Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

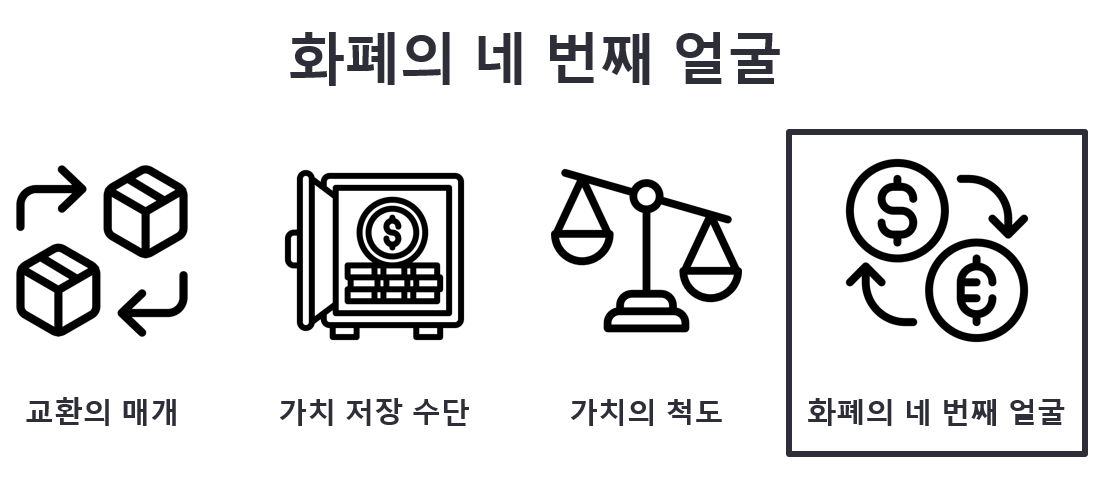

The history of money has evolved alongside human civilization. As we examined in Chapter 1, money has performed three essential functions: a medium of exchange, a store of value, and a measure of value. However, with the globalization of the 20th century and the digital age of the 21st century, money needed a new function. As international finance became commonplace and cross-border trade increased explosively, the need for an "intermediary currency" for efficient exchange between different fiat currencies emerged.

As civilization advances, money is required to take on new roles. Globalization and digitization have created a strong need for "bridge currencies" to facilitate exchanges between different currencies.

In the late 20th century, the global financial system attempted to solve this problem through the dollar. With most international transactions conducted through the dollar, it became the de facto global intermediary currency. However, this created new problems: high costs, long processing times, and excessive dependence on one country's currency.

The emergence of Bitcoin in 2008 marked a turning point in this situation. Bitcoin leveraged blockchain technology to create a new store of value for the digital age. However, the biggest challenge facing the international financial system—efficient exchange between different fiat currencies—remained unresolved.

The effort to find an answer to this need began in 2004 with one programmer's idea. Ryan Fugger envisioned a new type of payment system based on trust relationships between people, which he named "RipplePay." This was an innovative attempt to break the existing notion that all transactions must go through banks, instead creating a network where people could directly trust and trade with each other.

Early RipplePay was unrelated to blockchain but embodied Ripple's core idea of a decentralized payment system. (Source: PlanXRP)

In 2012, this initial idea evolved to an entirely new level when two entrepreneurs, Jed McCaleb and Chris Larsen, joined forces. McCaleb, an early cryptocurrency entrepreneur who created Mt. Gox, one of the world's first major Bitcoin exchanges, and Larsen, a veteran businessman with experience successfully leading several fintech companies, believed they could create something revolutionary by incorporating blockchain technology into Fugger's initial idea.

They aimed to fundamentally change the global financial system using blockchain technology. In particular, they sought to solve the chronic problems of high costs and long processing times in the international remittance market. To achieve this, they realized they needed a new type of intermediary currency. While Bitcoin had created a new store of value using blockchain technology, Ripple went a step further by designing a new function as an intermediary currency for exchange between fiat currencies.

In September 2012, OpenCoin (now Ripple Labs) was established, and the following year, the XRP Ledger was officially launched. From the beginning, Ripple took a different path from other cryptocurrencies. While most cryptocurrencies tried to replace the existing financial system, Ripple chose to improve and complement the existing system. This approach was similar to how, when automobiles appeared, rather than eliminating all horses and carriages, the existing transportation system was gradually developed.

Jed McCaleb (left) and Chris Larsen (right) met and co-founded OpenCoin, the predecessor of Ripple Labs.

Ripple began its first partnership with German digital bank Fidor Bank in 2014, continuously expanding collaboration with traditional financial institutions. This was one of the first instances where blockchain technology was adopted by actual financial institutions, marking an important milestone showing that Ripple's pursuit of the "fourth face of money" was beginning to materialize.

