Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

Sending money in our daily lives has become incredibly convenient. When you need to send money to a friend within the same country, you can make real-time transfers in seconds through a smartphone banking app. Domestic transfers are so familiar and convenient that most people don't even think they need improvement. International remittances, however, are a different story.

International transfers take surprisingly long. It can take several days from when you initiate a transfer until the recipient receives the money, and you typically pay a fee amounting to several percent of the transaction. Why this difference? Simply put, international transfers don't occur through direct bank-to-bank transactions but instead follow complex international rules and involve multiple intermediaries.

There are two main reasons behind the complexity of the international remittance system. One is the monetary sovereignty of nations. Countries need to maintain sovereignty over their currencies while managing international capital flows. After the introduction of the Bretton Woods system in 1944, the international community designed a system where only central banks and their approved financial institutions could handle cross-border capital movements. This approach provided a framework to protect each country's monetary sovereignty while monitoring and controlling capital flows. However, this process became complicated as multiple intermediaries were incorporated into the system.

Another issue with the international remittance system is the long-standing absence of technology that could simplify the existing complex process. The international remittance structure, with multiple intermediaries involved, slowed processing times and increased costs, but there was no technology to create a streamlined procedure without these intermediaries that could still be trusted. However, with the emergence of blockchain technology following Bitcoin's introduction in 2008, this situation began to change.

The current international financial ecosystem is in a transitional period, improving the complex international remittance process through blockchain technology adoption. In this chapter, we'll explore the various entities that make up the international remittance system and the inherent limitations they create. We'll also examine the efforts being made by financial institutions, including Ripple, to address these problems and how they will transform the international financial ecosystem.

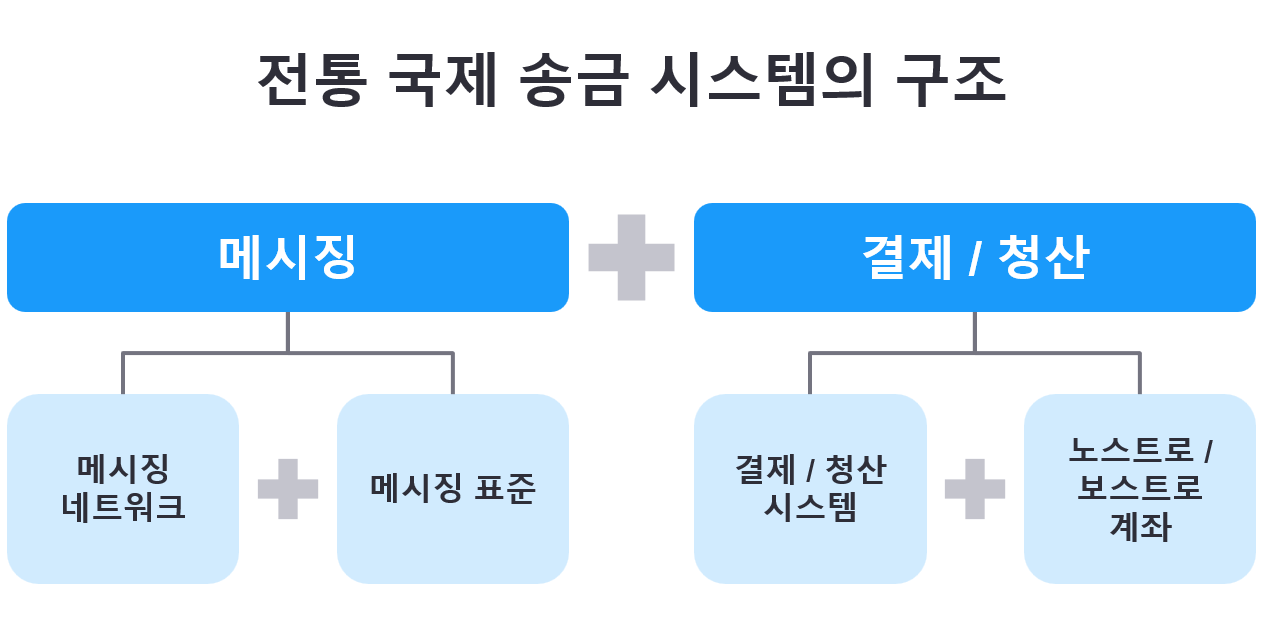

The international remittance system operates through cooperation between messaging networks and settlement/clearing systems. In most cases, messaging and settlement/clearing systems exist separately and work together to process international transactions/remittances. The fact that messaging and settlement/clearing systems exist separately is one reason why international remittances are slow.

The traditional international remittance system operates through collaboration between multiple complex systems. This compartmentalized structure fundamentally causes inefficiencies in processing time and cost.

A typical international remittance follows this process:

Messaging networks are core infrastructure in the international financial system that enable standardized communication between banks. Similar to email systems, they allow financial institutions worldwide to exchange messages securely and in standardized formats.

SWIFT is the most widely used global financial messaging network. This cooperative, established in 1973 by 239 banks from 15 countries, has grown into the world's largest financial communications network, now used by over 11,000 financial institutions in more than 200 countries. SWIFT processes messaging for transactions averaging about $5 trillion daily, with over 42 million messages transmitted through this network each day.

