Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

In modern monetary systems, currency exists in two main forms. One is cash (banknotes and coins) issued by central banks, and the other is deposit money created by commercial banks. Cash, as a direct liability of the central bank, is the safest form of money, but its physical nature makes it costly to transport and store, and it's unsuitable for large transactions. Deposit money, on the other hand, exists in digital form and is convenient, but it depends on commercial banks' credit and carries risk if problems arise in the banking system.

Currently, over 90% of circulating currency exists as deposit money. This means central banks are gradually losing direct control over the money supply. Commercial banks create credit through fractional reserve banking, increasing the money supply in this process. The 2008 financial crisis vividly demonstrated the vulnerability of this system.

In this context, CBDCs (Central Bank Digital Currencies) have emerged as a new solution. CBDCs, digital forms of currency issued directly by central banks, combine the safety of cash with the convenience of deposit money. The necessity of CBDCs can be explained from four perspectives.

First, enhancing monetary policy efficiency. Currently, central banks can only implement monetary policy indirectly through commercial banks. This creates policy lags and reduced effectiveness. Through CBDCs, central banks can track and directly control the money supply and fund flows in real-time. For example, in situations requiring economic stimulus, more sophisticated policies become possible, such as supplying conditional currency to specific industries or regions.

Second, payment system innovation. Current payment systems incur costs and time as they pass through various intermediaries. CBDCs can simplify both domestic and cross-border transactions. Particularly for international remittances, which typically take 3-5 days and cost 5-7% in fees, CBDCs can significantly reduce costs and time by simplifying the intermediary structure.

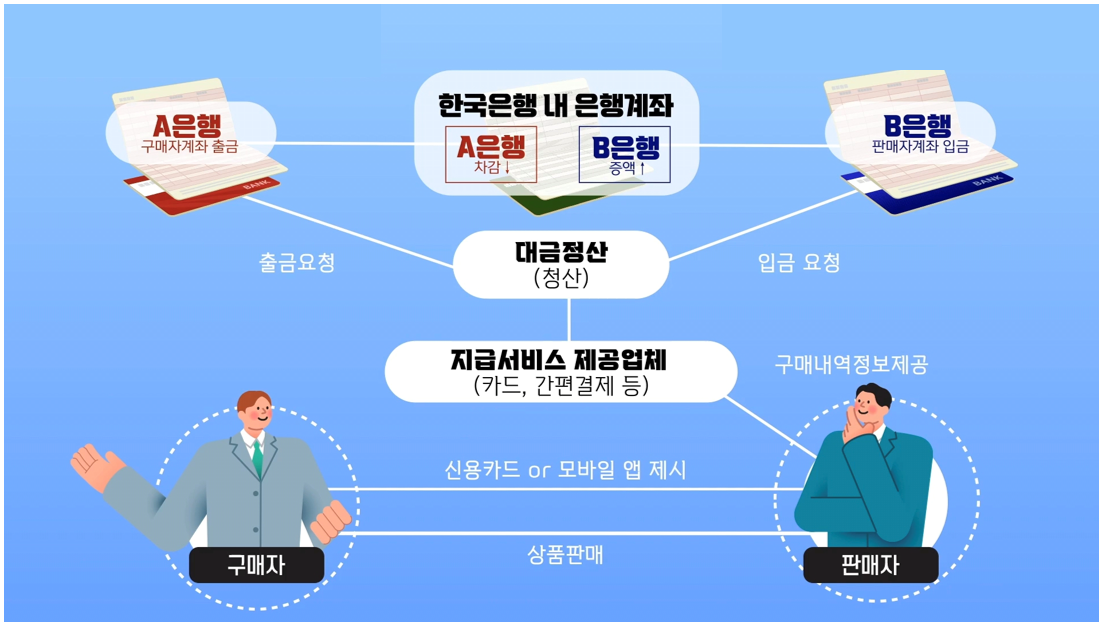

Structure of Japanese domestic payment systems. CBDC development could also simplify the structure of domestic payment systems, but users currently don't feel much inconvenience, so the impact is expected to be less noticeable. (Source: JBPCN)

Third, responding to competition for global financial leadership. China is already exploring a new international financial order through its digital yuan. As of January 2024, it's being piloted in 14 cities and has begun to be used for international payments through Hong Kong. As countries under U.S. sanctions, like Russia and Iran, show interest in the digital yuan, the dollar-centered international financial order faces challenges. In response, the U.S. is actively fostering stablecoins, while the EU is accelerating the development of the digital euro.

