Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

In January 2024, the global cryptocurrency market began the new year with game-changing news that completely reshuffled the industry: the approval of Bitcoin ETFs. Just four months later in May, against everyone's expectations, Ethereum ETFs were also approved. So which cryptocurrency will be next to be included in an ETF? Industry experts now believe there's a very high probability that Ripple will take that position.

Then in December 2024, Ripple's stablecoin RLUSD received approval from the New York Department of Financial Services (NYDFS). This approval gained even greater significance as competing stablecoin Tether (USDT) came under regulatory pressure in Europe around the same time. Ripple has emerged as a rising power in the market at the exact moment when the strongest competitor in the existing stablecoin market began to stumble.

The series of events—Ripple's victory in the SEC lawsuit, stablecoin approval, and progression toward ETF inclusion—signify that Ripple is now irreversibly being incorporated into mainstream finance. So let's explore what these developments mean for Ripple.

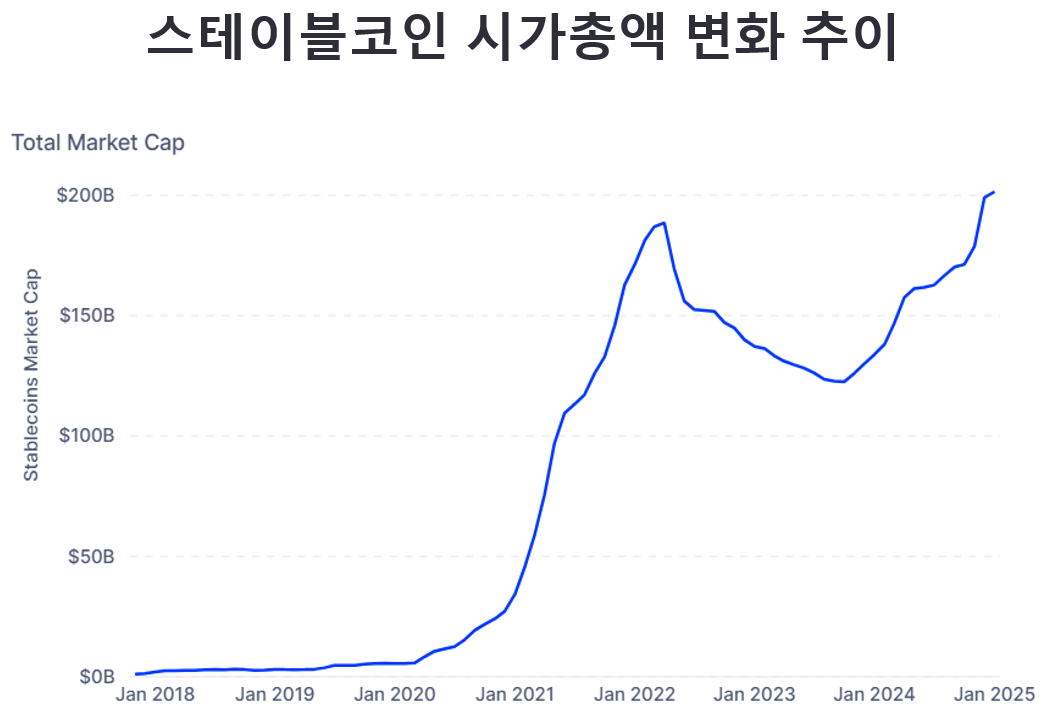

Stablecoins are digital currencies with values pegged to specific assets. Most stablecoins are pegged to the US dollar at a 1:1 ratio, maintaining their value by holding actual dollars or dollar-denominated assets as reserves. As of early 2025, the global stablecoin market capitalization has surpassed $200 billion.

Stablecoin market cap surpassed $200 billion in January 2025, exceeding the previous all-time high of $188 billion from April 2022. (Source: Into The Block)

The primary function of stablecoins is to solve the price volatility problem that was the biggest limitation of existing cryptocurrencies. Cryptocurrencies like Bitcoin or Ethereum can experience price fluctuations of tens of percent in a single day, making them difficult to use for actual financial transactions. Stablecoins, on the other hand, provide a stable digital payment method by fixing their value to fiat currencies like the dollar.

