Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

Trump originally disliked cryptocurrencies. In fact, quite the opposite. Looking at his past statements, it's easy to see how strongly negative his perception of cryptocurrencies was.

In July 2019, while president, he publicly criticized Bitcoin and cryptocurrencies through Twitter:

"I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated crypto assets can facilitate unlawful behavior."

Trump's tweet from July 2019. At that time, Trump had not yet discovered the connection between cryptocurrencies and America's interests. (Source: X)

His aversion to Bitcoin wasn't just an opinion but was reflected in policy. In August 2020, at a White House press briefing, he emphasized that "fraudulent cryptocurrency transactions are increasing" and that "the dollar must remain the world's reserve currency." This showed his assessment that cryptocurrencies could potentially threaten America's financial hegemony. During Trump's first term, lawsuits were filed against several cryptocurrency companies, including Ripple.

In June 2021, in an interview with Fox Business, he took an even stronger stance: "Bitcoin just seems like a scam. I don't like it. The currency of this world should be the dollar. And I don't think we should have all of the Bitcoins of the world out there. I think they should regulate them very, very high." To Trump, cryptocurrencies weren't a new technology but rather a risk factor that could shake the foundation of the American economy and financial system.

However, in 2024, he appeared before the world with a completely reversed position on cryptocurrencies. During the subsequent election campaign, he began calling himself the "Crypto President." On July 29, 2024, at the Bitcoin 2024 conference in Nashville, Trump declared:

"I will make America the crypto capital of the planet."

"I will make America a Bitcoin superpower."

These statements signified that Trump's view of cryptocurrencies had completely changed. He was now clearly stating that the United States should not merely tolerate cryptocurrencies but lead the cryptocurrency industry.

At the same venue, Trump also addressed his relationship with regulatory authorities: "On the day I take office, I will fire SEC Chairman Gary Gensler." Gensler, as the head of the SEC under the Biden administration, had pursued strict regulatory policies against cryptocurrencies, including the lawsuit against Ripple, regulatory pressure on Coinbase, and legal battles with Binance. Trump's statement was received as a signal of regulatory relief for the cryptocurrency industry, and the market reacted immediately.

The annual Bitcoin Conference held in Nashville in July 2024 was where Trump first declared that he would be the "Crypto President." (Source: NYT)

But there's more. Trump also began to view Bitcoin not just as an investment asset but as a national asset. In his speech, he announced, "When I am elected, it will be the policy of my administration to maintain 100% of America's Bitcoin holdings that the government currently has or acquires in the future." This statement was interpreted as the U.S. government's recognition of Bitcoin as a strategic asset.

On June 13, 2024, he posted on Truth Social:

"I want to make sure all of the remaining Bitcoin is mined in the USA! This would help our dominance in the energy sector!!!"

This revealed his intention to actively foster the Bitcoin mining industry, which is the production method for Bitcoin, as a strategic industry for the United States.

On August 2, 2024, in a Fox News interview, he made an even more radical statement:

"Who knows? Maybe we'll be able to pay off our $35 trillion national debt. Maybe we could get rid of $35 trillion by giving away a little bit of Bitcoin."

This was a shocking proposition at the time—a U.S. presidential candidate publicly mentioning the possibility of using Bitcoin as a means to resolve national debt.

In conclusion, while Trump viewed Bitcoin and other cryptocurrencies as hotbeds of illegal activities and fraud until 2019, during his 2024 re-election campaign, he came to accept cryptocurrencies as an important part of the U.S. economic and financial system. And now he's arguing that the United States should lead the global cryptocurrency industry and market.

