Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

As we saw earlier, the modern financial system is in desperate need of fundamental change. Centralized control, high costs, slow processing speeds, and financial exclusion all demand new solutions. Cryptocurrency emerged as an answer to these challenges.

The 2008 debut of Bitcoin posed fundamental questions about the nature of money and finance. Instead of the centralized trust systems that have persisted for thousands of years, it introduced a new trust system based on mathematics and cryptography. Much like how the internet transformed the flow of information, cryptocurrency has the potential to transform the flow of value.

To understand cryptocurrency, we need to first examine the blockchain technology that underlies it. How does blockchain work, and why might it become a new paradigm of trust?

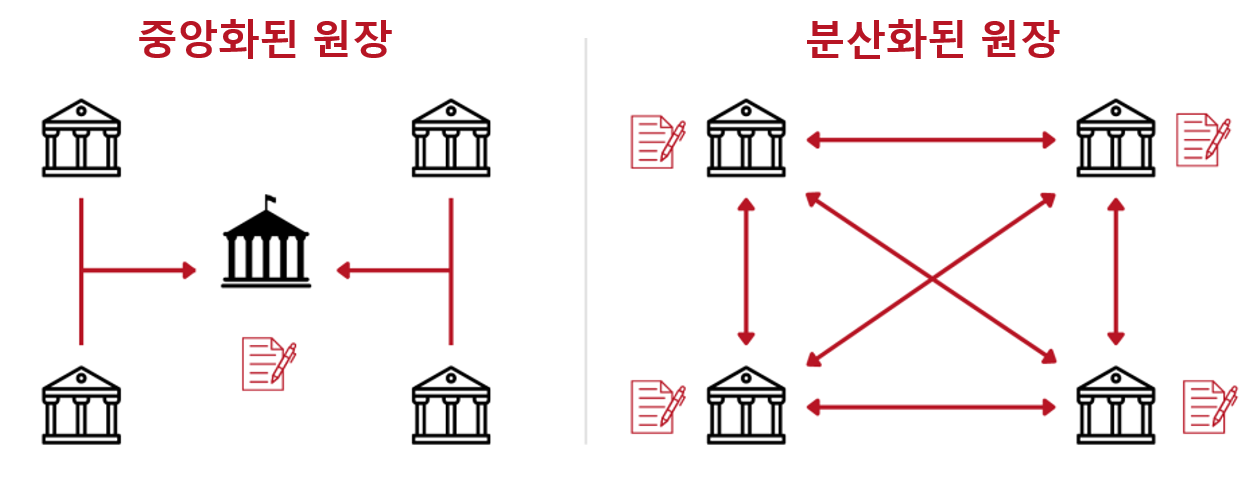

When people describe blockchain, they often use terms like "distributed ledger technology." While accurate, this alone doesn't convey blockchain's true concept. Let's understand it through a more familiar example.

When you deposit money in a bank, that record is stored on the bank's central computer. This central database contains all financial information including transaction histories and balances of all customers. But what if this computer is hacked or breaks down? Would our precious assets remain safe?

Blockchain offers an ingenious solution to this problem. Instead of a single central computer managing all information, thousands of computers worldwide share identical records. Even if one computer's record is damaged, the system remains secure because everyone else has the correct records.

This approach goes beyond technological innovation—it fundamentally changes how we build trust. Until now, we've trusted central institutions like banks or governments. Blockchain, however, offers a new form of trust based on mathematics and cryptography.

Blockchain technology created a more reliable trust system than potentially corrupt or inefficient central authorities by distributing ledger storage and verification rights among multiple participants. (Source: CFTE)

To understand how blockchain works, imagine a common situation. Let's say you're managing club dues. Typically, one person collects dues, organizes the budget, and records expenditures. But problems arise if that person accidentally records the wrong amount or loses the records.

Now imagine if all club members simultaneously recorded dues on a smartphone app, with records automatically synchronizing. Everyone has the same information in real-time, and changing data requires approval from all members. This would create a much safer and more transparent system.