SWIFT is a messaging-centric global network, with actual movement of funds occurring through settlement systems like CHIPS. For example, when a Korean bank sends money to the United States, SWIFT only transmits information about "who is sending how much to where," while the actual movement of dollars is processed by CHIPS. These two systems have worked closely together for over 40 years, establishing themselves as the foundation of international finance.

Exterior view of SWIFT headquarters in Belgium. SWIFT maintains an unrivaled position in the international financial ecosystem through its extensive history and global network. (Source: SWIFT)

According to SWIFT's RMB Tracker (monthly report), the U.S. dollar has the highest share in international settlements at about 40-45%. This is followed by the euro (EUR) at about 25%, British pound (GBP) at 7%, Japanese yen (JPY) at 3%, and Chinese yuan (CNY) at 2%. The yuan's share was less than 1% in 2015 but has been steadily rising with China's growing economic power.

As the most universally used network, SWIFT also plays a role in creating standards for international finance. It is working to convert all financial messages to the ISO 20022 standard by 2025 and is actively considering the adoption of new technologies like blockchain.

CIPS is an international settlement system launched by China in 2015 to expand its influence in the international financial market. Led by the People's Bank of China (PBOC), this system serves as core infrastructure for the internationalization of the yuan, playing a pivotal role especially in transactions with countries participating in the "Belt and Road" initiative. Russia, Pakistan, Kazakhstan, and Thailand are major user countries, and CIPS already plays a central role in trade settlements between these countries and China.

China established CIPS in 2015 to counter dollar hegemony, creating a system capable of handling both messaging and settlement functions.

The most distinctive feature of CIPS is that it provides both messaging and settlement functions. Unlike SWIFT and CHIPS, which operate separately, CIPS processes both message transmission and fund settlement on a single integrated platform. This has improved the efficiency of international yuan settlements and reduced costs. As of January 2025, over 1,400 financial institutions from more than 100 countries around the world participate directly or indirectly in CIPS, with daily processing amounts exceeding 50 billion yuan (about $7 billion) and annual total transaction amount surpassing 1 trillion yuan.

However, CIPS also has some limitations. First, it still uses the nostro/vostro account system, which limits real-time processing. Additionally, most transactions are centered around Asian financial hubs such as Hong Kong and Singapore, so it will take more time to grow into a truly global network. Nevertheless, CIPS is gaining attention as a key means for expanding China's international financial influence and as an important challenge to the U.S.-centered international financial order, along with the "digital yuan."

SPFS is an alternative messaging system developed by Russia in 2014 in response to threats of SWIFT exclusion following the Crimean crisis. Led by the Russian Central Bank, this system currently has about 400 financial institutions participating and is connected with some countries including Iran, Turkey, and China. Despite regional constraints, SPFS has established itself as an important alternative for Russian financial institutions blocked from SWIFT access due to Western sanctions.

Russia's potential SWIFT expulsion in 2014 wasn't implemented due to factors including Europe's high dependence on Russian natural gas. However, following the Russia-Ukraine conflict in 2022, SWIFT expelled Russia's major banks. (Source: BBC)

SFMS is a domestic financial messaging system operated by the Reserve Bank of India (RBI). Introduced in 2001, this system has achieved standardization and automation of inter-bank message transmission in India and is currently used by all banks and major financial institutions in India. While SWIFT mainly handles international remittances, SFMS plays a pivotal role in communication between banks within India.

Messaging standards can be thought of as the common "language" used by financial institutions when communicating with each other. It's similar to the standardized format of diplomatic documents used by diplomats worldwide. With the structure of documents, terminology used, and delivery methods standardized globally, they can be understood and processed identically in any country. Similarly, financial messaging standards allow financial institutions worldwide to communicate accurately without misunderstandings.

ISO (International Organization for Standardization) is an organization that develops and disseminates standards used worldwide. Things we use in everyday life, such as A4 paper size, credit card specifications, and quality management standards like ISO 9001, all conform to ISO standards.

In the financial sector, ISO 15022 and ISO 20022 are used as the main messaging standards. ISO 15022 is the existing standard, focusing on concise data representation. In contrast, ISO 20022 is a more modern and comprehensive standard, using contemporary data formats like XML and JSON to efficiently process more information and complex data.

ISO 20022 is not exclusive to SWIFT and can be used by other financial networks (e.g., RippleNet, CIPS, etc.). In fact, blockchain-based payment networks like Ripple or JP Morgan's IIN (IntraBank Information Network) also utilize ISO 20022 to maintain compatibility with the global financial system.

By 2025, SWIFT plans to completely replace the existing ISO 15022 messaging standard with ISO 20022. This represents a significant change in financial messaging and will enable richer data exchange and automated processing.

In international finance, the actual movement of funds occurs through settlement/clearing systems operated by central banks and major financial institutions of each country. Settlement/clearing systems move funds through cooperation with nostro/vostro accounts.

CHIPS is the major large settlement system in the United States, operated by The Clearing House (TCH) in New York. As the world's largest dollar clearing system, it is estimated to handle about 95% of international dollar settlements, processing transactions averaging $1.8 trillion daily. It's a system in which mainly large commercial banks participate, with 45 major global financial institutions, including JP Morgan, Citigroup, and Deutsche Bank, as direct members.