The use of stablecoins in international finance is particularly prominent in three areas. First, trade finance. As of 2024, the global trade finance gap is estimated at $2.5 trillion, and stablecoins are gaining attention as a new tool to bridge this gap. They're especially contributing to improving trade finance accessibility for small and medium-sized enterprises in emerging countries.

Second, institutional settlement. Major asset management companies like BlackRock and Fidelity have begun using stablecoins as settlement methods for digital asset transactions. The ability to settle in real-time in the 24-hour digital asset market is a significant advantage.

Third, the foreign exchange (FX) market. In the foreign exchange market where an average of $7.5 trillion is traded daily, stablecoins are playing a new role as bridge currencies. Particularly when direct trading between emerging market currencies is difficult, using stablecoins as intermediary currencies can significantly reduce costs and time compared to the traditional dollar routing method.

Major financial institutions around the world are already entering the stablecoin business and expanding use cases. JP Morgan launched its own stablecoin 'JPM Coin' in 2019, processing over $1 billion in transactions daily as of January 2024. Goldman Sachs invested $15 million in BitGo, a digital asset custody company, in 2018, and BitGo launched a new stablecoin called USDS in September 2024.

The most notable change in the stablecoin market during 2024 was the full-scale participation of global custody banks (specialized banks that store and manage assets for institutional investors). BNY Mellon, State Street, and Northern Trust began offering stablecoin custody services, further accelerating institutional investment in digital assets.

BNY Mellon, the world's largest custody bank, safeguards over $47 trillion in assets. The participation of such large financial institutions demonstrates that stablecoins are becoming new infrastructure in mainstream finance. (Source: Reuters)

Stablecoins are now undoubtedly growing their influence as an important part of the international financial system. In June 2023, the Bank for International Settlements (BIS) analyzed through its report "Stablecoins and the International Financial System" that stablecoins could become new infrastructure for international finance. Swift also forecast in its 2024 "Future of Payments" report that stablecoins would become a key element of the international payment system. In particular, Swift is running a pilot program integrating stablecoins into existing inter-bank messaging systems.

Global financial market experts forecast 2025-2030 as the 'stablecoin takeoff period.' Coinbase predicted in its "2025 Crypto Market Outlook" report released in late 2024 that the stablecoin market would grow to $3 trillion by 2030. In particular, it forecast significant growth in stablecoin usage in institutional transactions and trade finance.

The most important variable for stablecoins to grow in scale and expand their domain over the next few years is regulation. Governments around the world are making efforts to accommodate stablecoins. In the United States, stablecoin regulatory legislation began to be seriously discussed from the second half of 2024, and the European Union has established a comprehensive regulatory framework for stablecoins through the Markets in Crypto-Assets (MiCA) regulation.

The approval of Ripple's stablecoin RLUSD by the New York Department of Financial Services (NYDFS) in December 2024 carries meaning beyond a simple administrative procedure. The NYDFS has the nickname 'cryptocurrency police,' and its digital asset business approval process is known as one of the most rigorous screening procedures in the financial industry. To gain approval, high standards must be met in all five core areas: capital adequacy, compliance framework, technical security, executive qualifications, and consumer protection framework. The fact that RLUSD passed this demanding review means that Ripple's technology and operational framework have satisfied the highest regulatory standards.

Ripple CEO Garlinghouse sharing news about RLUSD approval. RLUSD was originally scheduled to launch on December 4 but was delayed a week due to administrative issues. This delay temporarily calmed XRP's sharp rise. (Source: X)

Unlike existing stablecoins, RLUSD was designed with regulatory compliance in mind from the beginning. While Tether, the market share leader, has continuously stirred controversy over transparency issues by holding various assets as reserves beyond US Treasury bonds, RLUSD composed 100% of its reserves with US Treasury bonds and cash-equivalent assets. Additionally, these reserves are deposited in banks fully covered by FDIC insurance, guaranteeing the highest level of safety.

Ripple's RLUSD has two important differentiators. First, a real-time reserve audit system. Using blockchain technology, it can verify in real-time that RLUSD's issuance volume and reserves are always maintained at a 1:1 ratio. This provides a different dimension of transparency compared to Tether (USDT) or USDC, which submit audit reports quarterly or monthly.