Blockchain works on a similar principle. When someone initiates a transaction, this information is broadcast to all network participants. Participants verify whether the transaction is valid, and once a sufficient number confirm its validity, the transaction is bundled into a "block" and added to existing records. These blocks are connected like a chain, hence the name "blockchain."

The key point is that this entire process is mathematically verifiable. Just as we believe that 1+1=2 without requiring anyone's guarantee, blockchain transactions are inherently trustworthy. Moreover, once recorded, content cannot be modified.

The security and reliability of blockchain come from the harmonious combination of three core technologies. Let's examine these through real-life examples.

The first core technology is encryption. Think about our email system. Anyone can know an email address, but accessing the email account requires a password. Blockchain's "public key cryptography" works similarly. Anyone can share an address (public key) for receiving transactions, but moving assets stored at that address requires a private key.

The second is the "hash function" technology, which is like our fingerprints. Just as each person's fingerprint is unique, a hash function creates a unique "digital fingerprint" for any data. For example, if you input a long, complex contract into a hash function, it's converted into a simple, unique value specific to that document. If even a single letter in the contract changes, an entirely new hash value is generated, immediately revealing any tampering.

Even identical text written in lowercase and uppercase is recognized as different records, generating unique hash values. These unique hash values for each record make tampering with blocks fundamentally impossible. (Source: CFTE)

The third important element is the "consensus algorithm." This is one of blockchain's most innovative solutions, yet one of the hardest core concepts to understand. Simply put, the consensus algorithm determines "who has the real data." Think about deciding on a meeting date in a group. Everyone may prefer different dates, but eventually, you reach consensus through majority vote.

Blockchain's consensus algorithm is similar, though much more sophisticated and mathematical. All participants share data, and data agreed upon by the majority according to specific criteria is recognized as "truth." This consensus data is stored simultaneously by everyone and cannot be arbitrarily changed.

The most distinctive feature of such consensus algorithms is their creation of "decentralized trust." Just as we make decisions through elections in a democratic society, blockchain determines truth through participant consensus. But there's one important difference. While specific institutions count votes in elections, in blockchain, all participants jointly verify and confirm.

Bitcoin uses a method called "Proof of Work." This is like solving a difficult math problem. It takes significant time to solve the problem, but checking if the answer is correct is very easy. Like decrypting a complex code, blockchain expends considerable effort in verifying data, but allows anyone to easily confirm the results.

Blockchain security resembles the robust fortresses of the Joseon Dynasty. Just as fortresses built multiple layers of defense systems like walls and watchtowers against foreign invasions, blockchain protects data through various levels of security mechanisms. This extends beyond technical defense to include economic and social factors, designed in multiple layers.

First, blockchain security begins with cryptographic technology. The public key encryption used to protect transaction data is a technology that condenses the achievements of modern mathematics and computer science. Through this, transaction data moves safely, and transactions signed with private keys can be verified by anyone, but the private keys themselves are never exposed. This is like a vault's lock but much stronger. Decoding this digital vault would require solving a complex code that would take hundreds of years even with current computing technology.

But blockchain security doesn't rely solely on cryptography. Blockchain operates as a distributed network where all participating nodes share and verify data, rather than a central server. This eliminates the single point of failure, making the network impossible to destroy in any form. Just as important documents are kept safe when everyone has a copy rather than just one person, an attacker would need to simultaneously modify the data of millions of network participants to manipulate a document—practically impossible.

In December 2024, when Google unveiled its quantum chip, the cryptocurrency market temporarily declined. However, the commercialization of quantum computers is expected to take considerable time, and the blockchain ecosystem continues to prepare for quantum technology. (Source: Forbes)

Another unique security mechanism of blockchain comes from its economic design. Attempts to attack blockchain are designed to be prohibitively expensive. For Bitcoin, damaging the network would require controlling over 51% of the network's mining power, demanding enormous power consumption and hardware costs. This is like if breaking into a bank vault cost more than the money inside—attackers wouldn't even try. Blockchain makes such attacks irrational and uneconomical, further securing the network.