Building on the success of the first partnership with Fidor Bank, Ripple made a crucial strategic decision. Unlike most cryptocurrency projects at the time targeting individual users, Ripple chose financial institutions as its primary customers. This was a challenging choice, as convincing conservative financial institutions was no easy task. But Ripple believed this was the path to creating genuine change.

As 2015 arrived, Ripple's approach slowly began to bear fruit. Several major financial institutions started showing interest in Ripple's technology, with some launching pilot projects. Ripple's technology garnered particular attention in the international remittance market. International transfers that took 3-5 days with existing systems could be completed in seconds using Ripple's technology.

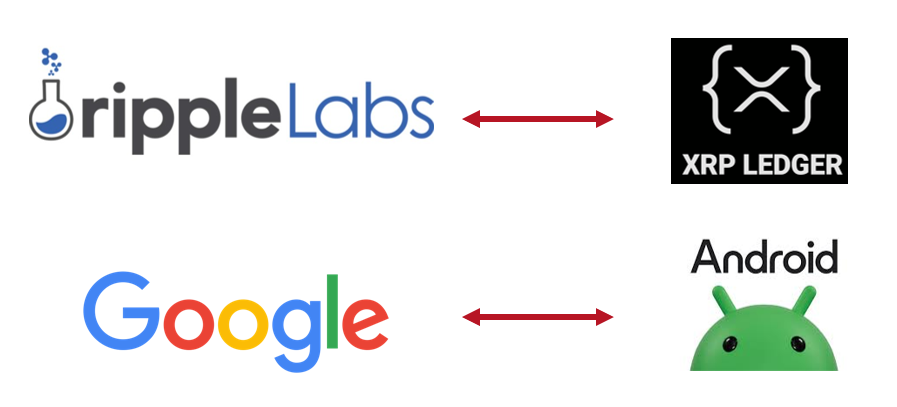

When many people hear the name "Ripple," they often think of simply one cryptocurrency. However, the Ripple ecosystem has a much more complex and organic structure. To understand this, let's use an analogy.

Think about the Android ecosystem. It consists of three main elements: Google as a company, Android as an operating system, and apps running on the operating system. Google develops and maintains the Android operating system, but the apps using the operating system all operate independently, and Google does not control the apps themselves.

The Ripple ecosystem has a very similar structure. Here, Ripple Labs, the XRP Ledger, and XRP are the three main elements, each playing their own role while interacting with each other. They maintain relationships that are both independent and complementary, and this structure ensures the stability and scalability of the Ripple ecosystem.

Ripple Labs and Google are responsible for developing technologies, marketing, and sales strategies that attract more users to their respective ecosystems for growth and expansion.

Ripple Labs, headquartered in San Francisco, is the company that develops and maintains the core technology of the Ripple ecosystem and expands the ecosystem through partnerships with financial institutions. Just as Google builds the technological foundation of the Android ecosystem, Ripple Labs provides technology that allows financial institutions to process international remittances faster and cheaper.

However, Ripple Labs does not own the XRP Ledger, the distributed ledger where XRP transactions are recorded. The XRP Ledger is an open-source platform where anyone can participate and contribute to the verification process. This is similar to how Google developed Android, but Android is provided as open-source, allowing various manufacturers and developers to freely utilize it.

The XRP Ledger is the underlying system where all transactions take place. A ledger means a book of accounts. All transactions and information between businesses and institutions are processed and recorded in this ledger. The XRP Ledger operates as a completely open system where anyone can participate and contribute to verification.

The XRP Ledger also provides high scalability and energy efficiency through its unique consensus mechanism. Unlike other blockchains like Bitcoin or Ethereum that require energy-intensive mining processes, the XRP Ledger uses a unique consensus protocol to process over 1,500 transactions per second with minimal energy. These characteristics make the XRP Ledger suitable for use in real business environments for enterprises and financial institutions.

So what is XRP, which ordinary people like us can directly buy and sell on exchanges? XRP is the digital asset used in the Ripple system. It plays a role similar to fuel in a car. A very small amount of XRP is used as "fuel" for all transactions and operations. This helps protect the network from spam and ensures the system runs smoothly.

Another important function of XRP is its role as a bridge currency, mediating transactions between different currencies. For example, when it's difficult to directly exchange won for pesos, XRP can be used as an intermediary. This is similar to how the dollar served as a reserve currency mediating currency exchanges in 20th-century international finance, but XRP goes a step further by enabling real-time digital exchange. This is why XRP is gaining attention as the fourth face of money—a new intermediary currency for the digital age.