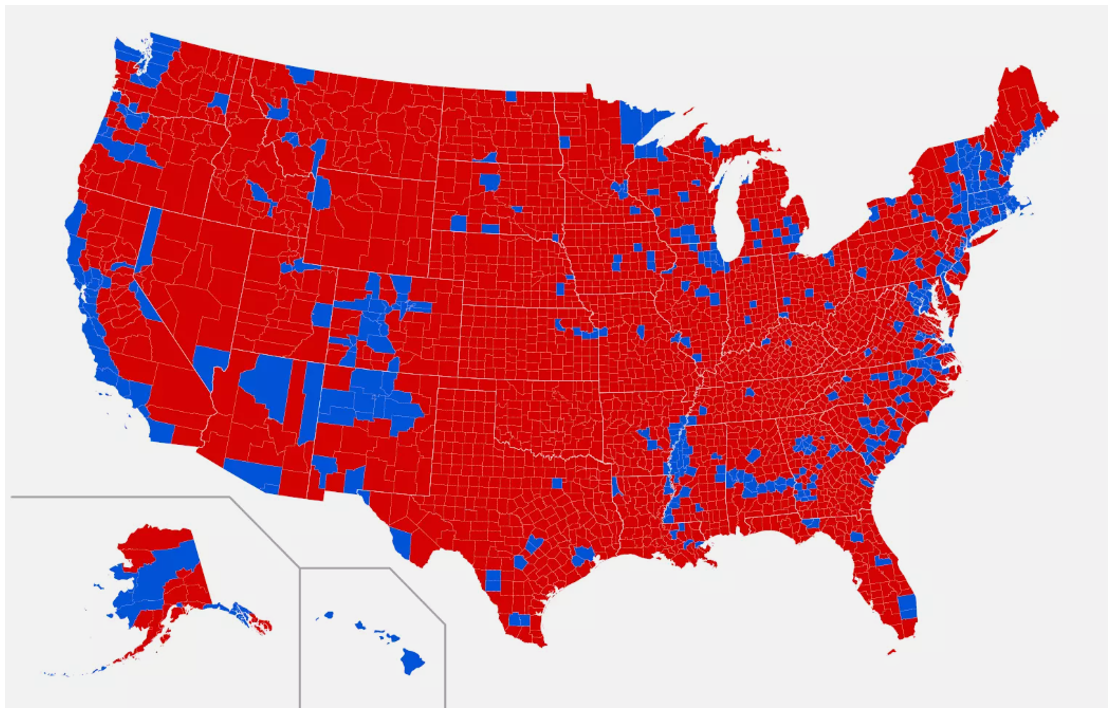

In November 2024, Trump overcame his 2020 defeat and succeeded in his re-election. Trump not only secured the electoral college votes needed for victory but also won the popular vote against Biden. Above all, he achieved a decisive victory by winning all seven swing states, defying the predictions of many media outlets and experts. Furthermore, with Republicans winning both the House and Senate elections, Trump gained control not only of the executive branch but also the legislative branch. The "Trump World," with even more power than in 2016, opened once again.

County-level map of the 2024 US presidential election results. Unlike his first term, Trump began his term with powerful mandate after winning all swing states and both house and the senate. (Source: Freedom Quest)

Having maintained a pro-cryptocurrency stance throughout the election campaign, Trump began implementing related policies as soon as he returned to the White House. The first thing he did was to change the regulatory tone.

On January 20, 2025, just before Trump's inauguration, SEC Chairman Gary Gensler resigned. The very next day, January 21, Trump appointed SEC Commissioner Mark Uyeda as Acting Chairman of the SEC.

That same day, Uyeda announced the launch of a cryptocurrency task force (TF) within the SEC. The SEC explained that "the TF will focus on drawing clear regulatory lines, providing realistic registration pathways, and creating a reasonable disclosure framework." This presented a completely different direction from the previous cryptocurrency regulatory approach.

Then on January 23, Trump signed an executive order to "Establish American Leadership in Digital Financial Technology." The core content of this executive order was to create a "Presidential Working Group on Digital Asset Markets."

The head of this working group is David Sacks, who was appointed as the "Crypto & AI Czar" in the Trump administration. The group requires the mandatory participation of the Treasury Secretary, Attorney General, SEC Chairman, and CFTC Chairman, and must submit policy proposals to the President within 180 days. The policy recommendations must include an assessment of how to stockpile digital assets at the national level and a federal regulatory framework governing digital assets, including stablecoins.