The difference between CHIPS and SWIFT is clear. CHIPS plays the role of clearing settlements and moving funds. In contrast, SWIFT is an inter-bank messaging (information delivery) network, functioning to deliver transaction information rather than actual settlement. In international remittances, transaction information (who is sending how much to where) is delivered through SWIFT, and then the actual settlement takes place through CHIPS.

The most significant feature of CHIPS is its multilateral clearing system (Net Settlement). Rather than processing individual transactions immediately, it aggregates all transactions during the day and settles only the final difference at once. For example, if Bank A needs to send $1 billion to Bank B, and Bank B needs to send $800 million to Bank A, instead of individual transactions totaling $1.8 billion, only the difference of $200 million is settled at once. In this way, CHIPS is trying to minimize fund movement through nostro/vostro accounts, but it still has the limitation of having to use these accounts.

Real-Time Gross Settlement Systems (RTGS) operated by central banks of each country process settlements for the main currency of that country. Looking at major systems:

TARGET2 (Europe): TARGET2, jointly operated by the European Central Bank (ECB) and 19 Eurozone countries, is a symbolic presence of European integration. Introduced in 2007, this system processes an average of €2.5 trillion in transactions daily, handling over 90% of euro transactions. Through TARGET2, banks in Europe exchange funds through mutual nostro/vostro accounts, with accounts opened at the German Federal Bank and the French Central Bank playing key roles. This has allowed the entire Eurozone to build a unified settlement system.

CHAPS (UK): CHAPS, operated by the Bank of England, is the artery of UK finance. Processing an average of over $2 trillion in transactions daily, it particularly supports London's status as an international financial center. Banks participating in CHAPS have nostro accounts at major banks in the City of London, through which international settlements of the pound take place. In particular, the nostro accounts of UK major banks such as HSBC, Barclays, and Standard Chartered play an important role as settlement channels for global finance.

BOJ-NET (Japan): The Bank of Japan's BOJ-NET has been the foundation of the Japanese financial system since its launch in 1988. Processing an average of $1.5 trillion in transactions daily, it plays a central role particularly in international settlements of the yen. Japanese megabanks (MUFG, SMBC, Mizuho) serve as major yen nostro account providers for overseas financial institutions, processing most of the world's yen settlements through BOJ-NET. BOJ-NET's role is particularly prominent in yen settlements for financial institutions in the Asia-Pacific region.

The nostro/vostro account system is essential for messaging networks like SWIFT and CIPS to work seamlessly with settlement/clearing systems like CHIPS and various countries' RTGS systems. It serves as the foundational infrastructure for actual fund movements in international finance, where banks exchange funds through accounts they've established in each other's countries.

A nostro account (Nostro Account) is an account that one bank opens at a foreign bank, operated in the currency of that foreign bank. For example, a Brazilian bank's dollar account opened at a New York bank falls into this category. Conversely, a vostro account (Vostro Account) is the opposite concept; from the New York bank's perspective, that account opened by the Brazilian bank is called a vostro account. Actual international remittances occur through these accounts. For Shinhan Bank in Korea to send money to the United States, it must necessarily have a dollar account (nostro account) at some bank in New York. All international banks maintain dozens or hundreds of such accounts in various countries.

The biggest problem with the current international remittance system is not speed but the amount of funds that must remain tied up in nostro/vostro accounts. Freeing up this enormous capital would be a tremendous innovation. (Source: Investopedia)

The biggest problem with this system is that enormous amounts of funds must be tied up in accounts across different countries. According to McKinsey's survey, banks worldwide have deposited approximately $27 trillion (about 3.5 quadrillion Korean won) in these accounts. This money is not actually being used but is tied up as a safety measure for transactions. This is a tremendous waste of resources and significantly reduces banks' fund operation efficiency. Moreover, this inefficiency ultimately leads to high transaction costs, which consumers end up bearing.

As we've examined, the existing international remittance system has operated for the past 50 years with problems that must necessarily be improved. Finally, with the emergence of blockchain technology in 2008, fundamental changes are occurring in the international financial system. Existing international payment networks like SWIFT are introducing blockchain technology to integrate messaging and settlement systems and reduce processing time and costs, while new challengers are also emerging.

This innovative movement is progressing in four main directions. First, there's SWIFT 2.0, SWIFT's project to maintain its existing international financial leadership. Second, there are state-led de-dollarization systems like China's CIPS and BRICS countries' BRICSpay. Third, there are emerging payment networks from private companies based on blockchain technology, such as Ripple and JPM Coin. Fourth, there are CBDC-based payment networks being developed by central banks around the world. These players are competing fiercely to take the lead in international finance in the digital age during this paradigm shift period, each with their own strengths.

SWIFT 2.0 is a major innovation project prepared since 2022 to overcome the limitations of the existing older system. The core of this project is to build a new payment system that enables real-time settlements by introducing blockchain technology.

SWIFT 2.0 aims to comprehensively upgrade the existing SWIFT system by introducing ISO 20022 and blockchain technology. It particularly focuses on real-time payment functionality and reducing nostro/vostro account dependency. SWIFT is attempting to integrate messaging and settlement by utilizing ISO 20022 adoption and blockchain technology, but as it was fundamentally a messaging-centric system, complete integration with settlement is still in progress.