Finally, blockchain security is based on social trust and consensus. Users participating in the network follow the rules, maintaining the overall system's stability. Just as we accept paper money as currency due to social consensus, in blockchain, users trust the network's rules and data, giving transaction records stability and value.

Consequently, blockchain security is formed through the organic combination of cryptographic technology, distributed structure, economic design, and social trust. Through the interaction of all these elements, blockchain presents a new trust model for the digital age.

Like all innovative technologies, blockchain faces challenges that need resolution. Just as early internet struggled with speed and stability issues, blockchain encounters various challenges during its growth process.

The biggest challenge is "scalability." This can be understood by thinking about a city's transportation system. A small town's roads have no problem handling a few cars. But as the city grows and vehicles increase, traffic congestion occurs, requiring wider roads and more efficient transportation systems. Blockchain faces a similar situation. As more people use it, the network becomes congested, and transactions slow down.

Various approaches have been proposed to solve this problem. Technologies like the "Lightning Network" are similar to building new highways. Instead of processing all transactions on the main network, some transactions are handled in separate channels. Another approach is making the blockchain itself more efficient—like making existing roads smarter so more vehicles can move faster.

The second important challenge is "energy consumption." Particularly, Bitcoin's proof-of-work method consumes substantial electricity. This is similar to how fuel efficiency and environmental concerns were important challenges in the early history of automobiles. Just as electric vehicles became the solution to that problem, blockchain is trying to improve energy efficiency through new methods like "proof-of-stake."

Night view of Buenos Aires, Argentina. Bitcoin network's annual electricity consumption is 132.2 TWh, exceeding the annual electricity consumption of countries like Argentina (121 TWh), Norway (124 TWh), and Sweden (123 TWh). (Source: Reddit)

The third challenge is "usability." Current blockchain technology remains difficult and complex for ordinary users. This is similar to how early computers could only be used by experts. Personal key management, gas fee calculations, address verification, and many other aspects burden average users. But just as the IT industry developed and through various innovations computers gradually became easier to use, blockchain technology is evolving toward more intuitive and secure interfaces.

In the fall of 2008, the world faced an unprecedented financial crisis. Beginning with Lehman Brothers' bankruptcy, the crisis spread like dominoes worldwide, causing countless people to lose their life savings overnight. During this process, people began to question: "Will my assets maintain their value decades from now? Can I continue to trust reckless, massive financial institutions?"

