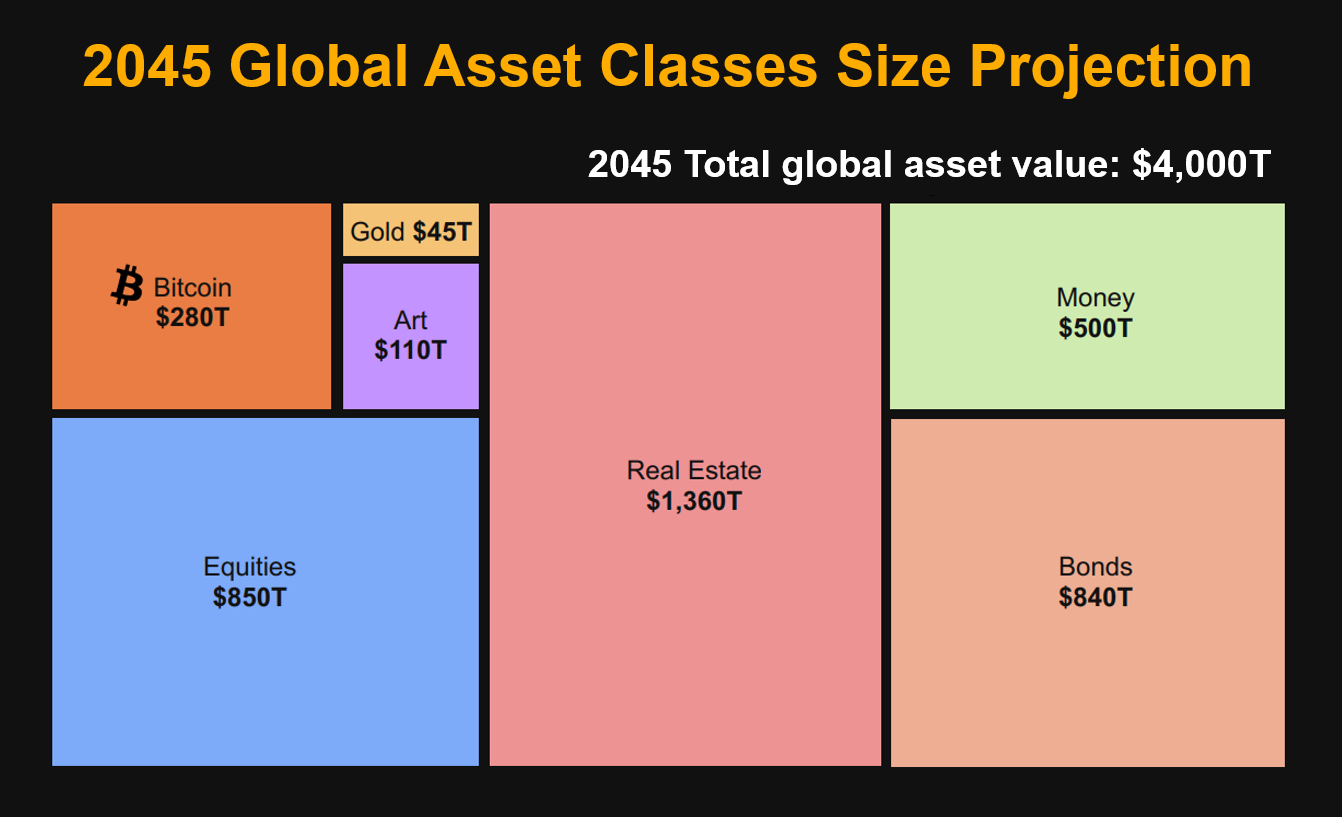

"My 21-year forecast is that Bitcoin will grow at an average of 29% per year. This means going from the current 60% down to 20% over 21 years. Growing at an average of 29% for 21 years takes Bitcoin to $13 million per coin and a market cap of $280 trillion.