Fourth, responding to private digital currencies. As shown by Meta's (formerly Facebook) Libra project and the rapid growth of stablecoins, tech giants are building independent payment systems. As of January 2025, the market capitalization of stablecoins exceeded $200 billion, with a transaction volume of $15.6 trillion in 2024. This suggests that private companies could essentially acquire currency issuance authority, potentially threatening central banks' monetary sovereignty.

In 2019, Meta announced the Libra project, a stablecoin linked to a basket of multiple national currencies. They later changed direction to a US-based stablecoin but discontinued the project due to continuous pressure from the Fed and Treasury. (Source: Verge)

Thus, Central Bank Digital Currencies (CBDCs) represent not just a technological advancement but an inevitable change responding to contemporary demands. The degree of necessity for CBDC adoption may vary by country. However, CBDC adoption itself is an unstoppable trend in the digital, blockchain, and globalization era, and countries worldwide are already preparing for the CBDC era in their own ways and schedules.

As of September 2024, over 134 countries are researching CBDCs, representing more than 90% of central banks worldwide. Until 2019, fewer than 30 countries were researching CBDCs, but in recent years, more than 100 additional countries have joined the research. Notably, 44 countries have already moved beyond the research phase into advanced stages of development.

China is undoubtedly the country most advanced in CBDC development. China began its digital yuan (e-CNY) project in 2014 and conducted large-scale testing at the 2022 Beijing Winter Olympics. By late 2023, cumulative transactions exceeded 1.8 trillion yuan (approximately 320 trillion KRW), and it's being actively used in daily commerce in major cities like Shenzhen and Suzhou. China's CBDC adopted a hybrid approach combining existing centralized databases with blockchain technology.

China is leveraging the CBDC era as a strategic opportunity to elevate the yuan's international status and challenge the dollar's monetary hegemony. Having judged it difficult to challenge the dollar's status in offline finance, China is seeking to secure first-mover advantages in the digital realm. In particular, it's building a CBDC-based trade settlement system with countries participating in the "Belt and Road" initiative and forming a new international financial network by linking CIPS with the digital yuan.

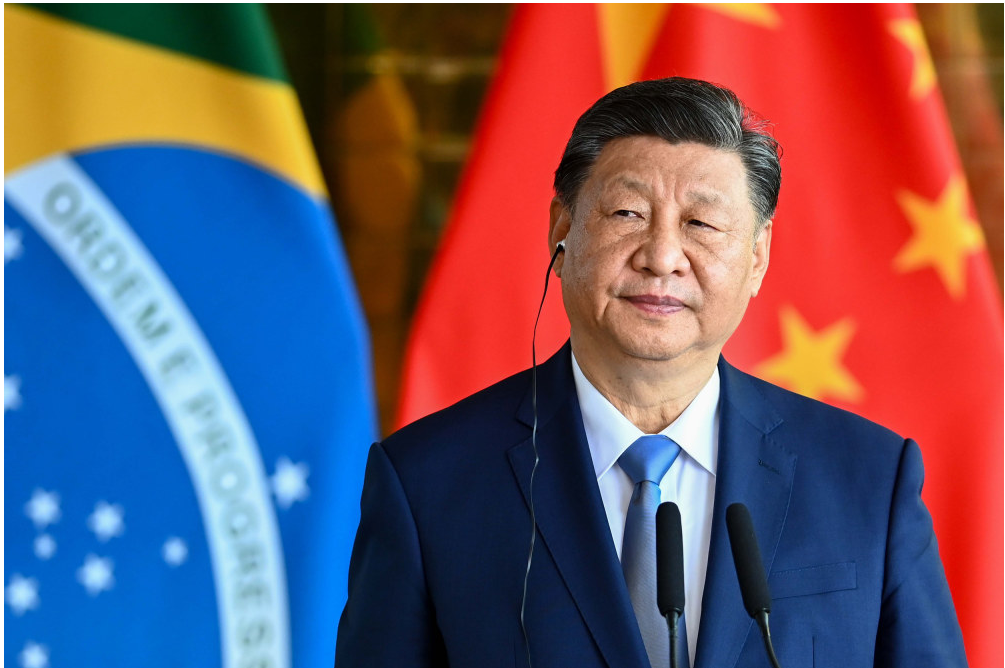

Chinese President Xi Jinping said at the 2020 G20 meeting, "The G20 should develop standards and principles for CBDC standards with an open and inclusive attitude." China is using its diplomatic influence to accelerate the transition to the CBDC era. (Source: NBC)