One of the important mechanisms related to XRP supply is the escrow system. Ripple Labs keeps about half of the total 100 billion XRP supply in escrow accounts, designed to release only 1 billion XRP per month. This is a mechanism to manage XRP supply in a predictable and stable manner. Unused XRP is locked back into escrow, preventing sudden supply increases in the market.

Additionally, XRP has a unique burning mechanism. A small amount of XRP (0.00001 XRP) is burned in every transaction, permanently disappearing. This prevents spam transactions and strengthens the network's long-term security. This burning mechanism also contributes to XRP's long-term value preservation.

XRP also has a minimum unit called a "drop." 1 XRP can be divided into 1 million drops, allowing transactions of very small units. This enables XRP to function as an efficient remittance medium even if its value increases significantly in the future. For example, even if XRP's price reaches $10,000, transactions can still be conducted with minimal fees by dividing it into drop units.

Ripple's success doesn't solely depend on the value increase of XRP as a cryptocurrency. Underlying it is the highly technical platform of the XRP Ledger and a unique consensus algorithm. These technologies serve as the center of the Ripple ecosystem and the core engine driving global financial system innovation.

The XRP Ledger is the distributed digital ledger underpinning the Ripple ecosystem. This digital ledger records and verifies all transactions and is designed as an open network where anyone can participate. The XRP Ledger differentiates itself from other blockchain platforms through three key features.

First is transaction speed and efficiency. XRPL can confirm and complete transactions in just 3-5 seconds. This is an incredible speed compared to Bitcoin's block generation time of over 10 minutes. For example, if a user sends money from Korea to the US, traditional banking systems might take days, but using the XRP Ledger, it completes in seconds.

Second is the balance between centralization and decentralization. While XRPL is a decentralized network recording all transactions, it operates through trusted validators. These validators confirm transaction accuracy and maintain network integrity. Anyone can participate as a validator, but the network ensures stability through majority consensus among trusted validators.

Third are the smart features built into the platform. XRPL is not simply a ledger storing data but a platform with various built-in financial functions. It includes features that can automatically process financial transactions such as issuable assets (e.g., tokens), decentralized exchanges (DEX), and payment path optimization. For example, when setting up a remittance route, the XRP Ledger calculates the optimal exchange rate and path in real-time, processing the transaction in the most efficient way.

Ripple's consensus algorithm was designed to overcome the limitations of existing blockchain technology. The traditional Proof of Work (PoW) method has drawbacks of consuming enormous power and slow processing speeds. Ripple introduced its own consensus algorithm, RPCA (Ripple Protocol Consensus Algorithm), to solve these problems.

The operating principle of RPCA is similar to deciding on a dinner location with friends. Everyone has their preferred restaurant, but ultimately a single place must be chosen. In this situation, it's more efficient to quickly reach consensus based on the opinions of a few trusted friends rather than asking everyone's opinion individually.

Ripple's consensus algorithm works on this principle. Instead of having all participants verify every transaction like Bitcoin or Ethereum, it reaches consensus quickly through a network of trusted validators. If Bitcoin's Proof of Work method is like countless people worldwide solving complex math problems, Ripple's consensus process resembles swift decision-making by trusted experts.

The core of this process is the concept of "overlapping trust." Each node has its list of trusted validators (UNL: Unique Node List), and a transaction is approved when more than 80% of these validators agree. This is like how we value the opinions of people we trust when making important decisions.

Ripple's consensus algorithm demonstrates substantially faster processing times and hourly transaction throughput than first and second-generation cryptocurrencies Bitcoin and Ethereum.

Another important feature of Ripple's consensus algorithm is energy efficiency. While Bitcoin's mining process consumes an enormous amount of electricity, Ripple's consensus process requires only power at the level of normal server operation. Ripple's consensus algorithm is designed to handle maximum throughput per hour for practical use in real financial environments such as international remittances.

Thus, Ripple's core technologies—the XRP Ledger and consensus algorithm—play a pivotal role in enabling the Ripple ecosystem to overcome the limitations of traditional financial systems and provide trust and efficiency in the global financial market. This greatly helps Ripple gain adoption from financial institutions as a practical solution and expand its ecosystem.

Ripple currently provides three main services: RippleNet, ODL (On-Demand Liquidity), and CBDC connectivity services. Each service has different purposes and characteristics, working together to improve the efficiency of global finance.

RippleNet is a global payment network that enables financial institutions to transact quickly and securely across borders. Unlike traditional international remittances that must go through several intermediary banks, RippleNet allows direct connections between participating institutions.