ISO 20022 adoption will enhance SWIFT's usability. However, for SWIFT, which has operated based on the traditional international financial system for a long time, the introduction of blockchain technology is another mountain to climb.

Additionally, SWIFT 2.0 is actively pursuing connections with new digital assets. It's putting particular effort into linking with CBDCs and stablecoins. In early 2024, it successfully performed cross-border settlements within 20 seconds in a CBDC linking experiment conducted with 15 central banks. This demonstrated that even if CBDCs like China's digital yuan or Europe's digital euro use different technical standards, they can still be exchanged through SWIFT's network.

The connection with stablecoins is also noteworthy. SWIFT is trying to integrate major stablecoins like USDC and USDT into the existing inter-bank settlement system. Specifically, it aims to convert stablecoin transaction information into ISO 20022 standards to be compatible with traditional banking systems, support real-time settlement between stablecoin issuers and banks, and automate regulatory compliance such as anti-money laundering. This would allow a Korean bank wanting to settle in USDC to process it directly through the SWIFT network. This represents SWIFT's strategic attempt to lead the transition to new digital finance while leveraging its existing network of approximately 11,000 financial institutions.

China's CIPS is a core infrastructure for the internationalization of the yuan, showing steady growth since its launch in 2015 by continuously expanding participating institutions. Participants include not only China's major state-owned banks but also global large banks like HSBC, Standard Chartered, and Deutsche Bank.

CIPS began actively introducing blockchain technology in 2023. Through the CIPS 2.0 project, it's building a smart contract-based automated settlement processing system. This automates letter of credit processing in trade finance, implements conditional payment functionality, and automates regulatory compliance procedures. It has also introduced a real-time settlement system utilizing distributed ledger technology, enabling 24/7 real-time payments and direct settlement between participating institutions.

Particularly noteworthy is the integration with the digital yuan (e-CNY). CIPS is building an international payment system linked with China's CBDC, the digital yuan, and through this, it's expanding its domain to cross-border retail payments. It's also preparing for its role as an international payment infrastructure by connecting with China's smart city projects.

Real-world applications of CIPS are appearing across various industry sectors. In the energy sector, oil trade with Russia is a representative example. As of 2023, about 65% of Russia's oil exports to China were settled in yuan, with CIPS serving as the core payment platform in this process. In e-commerce, CIPS is being actively used in overseas transactions of Chinese e-commerce companies like Alibaba and JD.com, with yuan settlements particularly increasing in the Southeast Asian market. CIPS utilization is also prominent in construction and infrastructure. It's widely used in construction payment settlements for "Belt and Road" projects, with Pakistan's Gwadar Port development and Indonesia's high-speed rail project being representative examples.

CIPS's growth is bringing new changes to the global financial system. In particular, its role as an alternative payment system that can bypass U.S. SWIFT-based sanctions is gaining attention. Countries under U.S. sanctions, such as Iran and Russia, have been able to continue international financial transactions through CIPS, indicating a new change in the international financial order.

However, CIPS still has challenges to overcome. Compared to SWIFT's daily processing amount of $5 trillion, CIPS's scale ($7 billion) is still very small. Also, the share of the yuan in international settlements is at the level of 2.5% as of early 2024, far behind the dollar (42%) or euro (24%). There's still room for improvement in terms of large transaction processing capacity and security.

Despite these limitations, CIPS continues to show steady growth and is expanding its influence, especially in Asia and Africa. The Chinese government aims to increase direct participating institutions to 120 and expand daily processing amounts to 100 billion yuan by 2025.

CIPS's processing volume and the yuan's share in international settlements remain modest. Nevertheless, CIPS exists as an alternative to SWIFT and the dollar, potentially challenging the established system at any time. (Source: CIPS)

BRICSpay, while not currently operational, has the potential to be a strong payment network that could compete with SWIFT 2.0 if fully implemented. This is a project led by the BRICS countries (Brazil, Russia, India, China, South Africa), an attempt to build their own payment network to reduce dependence on the U.S.-centered financial system.

BRICSpay aims to create an integrated system that goes beyond simple message exchange to include payment and settlement. In particular, it seeks to enhance efficiency and independence by integrating digital currencies (CBDCs) and existing bank accounts. Currently in the pilot program and early testing phase, it's likely to develop into a system with integrated messaging and settlement, like CIPS.