Of course, global wealth will also increase, from $900 trillion to $4,000 trillion. There will still be many bonds, real estate, and equities. Bitcoin won't eat everything. It will just grow from being 0.1% of global wealth to about 7%.

I'm saying 29% annual return instead of 55% because I want to be conservative in my approach. But consider how revolutionary this change is. Imagine your company or country being capitalized at plus 55% instead of minus 5%. This is clearly working."

In Saylor's base case scenario, Bitcoin's market cap will grow approximately 130 times from current levels, while total global assets will grow 4-5 times. Bitcoin's capital absorption capacity is expected to be more powerful than any asset in history. (Source: Bitcoin Conference)

Saylor's specific numerical forecast provides a concrete framework for understanding Bitcoin's potential trajectory. By projecting an average annual growth rate of 29% over 21 years, he establishes a realistic benchmark that acknowledges both Bitcoin's current high growth rate and the inevitable slowing as it matures.

What makes Saylor's forecast distinctive is that it's not merely about Bitcoin's price, but about its role in the global financial system. By estimating that Bitcoin will eventually represent approximately 7% of global wealth, he places it in a context that institutional investors can understand and evaluate. This percentage is significant enough to represent a fundamental shift in global capital allocation, yet modest enough to acknowledge that traditional financial assets will continue to serve important functions.

The projection that Bitcoin will reach $13 million per coin by 2045 is derived from compound growth calculations rather than arbitrary price targets. By basing his forecast on an assumed growth trajectory and Bitcoin's relationship to overall global wealth, Saylor grounds what might otherwise seem like an extreme price prediction in mathematical principles and economic theories about capital flows.

Importantly, Saylor frames his projection as a "base case" rather than a certain outcome, acknowledging the inherent unpredictability of markets while maintaining confidence in the underlying trends driving Bitcoin adoption. This balanced approach, combining bold predictions with realistic constraints, gives his forecast credibility despite its ambitious numbers.

Saylor acknowledges that there could be various risk factors in the realization of this forecast. He has particularly addressed quantum computing, which is often mentioned as the greatest threat to Bitcoin's long-term outlook.

"Many people worry about quantum computing. But from my perspective, that's just a marketing announcement from Google. They announced good performance on a quantum benchmark they created, but there's still no practical application anywhere in the world.

Second, if you create a powerful computer, the most obvious way to make money with it would be to mine Bitcoin. This would increase the security of the network.

Third, if you really develop a computer powerful enough to crack cryptography, the first thing you'd attack would be Google itself. Would Google sell a computer that could destroy its own network? That's ironic.

Besides, even if you attacked the Bitcoin network, 99.9% of the world's assets exist outside it. You could attack all government networks, banking networks, and corporate networks first. Why would you target Bitcoin?"

Saylor addresses the quantum computing concern by placing it in a broader context of technological development and economic incentives. His perspective is that the much-discussed quantum threat to Bitcoin is largely theoretical at this stage, and even if quantum computing advances significantly, there are several reasons why it might not pose the existential threat that some fear.

The key insight in Saylor's response is his understanding of incentive structures. If quantum computing becomes powerful enough to theoretically threaten Bitcoin's cryptography, the economic incentives would likely favor using that technology to participate in the network rather than attack it. This follows the same logic that has protected Bitcoin from conventional attacks — when the reward for cooperation exceeds the potential gain from attacks, rational actors choose cooperation.

Furthermore, Saylor correctly notes that quantum advances wouldn't threaten Bitcoin in isolation. The same technology that could theoretically compromise Bitcoin's cryptography would simultaneously threaten virtually all digital security systems, including those protecting financial institutions, government agencies, and technology companies. This would likely prompt a coordinated response across all these sectors to develop quantum-resistant cryptography well before any large-scale attacks became feasible.

Also, Bitcoin's open-source nature and ability to adapt through community consensus actually gives it advantages in responding to technological threats. Unlike centralized systems that might struggle with legacy infrastructure, Bitcoin can implement cryptographic upgrades when necessary, ensuring its long-term resilience against emerging threats.