The European Central Bank's (ECB) digital euro project entered its preparation phase in October 2023. During the two-year preparation period, it plans to establish a regulatory framework and conduct tests for actual implementation, after which the issuance of the digital euro will be decided through the EU's legislative process and the ECB's final decision. Given Europe's characteristics, the ECB is particularly focusing on privacy protection. It's considering guaranteeing anonymity for small transactions, similar to cash, and designing for offline payments as well.

Sweden's e-krona project is one of Europe's most advanced CBDC experiments. With cash usage already below 2%, Sweden began CBDC research in 2017 and has been operating a distributed ledger technology-based pilot program in cooperation with Accenture since 2020. Sweden's approach adopts a 'hybrid CBDC' model, where the central bank directly issues CBDCs, but private financial institutions handle distribution.

Japan launched a full-scale CBDC pilot program in spring 2023. The Bank of Japan is simultaneously reviewing wholesale and retail CBDCs, with resilience in disaster situations considered an important design element. It's conducting tests in real environments with megabanks, aiming for full implementation after 2025.

The Bank of Korea has also been conducting CBDC simulations since 2021. In 2022, it completed the second phase of testing with financial institutions, verifying various use cases including cross-border payments, offline payments, and privacy protection. Korea's CBDC research particularly focuses on connectivity with existing fast payment systems.

Nigeria launched Africa's first CBDC, "eNaira," in October 2021. The eNaira secured about 800,000 users in its first year but showed slower-than-expected adoption due to cash-preference culture and technical issues. In October 2024, "eNaira 2.0" was launched, attempting a revival with an improved version. In particular, it introduced a USSD (Unstructured Supplementary Service Data)-based offline payment system to enhance financial inclusion in rural areas, focusing on practicality.

Uruguay conducted the world's first CBDC pilot program, "e-Peso," in 2017. This six-month program involved 10,000 users and successfully verified the possibility of P2P transfers through mobile wallets. Currently, it's preparing for broader CBDC adoption based on this experience.

The Bahamas, an island nation in the southeastern United States, officially launched the world's first general-purpose CBDC, "Sand Dollar," in October 2020. Given the Caribbean archipelago's characteristics, with many island regions where financial services are difficult to provide, it set CBDC-driven financial inclusion as a main goal.

These various CBDC projects each have their own characteristics and goals. While developed countries mainly focus on cash replacement and financial innovation, developing countries show greater interest in enhancing financial inclusion and reducing remittance costs. These diverse attempts demonstrate that CBDCs can evolve beyond simple digital cash into customized solutions fitting each country's situation and needs.