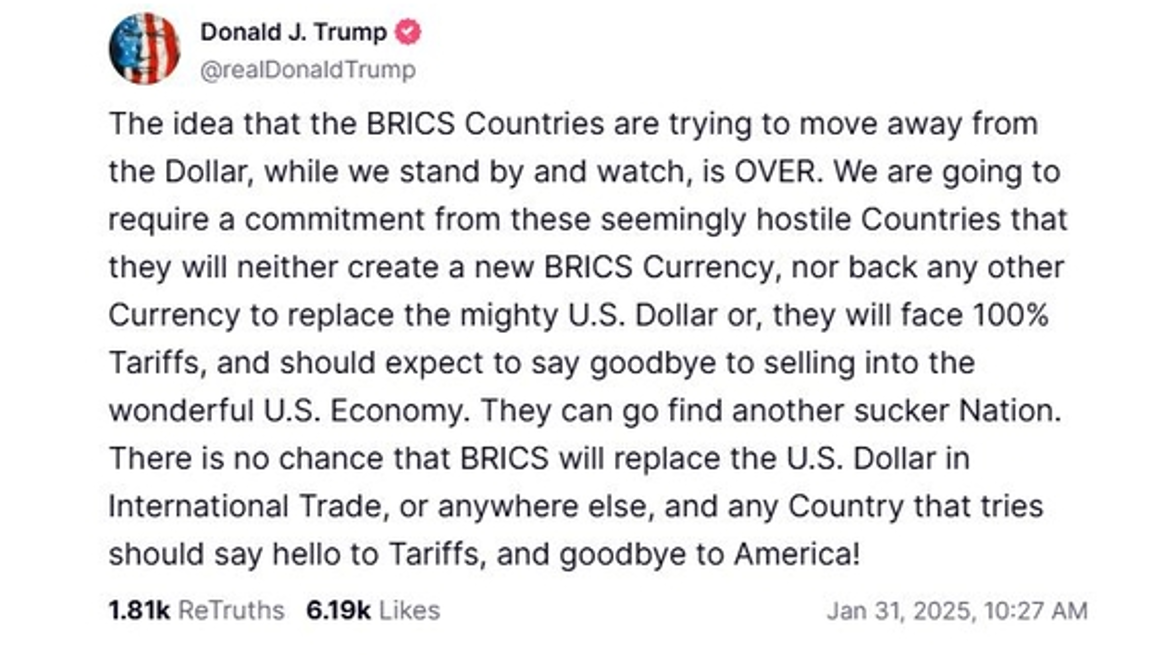

The development of BRICSpay also carries the significance of a challenge to the dollar-centered international financial order. The BRICS countries are indeed expanding direct trade between their currencies, which could affect the dollar's status as the reserve currency. As of 2024, the share of dollar settlements in trade among BRICS countries has already fallen below 50%.

After his 2024 election victory, Trump used the US market as leverage to warn against the launch of BRICSpay. He warned BRICS countries of 100% tariffs if they launched a BRICS currency. (Source: Truth Social)

Blockchain-based international remittance systems that could become competitors to SWIFT 2.0 are also emerging. These emerging payment networks are trying to carve out their piece of the international payment market with their unique technologies and approaches.

Ripple's ODL (On-Demand Liquidity) is an innovative solution that drastically reduces dependence on nostro accounts, the biggest inefficiency in existing international remittance systems. Ripple has already integrated messaging and payment functions and eliminated nostro/vostro account dependency using ODL and its own digital asset, XRP. This shows that Ripple is already one step ahead of existing systems in the competition utilizing blockchain technology.

Ripple's international payment network, RippleNet, has grown into a global network with more than 300 financial institutions participating worldwide. It's achieving particular success in the Asia-Pacific region, with major financial institutions such as Japan's SBI Group, Thailand's Siam Commercial Bank, and the Philippines' BDO actively using RippleNet in their actual operations. In the Trump 2.0 era, with the SEC lawsuit ending and clear cryptocurrency regulations being established, the participation of large U.S. financial institutions in the Ripple ecosystem is expected.

JPM Coin, developed by JP Morgan, is an internal closed blockchain system specialized for business-to-business payments and fund management. Operating through JP Morgan's blockchain network Onyx, this system has succeeded in reducing the need for messaging, payment, and nostro accounts. However, it's currently only being used limitedly within the JP Morgan network, so additional expansion is needed to develop into a true global interchange network.

JPM Coin, which began actual commercial use in 2021, is showing rapid growth. As of early 2024, daily transaction amounts exceed $1 billion, and it has demonstrated high efficiency particularly in multinational companies' fund management and international payments. While the ability to leverage JP Morgan's existing corporate client network is a significant advantage, its closed system nature is cited as a limitation.

IBM World Wire is an innovative international payment network based on the Stellar blockchain. This system is an integrated platform that processes messaging and payment simultaneously and is working to eliminate dependency on nostro/vostro accounts by utilizing digital assets like stablecoins. It has also secured compatibility with existing financial systems by fully supporting the ISO 20022 messaging standard.

World Wire has already successfully integrated with 72 payment networks in more than 50 countries during the testing phase in 2019. Gradual growth is expected based on IBM's powerful global network and technological capabilities, but the spread has been somewhat slow so far. Nevertheless, considering IBM's existing corporate customer base and technological prowess, it has the potential to establish itself as a significant international payment network in the long term.

Ripple co-founder Jed McCaleb left Ripple in 2013 to establish Stellar. While similar to Ripple, Stellar places greater emphasis on decentralization and expanding financial accessibility. (Source: CryptoSlate)

Visa B2B Connect is a business-to-business international payment network developed based on experience operating existing card payment networks. While not directly using blockchain technology, it provides high levels of security and efficiency by utilizing distributed ledger technology (DLT). In particular, it has greatly reduced nostro/vostro account dependency by enabling direct transactions between institutions, bypassing the existing banking network.