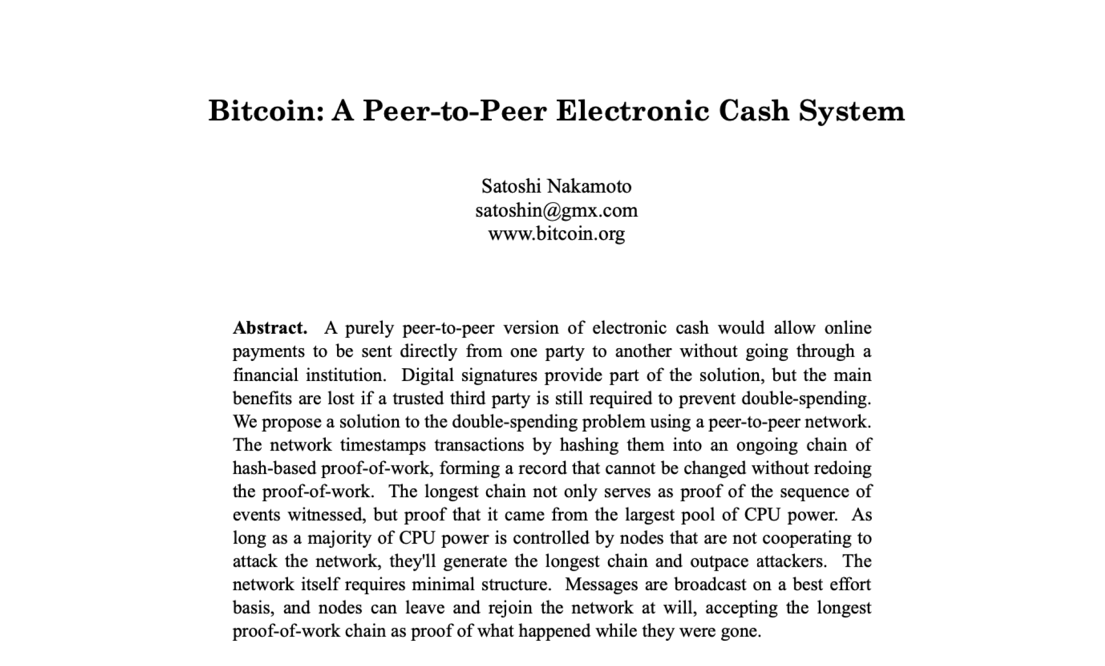

At this precise moment, an anonymous figure named Satoshi Nakamoto published a paper on the internet. Titled "Bitcoin: A Peer-to-Peer Electronic Cash System," this paper proposed a completely new type of monetary system based on the blockchain technology we examined earlier.

Satoshi Nakamoto combined various technologies and concepts to create Bitcoin and blockchain—an entirely new digital trust system. This ingenious concept is steering human wealth and financial history in a revolutionary direction. (Source: Bitcoin.org)

Bitcoin's emergence posed fundamental questions about the concept of money itself. Historically, money's value has always been based on something. Initially, precious metals like gold or silver were money themselves, later followed by notes based on these precious metals. After the gold standard was abolished in 1971, government and central bank credit became the foundation of currency value.

Bitcoin proposed a completely different approach from these traditional methods. No longer was government or central bank guarantee necessary. Instead, mathematics, cryptography, and the consensus of network participants became the foundation of currency.

The most likely candidate for Satoshi Nakamoto is American programmer Hal Finney. He was the first to receive Bitcoin from Satoshi and fixed early bugs. Diagnosed with ALS in 2009 when Bitcoin first launched, he died in 2014 at age 58. Satoshi's Bitcoin holdings are estimated at 1.1 M BTC. (Source: Independent)

Since Bitcoin's emergence, cryptocurrency technology has continuously evolved. This is like how computers started as simple calculators but have now become powerful tools capable of running artificial intelligence. This evolutionary process can be divided into three generations.

The first generation, represented by Bitcoin, was the era of "simple transfer." Bitcoin first implemented a safe and reliable digital transfer system. Bitcoin has now become like digital gold. Like actual gold, new bitcoins are created through mining, and its scarcity has earned it recognized value.

The second generation began with Ethereum's debut in 2015. Ethereum introduced the revolutionary concept of "smart contracts." To understand this, think of an online reservation system. When purchasing an airline ticket, the reservation is completed immediately upon payment, and an e-ticket is issued. No separate consultant or paper contract is needed. Smart contracts work similarly. When specific conditions are met, the contract executes automatically, eliminating complex intermediate processes.