The Trump 2.0 era is moving not just toward introducing pro-cryptocurrency policies, but toward the United States dominating the global cryptocurrency hegemony. Trump, who has returned with a completely different attitude, is now trying to lead a cryptocurrency revolution from the White House.

The executive order signed by President Trump on January 23, 2024, President Trump signed the executive order on January 23, 2024, establishing the "Cryptocurrency Working Group," signaling the beginning of a U.S.-led cryptocurrency era. (Source: Reuters)

Trump did not return to the White House alone. He returned with a pro-cryptocurrency brigade that actively supports cryptocurrencies. From the White House to financial regulatory agencies to the Treasury, positions were filled with individuals who actively embrace cryptocurrencies. These are not people who simply support cryptocurrencies. They are individuals with the philosophy that the United States should lead the cryptocurrency industry and the strong will to pursue market and industry-friendly policies. Trump is implementing specific plans to make the United States a cryptocurrency powerhouse with these individuals.

When Scott Bessent was nominated as Treasury Secretary in the Trump administration, the financial industry reacted immediately. He is known not as a traditional financial bureaucrat, but as a pragmatist who emphasizes free-market economics and financial innovation. During the Senate confirmation process, he was approved by a relatively large margin of 68 to 29, with even 16 Democratic senators supporting his nomination.

When Scott Bessent was officially nominated as Treasury Secretary on November 22, 2024, the cryptocurrency industry, including Ripple CEO Garlinghouse, unanimously expressed enthusiastic support. (Source: Reuters)

Bessent will play an important role in the Trump administration, overseeing U.S. tax policy and the $28 trillion Treasury bond market. But above all, he's receiving the most attention because he's in a position to design and implement digital asset policies, including cryptocurrencies. The Treasury is responsible for the foundation of the financial market, and it's especially important in determining what role stablecoins and digital assets will play in the global financial system.

Bessent has already expressed his pro-cryptocurrency stance several times. In a July 2024 interview with Fox Business, he said, "I'm pleased that former President Trump has embraced cryptocurrency" and that "cryptocurrencies symbolize freedom and are an essential element for America's economic future." This statement is also a strong signal that cryptocurrencies will be included in the core economic policies of the Trump administration.

With Bessent becoming Treasury Secretary, the direction of U.S. financial regulation is expected to fundamentally change. In particular, he is expected to actively promote the institutionalization of stablecoins. Currently, stablecoins exist in legal uncertainty within the United States, but Bessent plans to vitalize them within clear regulations and use them as a means to supply global dollar liquidity. Particularly, stablecoins backed by U.S. Treasury bonds can become a new source of demand for the bond market, which makes his policy direction significant.

The most notable change expected in the Trump administration is the major overhaul of the SEC. Under the Biden administration, the SEC was the cryptocurrency industry's biggest adversary. The SEC pursued policies close to all-out suppression rather than bringing the cryptocurrency market into the institutional framework, including lawsuits against Ripple, regulatory pressure on Coinbase and Kraken, and legal battles with Binance. In particular, former Chairman Gary Gensler maintained the position that "cryptocurrencies are mostly securities and require strong regulation," which dampened the market.

However, with Trump's successful re-election, this stance was completely reversed. On January 20, 2025, Gensler resigned upon inauguration, and the new SEC was filled with pro-cryptocurrency figures.

The key figure at the SEC in the Trump administration is Paul Atkins. He previously served as an SEC Commissioner during the George W. Bush administration and has advocated for market activation through financial regulatory relief. Particularly regarding the cryptocurrency market, he holds the position that "clear regulations are necessary, but excessive regulations that hinder innovation are not."

Since his time as an SEC Commissioner, he has criticized the existing financial regulatory approach for failing to keep up with rapidly changing technology. He views cryptocurrencies and blockchain technology not as mere speculative products but as new forms of finance, and has a philosophy that they should be stably grown within the institutional framework.

By nominating Atkins as SEC Chairman, Trump clearly demonstrated his will to make the cryptocurrency market more open. After his appointment, the SEC announced that it would "prepare a realistic regulatory framework suitable for new industries, rather than retroactively applying existing regulations." This is an important change that resolves the legal uncertainty that existing cryptocurrency companies have been facing.