Visa B2B Connect adopted the ISO 20022 messaging standard from the beginning. This ensures compatibility with the global financial system while allowing more rich transaction information to be delivered. Providing real-time payment services in about 190 countries worldwide, Visa B2B Connect is receiving particularly strong responses in emerging markets. It's demonstrating high efficiency, such as processing international payments that previously took an average of 4 days in just 3 seconds in countries like Brazil, India, and Nigeria.

These blockchain-based emerging payment networks each have their own strengths and specialized areas. Ripple leads in real-time international remittances, JPM Coin in business-to-business payments, IBM World Wire as an integrated platform, and Visa B2B Connect as a global payment network. Their successful adoption cases demonstrate that blockchain technology can drive innovation in the international financial system.

CBDC-based payment networks have the potential to integrate the roles of messaging systems, settlement systems, and nostro/vostro accounts that make up the existing international remittance system, thus becoming a powerful alternative that can replace or complement existing systems. This is possible thanks to the digital nature of CBDCs and their direct issuance by central banks. This is an innovation that could change the paradigm of international finance, opening the possibility of competition and coexistence with existing infrastructure while greatly improving the efficiency and transparency of the financial system.

In existing international remittances, messaging systems like SWIFT deliver remittance information, and settlement systems like CHIPS process actual fund settlements. However, CBDC networks can process message delivery and fund movement simultaneously. For example, in multi-CBDC platforms like the digital yuan (e-CNY) or Project Dunbar, remittance requests and fund settlements can occur in a single integrated system.

Also, in the existing system, banks needed to open nostro/vostro accounts in each other's countries and deposit funds for foreign exchange transactions, but CBDC-based payment networks can eliminate or minimize this account dependency by allowing central banks to directly exchange digital currencies. In multi-CBDC platforms, each country's CBDCs can be exchanged in real-time, enabling cross-border payments without separate intermediary banks.

CBDCs can also support conditional payments through smart contract functionality. For example, payments can be automatically made when certain conditions (e.g., confirmation of goods delivery) are met. This can simplify complex procedures that were handled by intermediaries in the existing international remittance system.

Various CBDC projects are currently underway around the world. BIS's Project Agora is a cross-border payment improvement project utilizing CBDCs, with various central banks participating. This project focuses on improving the efficiency of cross-border payments and solving problems of currency exchange and settlement. BIS analyzes that cross-border payments using CBDCs can reduce processing time by 99% and costs by 95% compared to existing systems. As it develops further, it has the potential to establish itself as an international payment network competing with SWIFT 2.0.

Project Dunbar, a collaboration between the central banks of Singapore, Australia, Malaysia, and South Africa, is a multi-CBDC platform utilizing blockchain technology, led by the BIS Innovation Hub. It aims to exchange multiple countries' CBDCs on a single network, integrate messaging and payment, and reduce the need for nostro/vostro accounts. Project Dunbar particularly focuses on CBDC integration in the Asia-Pacific region, and test results up to 2023 showed over 40% cost reduction in cross-border transactions.

The mCBDC Bridge, led by the central banks of Hong Kong, Thailand, UAE, and mainland China, processes cross-border CBDC exchange and settlement using blockchain. This project particularly aims to achieve real-time payments and reduce settlement risks by utilizing the transparency and decentralization properties of blockchain. In the pilot program conducted until the end of 2023, over 20 commercial banks participated, and real-time payments between various currencies were successfully made.

China's Digital Currency Initiative (DCEP) is leading the actual implementation of CBDCs through the digital yuan (e-CNY) project. China is studying the possibility of integrating messaging and settlement by linking the digital yuan with CIPS, and is already testing cross-border payments with Hong Kong, Macau, Thailand, and others. The digital yuan uses blockchain to enhance transparency and reliability and can process transactions in real-time without intermediary banks.

The European Central Bank's (ECB) digital euro project is considering both retail and wholesale CBDCs. The ECB is particularly addressing privacy protection and offline payment functionality and is preparing for official introduction in 2026. The digital euro is expected to enhance the efficiency of payment systems within the EU while also strengthening the role of the euro in international payments.

These various CBDC projects each have their own characteristics and goals, but they commonly show efforts to improve the efficiency and transparency of the international financial system. In particular, the use of CBDCs in cross-border payments is gaining attention as an important alternative to overcome the limitations of existing systems.

The international financial ecosystem is undergoing fundamental changes as it adopts blockchain technology. Existing international payment networks like SWIFT, as well as new challengers like the digital yuan or BRICSpay, and corporate-created payment networks like Ripple or JPM Coin, are all trying to integrate messaging and payment systems based on blockchain technology. This will dramatically improve the time and cost of international payments.

As the efficiency of all systems gradually converges upward, what variable will determine the competitive dynamics of the international payment market in the blockchain era? By far the most important variable is the choice of the United States, the owner of the dollar. The current status of the U.S. dollar in international payments is overwhelming. About 44% of world trade is settled in dollars, and over 60% of global foreign exchange reserves are held in dollars. Major commodities like oil and raw materials are mostly priced and traded in dollars. Also, most international banks hold dollar assets and process transactions through account connections with U.S. banks.

Which international payment network the Trump 2.0 administration will prefer and support will be a key factor determining the future direction of the international financial order. To predict this, we must first understand Trump's governing philosophy.