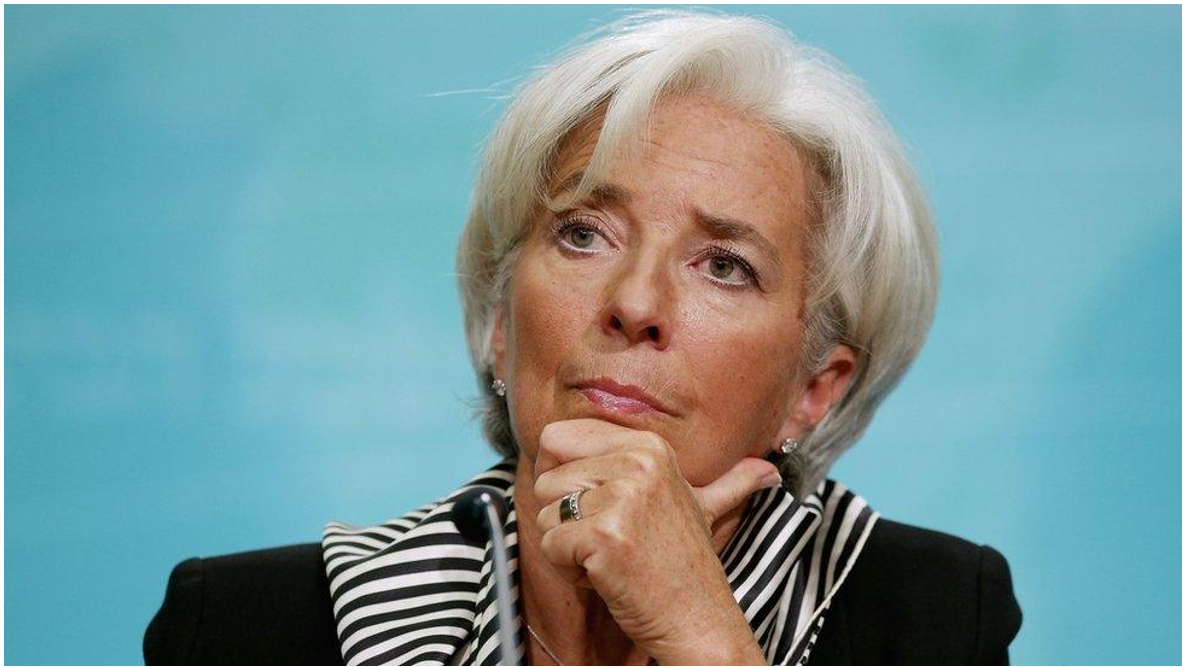

European Central Bank President Christine Lagarde stated that the world's current interest in CBDCs is significantly different from when she first took office in 2019, and that Europe cannot fall behind in CBDC development. (Source: BBC)

CBDC implementation is more than a simple technological change; it's a complex undertaking. As it alters the foundations of the financial system, various challenges must be addressed, from technical issues to institutional problems.

The most urgent technical challenge is the 'scalability' issue. Since CBDCs will be used by all citizens in daily life, they must be able to stably process tens of thousands of transactions per second. For instance, China's Alipay processes a maximum of 540,000 transactions per second. CBDCs need comparable processing capabilities.

Security is also a crucial issue. If a CBDC system is hacked, the entire national economy could be paralyzed. Particularly with the development of quantum computing technology, there are concerns that current encryption technologies might be neutralized. To prepare for this, the introduction of 'quantum-resistant encryption' technology is necessary.

Privacy protection is another important technical challenge to resolve. Since all transactions are digitally recorded in CBDCs, citizens' economic activities could be tracked in real-time. This could seriously infringe on personal privacy. Currently, various central banks are researching methods to guarantee transaction anonymity through technologies like 'zero-knowledge proofs' while still preventing illegal activities such as money laundering.

Given that CBDC implementation will greatly impact the entire financial system, there are also many institutional aspects to prepare. Particularly, changes in commercial banks' roles are inevitable. With CBDC introduction, citizens might prefer CBDCs over bank deposits, which could weaken banks' deposit bases. Methods to prevent potential "bank runs" are needed.

International standardization is also an urgent task. If each country develops CBDCs with different technical standards, cross-border CBDC transactions could become difficult. Standardization work is already underway centered on the BIS (Bank for International Settlements), but reaching consensus is not easy due to factors like U.S.-China technological hegemony competition.

Establishing a legal foundation is also necessary. Legal amendments are required for CBDCs to have the status of legal tender in each country. Additionally, a legal framework is needed to resolve disputes arising from CBDC transactions. It's also important to determine jurisdiction for issues occurring in cross-border transactions.

Ripple is one of the companies most actively moving in the CBDC market. It has particularly expanded cooperation with central banks since forming a dedicated organization in 2021. Ripple is already collaborating with numerous central banks and achieving actual results.

Cooperation with Bhutan's central bank (RMA) is one of Ripple's representative CBDC projects. Begun in September 2021, this project aims to develop the 'Digital Ngultrum.' The biggest reason Bhutan chose Ripple was environmental friendliness. As the world's first carbon-negative country, Bhutan found Ripple's energy-efficient technology an attractive choice.