RippleNet's biggest feature is its use of standardized protocols. Participating institutions can access the network through a single API, greatly simplifying system integration and maintenance. RippleNet also fully supports the ISO 20022 messaging standard, which the international financial ecosystem is preparing to fully transition to by 2025, ensuring compatibility with existing financial systems.

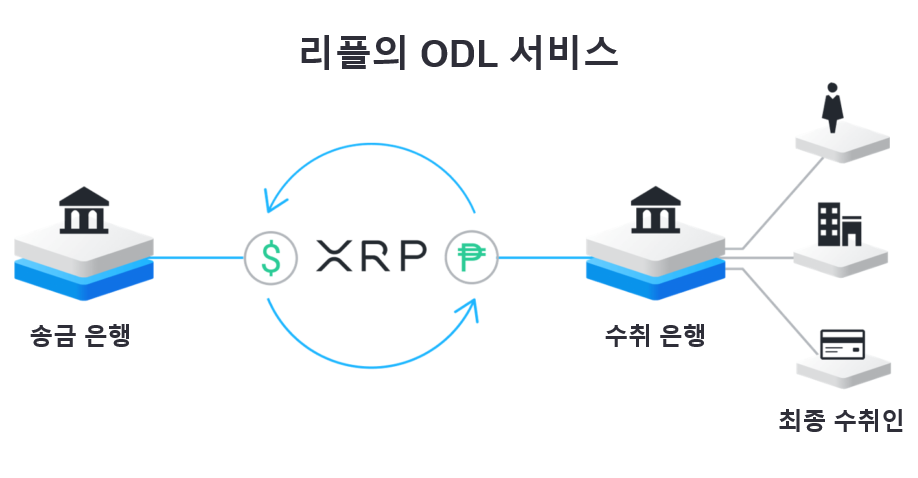

ODL is RippleNet's core service, enabling real-time cross-border remittances using XRP as a bridge currency. In existing international remittances, banks in each country had to maintain accounts and foreign exchange reserves with correspondent banks, but with ODL, these pre-funded accounts are unnecessary.

For example, imagine a Korean company wanting to send 100 million won to a business partner in the US. Through traditional methods, this process is very complex and inefficient. Money passes through multiple banks, incurring fees each time, with exchange rates applied differently at each stage. Moreover, transfers are impossible on weekends or holidays. Remittance fees alone average 3-5%, with processing times of 3-5 days.

In contrast, Ripple's remittance solution, ODL, provides technology and a platform that can fundamentally solve the problems in the current international remittance market. The international remittance process using ODL is as follows:

This process is completed in just seconds, with cost savings of up to 40% compared to existing systems.

ODL temporarily converts the sender's currency to XRP before converting it to the recipient's currency. Customers pay only a small fee, and ODL automatically handles the currency exchange and remittance. (Source: Ripple)

In preparation for the era of Central Bank Digital Currencies (CBDCs), Ripple has developed a dedicated blockchain platform called CBDC Private Ledger. This platform can process tens of thousands of transactions per second, guarantees central banks' control and privacy, and supports free value movement between countries through integration with the XRP Ledger.

Notably, CBDC Private Ledger is designed to allow smooth integration even if each country's CBDC uses different technical standards. In the near future, as CBDCs are introduced worldwide, concerns about cross-border compatibility will be essential. At this point, infrastructure with technology already tested and verified in the market is likely to have an advantage.

Ripple's CBDC services have already been tested in several countries, playing a significant role in supporting CBDC adoption in smaller nations. For example, Bhutan and Palau are collaborating with Ripple to develop their own CBDCs.

One of the most innovative features of Ripple's CBDC services is the "programmable money" function. This allows programming specific conditions and rules into currency, dramatically improving government and central bank policy implementation. For instance, disaster relief funds can be set with usage deadlines and regional restrictions, or education subsidies can be limited to tuition and textbook purchases only. Going further, real-time wage payment systems can also be implemented, with working hours automatically recorded and wages paid immediately, enhancing workers' economic autonomy.

Programmable money will become a crucial element of national currency competitiveness, with countries competing to implement optimal CBDC technology and infrastructure. Ripple is working diligently to become their solution of choice.

These CBDC services connect organically with Ripple's other services. If RippleNet provides the basic payment infrastructure and ODL solves liquidity issues, CBDC services build on this foundation to prepare for the future digital currency era. This demonstrates Ripple's evolution beyond simple remittance services, establishing new standards for global finance.

However, establishing new financial standards is never easy. It requires continuous technological innovation, convincing conservative financial institutions, and sometimes overcoming sharp conflicts with regulatory bodies. In Part 2, "Ripple's Present," we'll examine how Ripple has navigated these challenges. Let's follow Ripple's difficult journey from securing over 300 financial institutions as partners to winning its historic lawsuit against the SEC.