Many people assess Trump as unpredictable, but in fact, his actions are very predictable. This is because there is a single clear principle underlying all his policies and decisions: "America First." This is clearly evident in his actions since his inauguration in January 2025.

Immediately after taking office, Trump made a series of decisions prioritizing U.S. national interests. He declared withdrawal from the WHO, which was due to his judgment that the World Health Organization was biased toward China. He also withdrew from the Paris Climate Agreement, believing the agreement burdened major U.S. industries. These departures from the existing international order were all decisions prioritizing U.S. national interests.

Furthermore, Trump is showing a proactive pursuit of U.S. interests. Using the situation of TikTok facing expulsion from the U.S. market for national security reasons, he proposed a stake sale, and he also demanded greater U.S. control over the operation rights of the Panama Canal. He's even trying to change the name of the Gulf of Mexico to the "Gulf of America" and pursuing the merger of Greenland to secure strategic resources.

At a post-inauguration press conference, Trump postponed the TikTok ban in the U.S. for 75 days, indicating that the U.S. should acquire a 50% stake in TikTok as a condition for business approval in America. (Source: New York Post)

Trump's thorough America First approach is expected to apply equally in the transition to the new international financial paradigm. It's clear that Trump will choose a payment network that is most advantageous to the U.S. and allows the U.S. to maintain control.

So what are the conditions for an international payment system that the U.S. would prefer? The most important is "controllability." Looking at the level of influence the U.S. currently exercises in the SWIFT system helps us better understand this.

SWIFT is legally an independent cooperative headquartered in Belgium and is not directly owned or controlled by the U.S. Major policies of SWIFT are decided by consensus among member countries, and no country can make decisions unilaterally. However, the U.S. exercises powerful influence based on the dollar's status as the reserve currency and its leading position in the global financial network.

U.S. influence works through several channels. First, it's important that most international payments are processed through U.S. settlement systems. Transactions processed through CHIPS, operated by the New York Clearing House, are all under U.S. jurisdiction, and SWIFT provides messaging services for these settlements.

Additionally, the U.S. exercises policy influence on SWIFT through close cooperation with G10 central banks. Especially after the 9/11 attacks, U.S. control over SWIFT was further strengthened for national security reasons, and the U.S. became able to effectively implement sanctions against specific countries or institutions through the Office of Foreign Assets Control (OFAC) under the Treasury Department.

The reason the U.S. prefers the SWIFT system is clear. Through it, the U.S. can maintain global financial hegemony, monitor financial transaction data worldwide, and, if necessary, use it as a powerful sanction tool by blocking specific countries or institutions from the network.

Until now, the U.S. has maintained an international financial order centered on SWIFT based on its national interests. However, with the emergence of blockchain technology and competitive countries' moves to build independent payment systems, the U.S. recognizes that it can no longer maintain financial hegemony by simply maintaining SWIFT. Accordingly, the U.S. must seek alternatives that can maintain its leadership in international payment networks while embracing new technology. In this context, why would the U.S. prefer Ripple, and what role could Ripple play?

Ripple isn't simply another blockchain technology, but a strategic asset that can allow the U.S. to maintain leadership in the new international financial paradigm. Several features of Ripple align very well with U.S. interests.

First, Ripple is a regulation-friendly company. Unlike many cryptocurrency companies that advocate "replacement" of the existing financial system, Ripple has emphasized "cooperation" and "complementation" with the existing system from the beginning. Core services of Ripple, such as ODL (On-Demand Liquidity), transparently record all transactions and are designed to allow regulatory authorities access to necessary data.

Second, Ripple is a U.S. company. As China tries to build its own international financial network through CIPS, Ripple is an important asset that can allow the U.S. to maintain technological superiority in blockchain-based international finance. In particular, Ripple has already partnered with more than 300 financial institutions worldwide, making it a tool for expanding U.S. financial influence.

Third, Ripple ensures transparency of fund flows. The XRP Ledger has a structure where all transactions are recorded on a distributed ledger, allowing anyone to verify transaction details. More importantly, Ripple strictly complies with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations, enabling the fund flow monitoring that the U.S. government requires.

Fourth, Ripple can coexist with SWIFT. Rather than Ripple completely replacing SWIFT, it can play a complementary role in specific areas. For example, Ripple could take a leading role in small, fast remittances or transactions with developing countries, while SWIFT would still handle large-scale inter-institutional transactions.

Considering these characteristics, the U.S. is more likely to recognize Ripple as a manageable innovation and develop it rather than suppressing it. Especially with the thoroughgoing America First advocate Trump back in power, he might try to maintain U.S. leadership in the new international financial order through Ripple, a U.S. company.

Ripple CEO Garlinghouse, who has actively lobbied the Trump camp since the campaign trail, emphasizes that "this administration's slogan is America First, and the government should support American cryptocurrency companies." (Source: Binance)

The signs of resolution of the lawsuit between Ripple and the SEC under the new Trump administration can be understood in this context. As concerns arise that the SEC's stringent regulations could weaken U.S. cryptocurrency industry leadership and technological competitiveness, the U.S. approach to Ripple is changing to "management through regulation."

How the U.S. will utilize Ripple remains to be seen, but one thing is clear: Ripple's technology and network align with U.S. national interests. This indicates the possibility that Ripple could wield greater influence with U.S. support in the future.