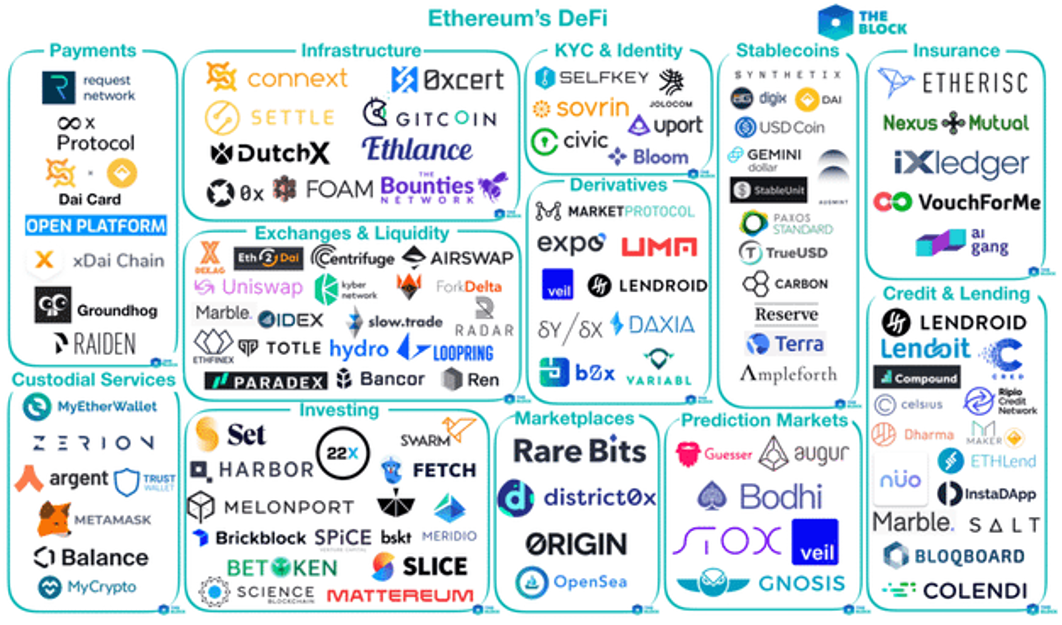

With Ethereum's emergence, cryptocurrency evolved from simple "money" into a "platform." This is similar to how the internet evolved from a simple information exchange medium to today's platform running e-commerce, social media, streaming services, and more. Ethereum enabled various applications like financial services, games, and art transactions.

Ethereum's DeFi (Decentralized Finance) ecosystem. Since its creation in 2015, the Ethereum network has generated over 4,000 DApps, more than 5 million smart contracts, and over 800 DeFi protocols. (Source: The Block)

Third-generation cryptocurrencies focus on overcoming previous generations' limitations. The biggest challenge is "scalability." This is like how early internet connected through telephone lines at slow speeds, gradually evolving to fiber optic cables and 5G networks. New projects like Solana and Cardano have developed technology capable of processing tens of thousands of transactions per second.

Looking at the forms of money we use daily, we see various types used for different purposes. There's cash, debit cards, credit cards, as well as special forms like gift certificates or local currencies. Similarly, the cryptocurrency world has various types with different purposes and characteristics.

The first is "payment cryptocurrency," with Bitcoin being the prime example. These primarily aim to store and transfer value like actual currency. They're the digital world's equivalent of cash. The biggest advantage of payment cryptocurrencies is their freedom to use across borders. When sending money from Korea to the US through banks, you go through multiple steps and incur high fees, but with Bitcoin, transfers are possible within minutes with minimal fees.

The second is "platform cryptocurrency," represented by Ethereum. This type goes beyond simple transfers to provide a foundation for creating various services and applications. This is similar to smartphone operating systems. Just as iPhones or Android phones can run various apps beyond basic call functions, Ethereum hosts financial services, games, art trading, and various other services.

Ethereum founder Vitalik Buterin stated that "Ethereum is not finance." Ethereum is a platform developed using blockchain technology that functions as an operating system for running economies and establishing governance. (Source: HIR)

The third is "stablecoins." These are cryptocurrencies whose values are linked to fiat currencies like dollars or won. Unlike most cryptocurrencies with volatile prices, stablecoins maintain stable values. This concept is similar to exchanging currency when traveling abroad. In the cryptocurrency market, stablecoins serve as safe havens and facilitate fund movement between exchanges, acting as lubricants.

Fourth are "utility tokens." These are like usage rights or memberships only usable within specific services or platforms. Like in-game currency in online games, they have value only within particular ecosystems. For example, a decentralized cloud storage service might require its utility token to access storage space.