Paul Atkins previously testified before Congress that "the SEC should reduce overlapping regulations and potential burdens on the digital asset industry." (Source: ABC)

Another figure to note in the new SEC of the Trump 2.0 era is Mark Uyeda, who was appointed as Acting SEC Chairman. As a representative pro-cryptocurrency figure within the SEC, he visited Korea in September 2024 and expressed a critical stance on the regulatory approach of the previous Gary Gensler regime, stating that "digital asset regulations should be clear." In particular, he emphasized that "we need to end the uncertainty about what standards cryptocurrency companies should comply with."

Under his leadership, the SEC launched a cryptocurrency task force (TF) and immediately began working on preparing practical and clear guidelines. This TF is focusing on establishing rational registration procedures and clear legal guidelines, departing from the existing regulatory approach.

Hester Peirce is a figure known in the industry by the nickname "Crypto Mom." She has consistently maintained a cryptocurrency-friendly stance and has been a representative cryptocurrency supporter within the SEC during Trump's first administration.

SEC Commissioner Peirce is known as "Crypto Mom" within the crypto community due to her typically crypto-friendly stance and actions, making her quite popular. (Source: Coinage)

With Trump's re-election, Peirce has gained even more influence. She was appointed as the leader of the SEC's cryptocurrency task force (TF) and is leading the work of creating a clear regulatory framework for the cryptocurrency market. In particular, she has advocated that "a regulatory framework that cryptocurrency companies can realistically comply with should be created" and has actively supported the growth of the Bitcoin ETF and stablecoin market.

David Sacks is a representative venture capitalist and entrepreneur in Silicon Valley who previously served as COO of the fintech startup PayPal. He has long supported technological innovation and free-market economics, and based on this background, he was appointed as the "Crypto & AI Czar" in the Trump administration.

David Sacks served as PayPal's COO and later became a venture investor in Silicon Valley as a member of the "PayPal Mafia" alongside Elon Musk. (Source: NYT)

His appointment heralds a major change in U.S. digital asset policy. Since taking office, Sacks has begun leading the Digital Asset Working Group to establish strategies for regulatory reform and innovation promotion in the cryptocurrency industry. He is also pushing to redefine NFTs and meme coins as "collectibles," excluding them from the category of securities regulation.

Sacks is also paying attention to the development of stablecoins. He believes that stablecoins can play an important role in strengthening the global leadership of the U.S. dollar and is planning to prepare policies to support this. He has emphasized that "stablecoins are an opportunity to expand the dominance of the dollar in the digital realm" and has shown his will to enhance the competitiveness of the U.S. economy through them.

Sacks's actions will play an important role in the United States taking a leading position in the digital asset field. He has stated that "the United States will quickly catch up with other countries in the digital asset industry" and has expressed the goal of making the United States the "world's cryptocurrency hub" through clear regulatory guidelines and innovation promotion.

Elon Musk, as the CEO of Tesla and SpaceX, is widely known as an icon of cutting-edge technological innovation. He has publicly expressed his interest in and support for cryptocurrencies, particularly gaining attention for his mentions of Bitcoin and Dogecoin.

Musk has also promoted the acceptance of cryptocurrencies through his business activities. Tesla once accepted Bitcoin as a payment method, and SpaceX announced a space mission using Dogecoin. These actions have had a significant impact on the popularization and industrial development of cryptocurrencies.

Musk's support for cryptocurrencies means more than just investment. He sees cryptocurrencies as symbolizing and promoting decentralization and freedom, and as a global speaker, he's expected to continue contributing to the growth and development of the cryptocurrency market.

The cryptocurrency market experiences stronger network effects as participation grows, and active support from global celebrities like Musk has significantly contributed to crypto's worldwide adoption. (Source: AP)

James David Vance (J.D. Vance) is a Senator from Ohio and a young politician born in 1984. With a career as a bestselling author and venture capitalist, he has expressed strong support for cryptocurrencies.