The future blockchain-based international financial ecosystem is expected to see the coexistence of various payment networks, including SWIFT 2.0. Financial institutions will no longer rely on a single network but will move toward selecting the most appropriate network according to the nature and needs of transactions.

Many financial institutions are already simultaneously joining and using multiple networks such as SWIFT, RippleNet, and CIPS. For example, Thailand's Siam Commercial Bank offers both traditional international remittances through SWIFT and real-time remittance services using Ripple's ODL. Japan's SBI Group also utilizes both SWIFT and RippleNet, choosing the optimal remittance method depending on the situation.

Such multiple network utilization is possible because modern financial technology supports easy system integration through APIs. Financial institutions can connect multiple payment networks simultaneously through self-developed interfaces and automatically select the optimal network according to each transaction's characteristics. For example, small urgent remittances can be processed through RippleNet, while large institutional transactions can use SWIFT or CIPS.

More importantly, the introduction of standard messaging formats like ISO 20022 is greatly enhancing interoperability between networks. Most major financial networks are expected to adopt ISO 20022 by 2025, enabling smooth information exchange between different networks. This is similar to how different email service providers can communicate smoothly through standard protocols.

The SWIFT 2.0 project is an ambitious plan, but it faces various challenges in its implementation process. The biggest problem is the complexity that arises in the transition process from the existing system. It's no easy task to transfer a massive system used by over 11,000 financial institutions worldwide to a new technology base.

From a technical perspective, integration with legacy systems is the biggest challenge. Each financial institution has different technology stacks and system structures, and integrating them all with a new blockchain-based system entails enormous complexity. Moreover, the transition to ISO 20022 must occur simultaneously, which is placing a considerable burden on many financial institutions. As of early 2024, only about 30% of global financial institutions have completed ISO 20022 adoption.

There are also significant difficulties from a cost perspective. The transition to SWIFT 2.0 is expected to cost a substantial amount per financial institution. While large banks can bear such investments, they are a significant burden for small and medium-sized financial institutions. Particularly, financial institutions in developing countries may find it difficult to afford these costs.

New challenges also await from an operational perspective. The new system supporting real-time processing requires much more computing power and network bandwidth. This can lead to increased operational costs, which may be a significant burden especially for financial institutions in developing countries.

The issue of trust in financial institutions cannot be overlooked either. Complaints about SWIFT's high fees and monopolistic position continue to be raised. As of 2023, SWIFT's average transaction fee is around $25 per transaction, and for some complex transactions, it can exceed $100. This high cost structure is providing opportunities to new competitors.

Moreover, external competition is intensifying daily. Ripple's ODL has already commercialized real-time international remittance services, and JPM Coin is rapidly growing in the business-to-business payment market. China's CIPS is expanding its influence centered around "Belt and Road" participating countries, and various countries' CBDC projects are also threatening SWIFT's position.

Especially in terms of innovation speed, SWIFT is falling behind compared to competitors. Due to its long history and complex decision-making structure, the adoption of new technologies is inevitably slow. On the other hand, new players like Ripple or JPM Coin can make quick decisions and apply technology flexibly.

There are abundant examples of startups that have dominated markets based on their advantage in new technologies during industrial paradigm shifts. The international payment industry will be no exception.

This time of change offers unprecedented opportunities for Ripple. Ripple has already commercialized real-time international remittance technology and partnered with over 300 financial institutions. In particular, the ODL service has solved the biggest inefficiency of existing systems by enabling real-time international remittances without nostro/vostro accounts.

Ripple's greatest strength is its proven technological capability. The XRP Ledger can process 1,500 transactions per second, with transaction finality guaranteed within 3-5 seconds. This is substantially superior performance compared to Bitcoin's 7 TPS or Ethereum's 15 TPS. Moreover, Ripple's consensus algorithm consumes almost no energy, unlike Bitcoin or Ethereum, making it environmentally friendly.

Ripple is also advantageously positioned from a regulatory perspective. After partial victory in its lawsuit with the SEC, Ripple can expand its business more actively within the United States. In particular, the ruling that securities laws do not apply to general exchange transactions will greatly help Ripple's market expansion. In fact, several major U.S. financial institutions began exploring cooperation with Ripple in 2024.

Ripple is also steadily preparing for the CBDC era. It's already participating in CBDC projects in several countries including Bhutan and Palau, and can provide customized solutions to central banks through the CBDC Private Ledger. In particular, Ripple's technology can serve as a bridge connecting different CBDCs, potentially becoming an important infrastructure in the future CBDC era.

Regional specialization strategies are also Ripple's strength. In Southeast Asia, Ripple focuses on real-time small remittance services, considering the high demand for overseas worker remittances. In the Middle East, it's expanding its market by emphasizing compatibility with Islamic finance. These region-specific strategies are also helping Ripple's global expansion.

The next five years are expected to be a period of significant change in the international financial system. Several changes will occur simultaneously, including the introduction of SWIFT 2.0, the commercialization of CBDCs, and the universalization of blockchain technology. In this time of change, Ripple is preparing for a new leap forward based on its already proven technological capabilities and global network. In particular, the ability to provide innovative solutions while maintaining compatibility with the existing financial system will be a major advantage for Ripple.