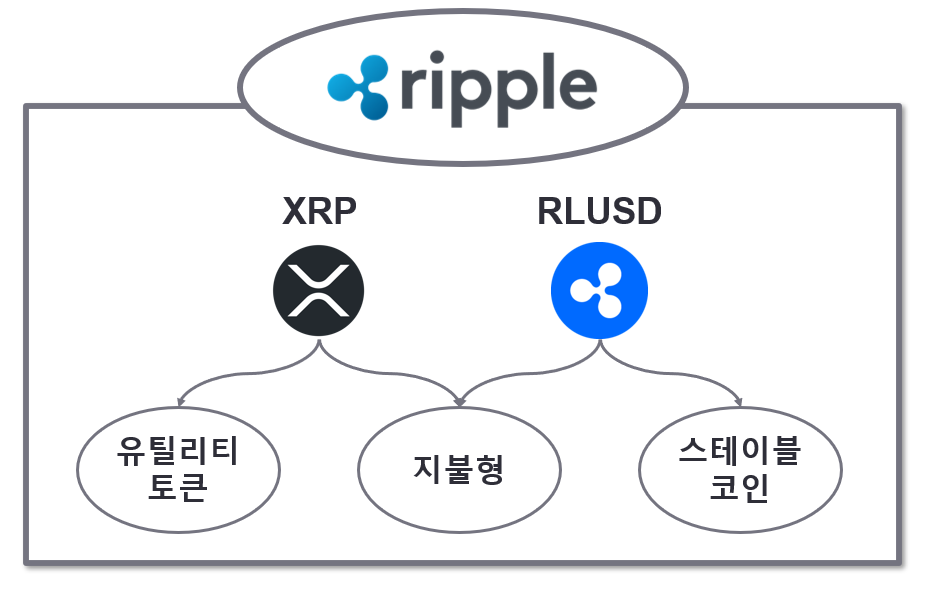

XRP has characteristics of both a payment cryptocurrency and a utility token, and in December 2024, Ripple Labs also launched a separate stablecoin (RLUSD). These hybrid characteristics create synergy across Ripple's business operations.

If regular wallets store cash and cards, cryptocurrency wallets work somewhat differently. Cryptocurrency wallets don't actually "contain" coins. Instead, they contain "keys" to access each person's coins. Think of a bank vault. Just as a key is needed to use valuables in the vault, special keys are needed to use our coins recorded on the blockchain.

These "keys" consist of two parts. One is the "public key," which functions like an account number. By sharing this address with others, they can send us coins. The other is the "private key." This is like a password that should never be shared with others, as the private key is necessary to use the wallet's coins.

Cryptocurrency wallets can broadly be divided into "hot wallets" and "cold wallets." This distinction is similar to carrying cash in a wallet versus storing it in a bank vault. Hot wallets are used while connected to the internet, such as smartphone apps or web-based wallets. They're convenient to use but vulnerable to hacking.

Conversely, cold wallets store keys completely disconnected from the internet. Hardware wallets resembling USB drives are typical examples. While highly secure, they can be somewhat inconvenient to use. This is like storing important jewelry in a bank vault—safe, but with the inconvenience of visiting the bank each time you need to use it.

British man James Howells mistakenly threw away a cold wallet (hard drive) containing 7,500 Bitcoin. He has been searching for the lost cold wallet for 10 years. (Source: BBC)

The most important aspect of wallet selection is "security." Unlike traditional bank accounts where passwords can be recovered through identity verification if forgotten, losing a cryptocurrency wallet's private key means permanently losing access to those coins. It's estimated that approximately 20% of Bitcoin remains inaccessible due to permanently lost private keys.

Cryptocurrency presents an entirely new economic paradigm beyond simple technological innovation. All currencies humans have used until now were based on someone's trust. Precious metals like gold or silver were based on their inherent value, while fiat currencies like the dollar were based on government credit. But cryptocurrency is based on objective and verifiable principles of mathematics and cryptography.