The project is proceeding in three phases. The first phase develops a wholesale CBDC for inter-bank transactions, the second phase expands to a retail CBDC, and the final phase aims to utilize it in cross-border payments. Given Bhutan's high volume of remittance transactions with India, cross-border payment functionality is a very important element.

Collaboration with Palau, an island nation in the South Pacific, is another type of CBDC experiment. Started in November 2021, this project aims to develop a digital currency based on the U.S. dollar. Since Palau uses the U.S. dollar as its official currency without its own currency, developing a "digital dollar" using Ripple's technology was a very realistic choice.

A distinctive feature of this project is its connection with the tourism industry. The Palau government aims to enhance payment convenience for tourists through the digital dollar while ensuring transparency in financial transactions. As part of their strategy to revive the tourism industry after COVID-19, digital currency is expected to play an important role.

Cooperation with Montenegro is also noteworthy. This project, begun in 2023, considered Montenegro's special situation as it prepares to join the European Union. Montenegro currently uses the euro but is not an EU member, so it aims to strengthen its financial sovereignty through CBDC while maintaining compatibility with the European financial system.

The Hong Kong case showed new possibilities for Ripple's CBDC business. In the e-HKD project with the Hong Kong Monetary Authority (HKMA) and Fubon Bank, Ripple is supporting the tokenization of real estate-related assets and the development of payment systems. This demonstrates that CBDCs can bring innovation to the asset market beyond being simple payment methods.

Additionally, Ripple has started CBDC research cooperation with or provided technical advice to central banks' CBDC projects in Lithuania, Georgia, Colombia, Venezuela, and the United Arab Emirates (UAE). While the countries Ripple has actually collaborated with so far are developing or smaller economies, these collaborations serve as references and test beds for Ripple's CBDC business, helping to increase contact points with more central banks and financial institutions.

The core of Ripple's developed CBDC solution is the 'CBDC Private Ledger.' This is a private blockchain modified for central banks' needs based on XRP Ledger technology. This technology has three main features.

First, high scalability. It can process tens of thousands of transactions per second, making it suitable as the foundation technology for a CBDC used by all citizens. Particularly, Ripple's consensus algorithm achieves this processing speed while consuming almost no energy, unlike Bitcoin or Ethereum.

Second, interoperability. The CBDC Private Ledger is designed considering compatibility with existing financial systems. It can especially connect with SWIFT, the international inter-bank communications network. It can also easily connect with other countries' CBDCs, enabling the efficiency of cross-border payments.

Third, controllability. Central banks can directly control all policy measures including issuance volume, interest rates, and usage restrictions. Additionally, anti-money laundering (AML) and know-your-customer (KYC) functions are basically built-in, facilitating regulatory compliance.

Particularly noteworthy in Ripple's CBDC strategy is its approach to 'cross-border CBDCs.' Connecting different countries' CBDCs is a technically complex task. Many issues need to be resolved, such as how to make CBDCs using different technical standards compatible, how to determine exchange rates, and how to ensure settlement finality.

Ripple has developed 'CBDC Bridge' technology for this. This is a system that mediates transactions between different CBDCs using XRP as a bridge currency. For example, when exchanging South Korea's digital won for Japan's digital yen, XRP acts as an intermediary currency. This process is completed within seconds and is much more efficient than existing international remittance systems.

Ripple CTO David Schwartz explained that various countries' CBDC platforms are built with core ledger technologies like the Ripple Ledger, demonstrating the potential for expansion of Ripple technology within the CBDC ecosystem. (Source: X)

However, for Ripple's CBDC infrastructure to be adopted by more central banks, there are several challenges. First, it must continuously prove the high level of security and stability required by central banks. Second, it must maintain an advantage in competition with other blockchain companies. In particular, large IT companies like IBM and R3 are also entering the CBDC market, so competition exists. Third, it must respond to different regulatory environments in each country. As CBDC is a country's basic financial infrastructure, it's expected to meet very strict regulatory requirements as it gets closer to the actual implementation stage.

The CBDC era has already begun. The number of countries starting CBDC research has rapidly increased in recent years, and central banks are showing movements to advance their implementation timing to secure national currency competitiveness. In this context, Ripple occupies a very unique position. This is because it's one of the few companies with both the stability of the existing financial system and the innovation of blockchain.