Vance's memoir "Hillbilly Elegy," which was also made into a Netflix film, elevated him to bestselling author, vice president, and a leading contender for power in the post-Trump era. (Source: Netflix)

In July 2024, former President Trump nominated Vance, from Ohio, one of the Rust Belt regions, as his vice-presidential candidate. This decision was received quite positively in the cryptocurrency industry. He personally holds Bitcoin and is known to own about $1,000,000 (approximately 1.4 billion KRW) worth of Bitcoin as of 2025.

Vance sees cryptocurrencies as a key element of financial innovation and has shown his will to strengthen the competitiveness of the U.S. economy through them. He has emphasized that "cryptocurrencies symbolize freedom and are an essential element for America's economic future" and has expressed his strong support for the cryptocurrency industry.

Senator Cynthia Lummis is one of the strongest advocates for cryptocurrencies in U.S. politics. The Wyoming native was appointed chairwoman of the Senate Banking Committee's Digital Assets Subcommittee on January 23, rising to a position where she can make a substantial impact on U.S. cryptocurrency policy. She has personally held Bitcoin for a long time and considers it not just an investment asset but a national strategic asset.

Her core argument is simple: "Bitcoin is the digital gold of the 21st century, and the United States should stockpile it strategically." This is based on the belief that Bitcoin will play an important role in the global financial hegemony competition of the future, just as traditional gold reserves once determined a country's economic stability and credibility. In July 2024, she introduced the "BITCOIN Act." This bill proposed a specific plan for the U.S. government to purchase 200,000 bitcoins annually for five years, totaling 1 million bitcoins, to secure about 5% of the total bitcoin supply and manage it as a national strategic reserve asset.

Lummis's appointment as chairwoman of the Senate Banking Committee's Digital Assets Subcommittee immediately after Trump's inauguration is interpreted as a clear signal that the United States intends to use cryptocurrencies as a strategic economic tool. Regarding this, former Binance CEO Changpeng Zhao (CZ) evaluated on January 24, 2025, through his X (formerly Twitter) account that "Senator Lummis's appointment is a signal that the U.S. strategic Bitcoin stockpile is almost confirmed." He analyzed that the United States is likely to establish a clear policy on Bitcoin and formalize government Bitcoin purchases. This means the U.S. is entering the stage of actually accumulating Bitcoin as a national asset, beyond the level of political discussion.

Senator Lummis's appointment as chair of the Digital Assets Subcommittee signaled that the U.S. Strategic Bitcoin Reserve plan had already been confirmed before the Digital Assets Working Group's policy recommendations. (Source: Forbes)

With the formation of the Trump administration's pro-cryptocurrency brigade, U.S. digital asset policy is fundamentally changing. While the previous Biden administration considered cryptocurrencies as risks to be regulated, the Trump administration sees them as a growth engine for the U.S. economy and a key means to solve debt problems. This change in perception is rapidly moving from a mere rhetorical level to the actual policy implementation stage.

First, the regulatory environment is rapidly changing. Under new pro-cryptocurrency leadership, the SEC is amending unclear regulatory guidelines and preparing a clear framework for cryptocurrency companies to operate legally. Additionally, a new financial infrastructure centered on stablecoins and Bitcoin is being built. Treasury Secretary Scott Bessent and White House Cryptocurrency & AI Czar David Sacks will focus on reshaping the U.S. financial system around the institutionalization of stablecoins and the strategic asset utilization of Bitcoin.

All these flows point in one direction: "The United States is trying to build a new economic hegemony through digital assets." Just as the United States built global financial hegemony by making the dollar the reserve currency in the late 20th century, it's now trying to establish financial hegemony once again by utilizing cryptocurrencies and blockchain in the 21st century.

And in this process, the most important element is the role of the U.S. dollar. In the traditional financial order, the dollar had an absolute status as the reserve currency. But in recent years, China and several other countries have shown de-dollarization movements, creating cracks in the dollar-centered global financial order. The Trump administration is preparing a new evolutionary model for the dollar, namely "Dollar 4.0," to respond to these changes.