Second, programmable compliance functionality. RLUSD has implemented anti-money laundering (AML) and know-your-customer (KYC) regulations at the smart contract level. This means financial institutions can utilize RLUSD's built-in regulatory compliance functions without building separate compliance systems.

These features are particularly meaningful to institutional investors. The biggest reasons institutional investors hesitate to adopt stablecoins are regulatory risk and lack of reserve transparency, and RLUSD has established a structure that can resolve both concerns.

On December 30, 2024, the European Union's Markets in Crypto-Assets (MiCA) regulation came into full effect. Under MiCA, substantial trading restriction measures were implemented against Tether. This was not simply a warning or recommendation but a powerful measure that actually halted Tether trading on major exchanges in Europe, with exchanges like Coinbase delisting Tether in Europe. Regulatory authorities pointed out three main issues: lack of reserve transparency, inadequate risk management frameworks, and audit reliability.

Behind this decision were years of accumulated concerns. Tether had long been ambiguous about the composition of its reserves. Initially, it claimed that all USDT was fully backed by US dollars, but it was later revealed that a significant portion consisted of corporate bonds or other risky assets. It also promised regular audits, but these were mostly partial and irregular.

The European Union had been preparing a strict regulatory framework for stablecoins through MiCA regulations since early 2024. MiCA is Europe's first comprehensive regulatory framework for the cryptocurrency market, presenting very specific and stringent standards, especially regarding stablecoins.

First, all stablecoin issuers must hold 100% of their reserves in cash or safe assets like treasury bonds. These reserves must be publicly disclosed in real-time and regularly verified by independent auditors. Issuers must also maintain sufficient equity capital and prepare detailed crisis response plans.

These standards were a very high barrier for Tether. Part of Tether's reserves consisted of risky assets like corporate bonds, and it had not established real-time disclosure or regular audit systems. Tether's quarterly asset reporting has been criticized as certification rather than accounting audits. Eventually, as MiCA regulations began to be fully implemented from late 2024, Tether was effectively expelled from the European market.

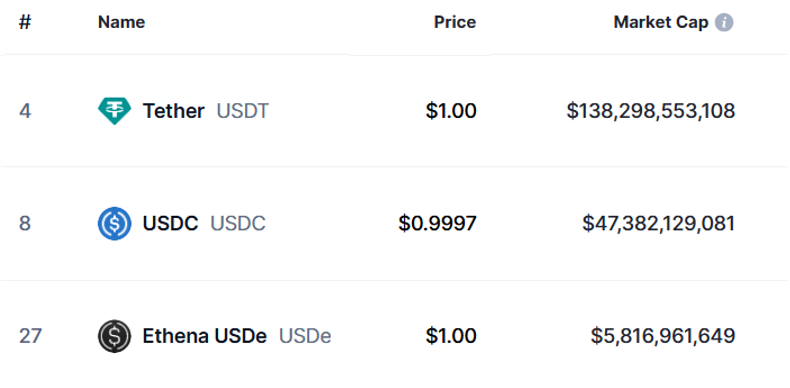

The current stablecoin market cap totals approximately $200 billion, with Tether and USDC commanding over 90% market share. (Source: Coin Market Cap)

Tether faces anticipated regulatory issues not only in Europe but also in the United States. In January 2025, Coinbase CEO Brian Armstrong stated in an interview with the Wall Street Journal that they could delist USDT if new stablecoin regulations are introduced in the US. He said, "The new regulatory environment will demand more transparency and legal compliance from stablecoin issuers," and predicted that future US stablecoin regulations would require issuers to hold 100% of their reserves in US Treasury bonds and undergo periodic audits.

In this situation, RLUSD is emerging as a new alternative in the European market and potentially the US market. This is because RLUSD already meets all the requirements of MiCA and can respond to regulations expected to be introduced in the US. In fact, RLUSD's reserve management system and transparency standards exceed the requirements introduced by MiCA. In particular, its real-time audit system and automated regulatory compliance mechanisms have received high evaluations from European regulatory authorities.