One of cryptocurrency's most important features is its difference in money supply method. Traditional currencies are regulated by central banks according to economic conditions. Sometimes they issue more money, sometimes they withdraw money from circulation. If this regulation isn't properly implemented, inflation or deflation occurs.

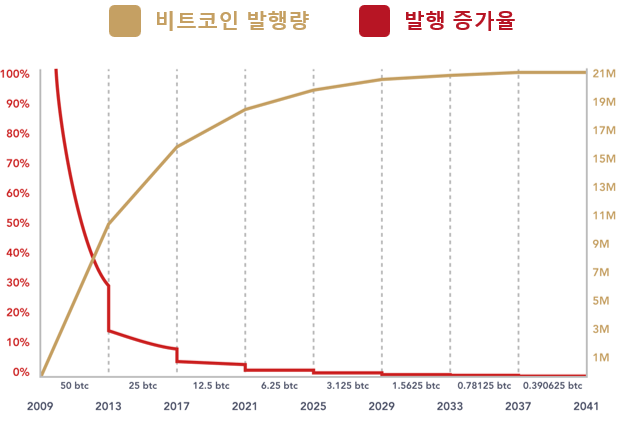

In contrast, most cryptocurrencies have predetermined total supplies. Bitcoin, for instance, is limited to a total issuance of 21 million. This is similar to how the total amount of gold is limited. New bitcoin is issued in small amounts according to a set schedule, strictly controlled by mathematical algorithms.

Currently, over 90% of all Bitcoin has already been mined, with the last Bitcoin expected to be mined in 2140. This limited supply further solidifies Bitcoin's status as the next-generation store of value. (Source: River F.)

Additionally, one of cryptocurrency's most innovative economic features is the concept of "programmable money." While existing money simply stored and transferred value, cryptocurrency can be programmed with specific conditions or rules. For example, conditions like "this money can only be used for education expenses" or "rent is automatically paid on the first of each month" can be programmed into the currency itself.

This characteristic of cryptocurrency can present a new paradigm of "programmable economy." For example, welfare payments from the government could be programmed to be used only for medical or educational expenses. Or when artists sell their digital works, they could set up automatic commissions whenever the work is resold. This has the potential to fundamentally change how we organize and manage economic activities.

One of the major changes cryptocurrency could bring to the world is "financial democratization." According to the World Bank's Financial Inclusion Index, about 1.4 billion adults worldwide still live without basic banking services. This isn't just because they can't meet requirements like identification or address verification, but also because banks don't provide services in areas they deem unprofitable. However, cryptocurrency enables anyone with a smartphone to access financial services.

Consider a farmer in Africa who needs to sell crops and receive payment. Without nearby banks, they must deal in cash, risking theft. But using cryptocurrency, they can safely receive and store payments via smartphone. Furthermore, this farmer can directly trade with buyers anywhere in the world.

This financial democratization can bring social innovation beyond mere technological progress. Until now, financial services were the exclusive domain of banks and large financial institutions. They only provided services to profitable customers and regions, resulting in many people unable to access even basic financial services. Cryptocurrency presents the possibility of bridging this gap.

However, there are challenges to be solved behind these innovative possibilities. Technologically, scalability, energy efficiency, and user experience need improvement. Institutionally, appropriate regulatory frameworks must be established, and harmonious coexistence with existing financial systems must be found. Socially, the digital divide must be bridged, and education and understanding of new technologies must be enhanced.

These challenges are not small. But just as the internet overcame its early technical limitations and instabilities to become an essential part of our lives today, cryptocurrency will gradually solve these challenges and continue to develop.

In the next chapter, we'll explore Ripple, which emerged to implement new currency functions using the blockchain technology created by Bitcoin. What purpose was Ripple developed for, and what ecosystem and technology is it using to realize this? And what will this mean for our future?