Ripple's biggest opportunity lies in connecting CBDCs between countries. Even if countries independently develop CBDCs, a standard protocol connecting them is needed. Ripple already has proven technological capability in the international remittance market and experience participating in CBDC projects in various countries.

In particular, 2025 is expected to be an important turning point for Ripple. As the SWIFT 2.0 project becomes full-scale and major countries' CBDCs begin to be introduced, the basic infrastructure of international finance will be reorganized. If Ripple can establish itself as a core technology provider in this change, its influence is expected to be substantial.

But risks also exist. First, central banks might choose independent technology development. In fact, China developed the digital yuan with its own technology. Second, geopolitical conflicts can influence technology choices. As U.S.-China technological hegemony competition intensifies, CBDC technology selection can also become subject to political considerations.

Additionally, the pace of CBDC adoption might be slower than expected. As it's a fundamental change in the currency system, central banks are taking a very cautious approach. Even the ECB's digital euro project is only expected to be actually introduced after 2026.

Nevertheless, CBDCs have become an unstoppable trend. As cash usage rapidly decreases and the digital economy expands, central banks must introduce a new form of currency. Additionally, the emergence of blockchain technology and the spread of dollar stablecoins are threatening countries' monetary sovereignty. In this process, the role of companies like Ripple, with proven technological capability and actual implementation experience for CBDCs, will become increasingly important.

Ripple's success in the CBDC era depends on three factors. First, can it maintain technological superiority? Second, can it meet each country's regulatory requirements while not losing innovativeness? Third, can it establish itself as a global standard? If it successfully addresses these three challenges, Ripple can establish itself as a core infrastructure provider in the CBDC era.

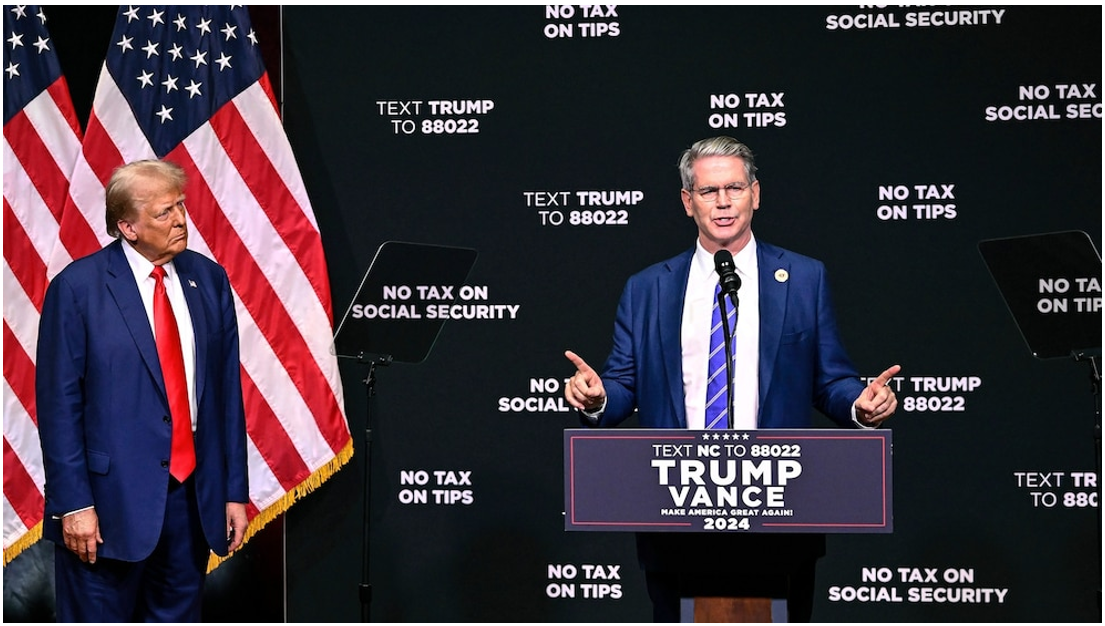

Trump and newly appointed Treasury Secretary Bessent have clearly stated their opposition to a US CBDC. However, countries that aren't reserve currency nations cannot help but accelerate CBDC adoption as other currencies like stablecoins threaten their monetary sovereignty. (Source: ABC)