Looking at financial history, the process of new innovations being incorporated into the mainstream has always been complex and difficult. Even when central banking systems were introduced in the late 19th century, many viewed them as 'dangerous innovations,' and similar concerns were raised when credit cards emerged in the early 20th century. Ripple understands these historical lessons well. Even innovative technology must eventually develop in harmony with existing institutions.

Ripple anticipated these market changes and prepared thoroughly. While many cryptocurrency projects were calling for 'replacement' of the existing financial system, Ripple emphasized 'complementation' and 'cooperation' from the beginning. RLUSD is the embodiment of Ripple's philosophy. It was designed with global regulatory environments in mind before launch and developed in close cooperation with regulatory authorities from various countries.

Ripple's partnerships and collaborations with institutions from various countries to date are no coincidence. Ripple has meticulously studied the regulatory environment and financial culture of each country and taken customized approaches. For example, in Singapore, it established a local office and collaborated with Singaporean financial authorities to expand services gradually to strengthen its position in the Asia-Pacific region. In Japan, it entered the market through partnerships with local financial institutions.

Ripple doesn't try to avoid or minimize regulation but has voluntarily adopted even higher standards. RLUSD's real-time audit system and automated regulatory compliance mechanisms far exceed the current regulatory requirements. This is expected to help Ripple preemptively prepare for future regulatory strengthening while establishing itself as a trustworthy leader in the stablecoin market.

Ripple CEO Garlinghouse appeared on CBS's "60 Minutes" last December, clarifying that what Ripple wants is not reduced regulation but clearer regulation. (Source: CBS)

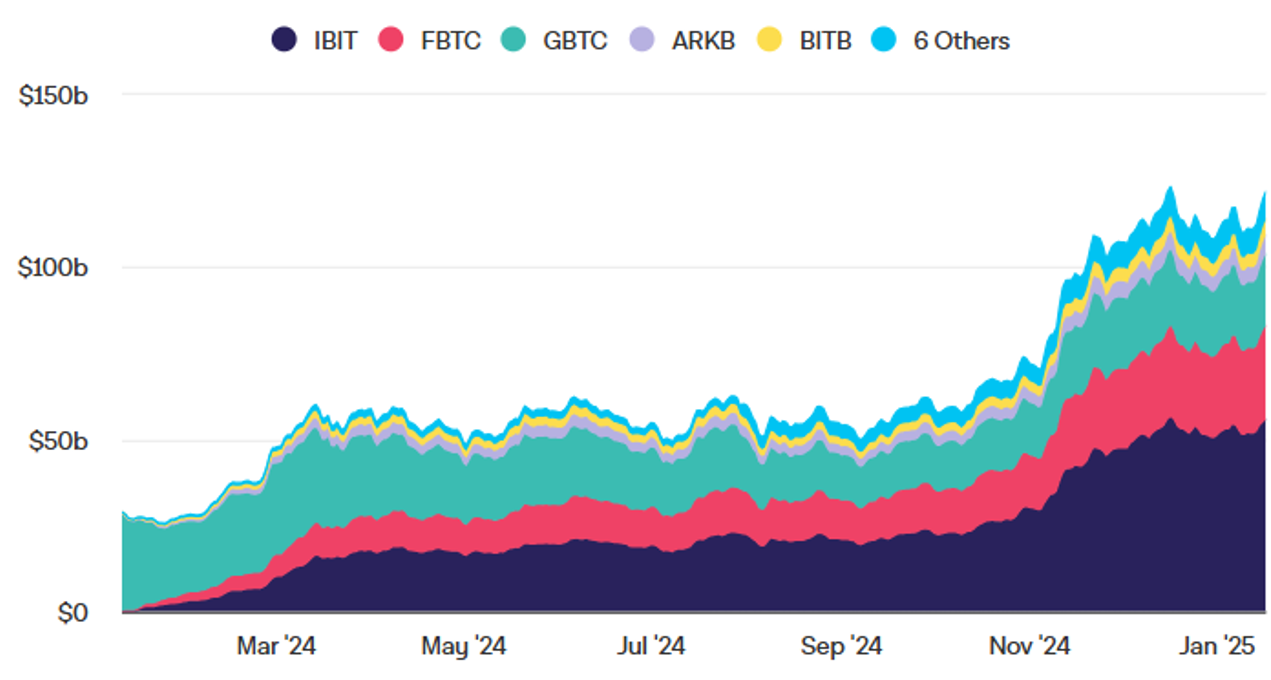

The approval of Bitcoin ETFs in early 2024 was a historic moment for the cryptocurrency market. BlackRock's Bitcoin ETF (IBIT) surpassed $10 billion in assets under management (AUM) within a month of launch, and Fidelity's FBTC also exceeded $6 billion. This was recorded as one of the most successful launches in ETF history. The approval and successful debut of Bitcoin ETFs signified that cryptocurrencies were finally beginning to be recognized as part of the traditional financial market.

To better understand what this means, we first need to understand what an ETF is and why it's important. An ETF is not just an investment product. It's like a certificate that the asset has been officially recognized in the mainstream financial market. For example, when gold ETFs were first introduced, they became the catalyst for gold to establish itself as an official financial product beyond a mere precious metal.

An ETF (Exchange-Traded Fund) is an exchange-traded fund designed to track the price of a specific asset or asset class, offering high liquidity as it can be traded in real-time on exchanges like stocks. ETFs are particularly preferred by institutional investors, now providing a channel to invest in digital assets without regulatory and operational risks. Even institutions with strict investment restrictions, like pension funds or insurance companies, can now indirectly invest in cryptocurrencies through ETFs.

BlackRock's IBIT surpassed $50 billion in AUM by January 2025, with total Bitcoin ETF market cap reaching $120 billion. (Source: Into The Block)

After the successful debut of Bitcoin ETFs, Ethereum ETFs were also approved just four months later, defying everyone's expectations. Initially, the SEC showed a cautious stance on Ethereum ETF approval because Ethereum has different characteristics from Bitcoin. However, the SEC eventually approved Ethereum ETFs as well, signifying that the SEC was beginning to recognize cryptocurrencies themselves as an asset class.

In this trend, the possibility of Ripple ETF approval is also increasing. Since winning the SEC lawsuit, several asset management companies have applied for XRP ETFs. Bitwise submitted an XRP ETF application in October 2024, followed by 21Shares, Canary Capital, and WisdomTree. Bitwise's application particularly emphasized that XRP had already received a 'non-security' ruling from the SEC.

XRP ETFs have different characteristics from Bitcoin or Ethereum ETFs. XRP is a utility token actually used by financial institutions for international remittances, which could receive differentiated evaluation during the ETF review process. SEC Chairman Gary Gensler has also mentioned in the past that "utility tokens could be evaluated differently from securities."

Ripple's ETF presents differentiated value from other cryptocurrency ETFs. First, it has an actual business model and revenue structure. Fee income through ODL service, operating income from stablecoins like RLUSD, and partnerships with over 300 financial institutions provide ETF investors with clear value assessment criteria.

Additionally, Ripple has strong characteristics as a financial infrastructure company. Ripple's RippleNet and ODL services, along with XRP, have high potential to be utilized as major infrastructure in the next-generation international payment market. This means that XRP ETFs could be investment vehicles for next-generation financial infrastructure rather than simply digital asset investments.

Furthermore, Ripple's participation in CBDC projects is also expected to impact ETF value. According to a BIS (Bank for International Settlements) survey, 80% of central banks worldwide are considering CBDC adoption by 2025. If Ripple establishes itself as a major technology provider in this process, it could provide additional growth engines for ETF investors.

The successful launch of Bitcoin ETFs in January 2024 opened a new chapter in the digital asset ETF market. Particularly, recording over $38 billion in cumulative trading volume during the first month of launch proved that there is actual demand from institutional investors for digital assets.

XRP ETFs have unique positioning within this trend. Ripple possesses a payment network actually used by financial institutions and participates in the development of next-generation financial infrastructure such as CBDCs and stablecoins. This suggests that XRP ETFs could be investment vehicles for financial infrastructure rather than simply speculative products.

It's also noteworthy that Ripple's market capitalization is still low compared to major financial technology companies. The influx of institutional funds through ETFs could be an opportunity to reassess Ripple's actual business value. However, this depends on how much success Ripple can show in major projects such as CBDC, SWIFT 2.0, and stablecoins.