Trending Now

- 1KOSPI

8

- 2Hollywood

8

- 3KOSDAQ

7

- 4shutdown

-2

- 5Bitcoin

-1

- 6ETF

4

- 7Mastercard

3

- 8dollar

2

- 9Ethereum

1

- 10stablecoin

by D.X.

2025-04-01 19:30:15

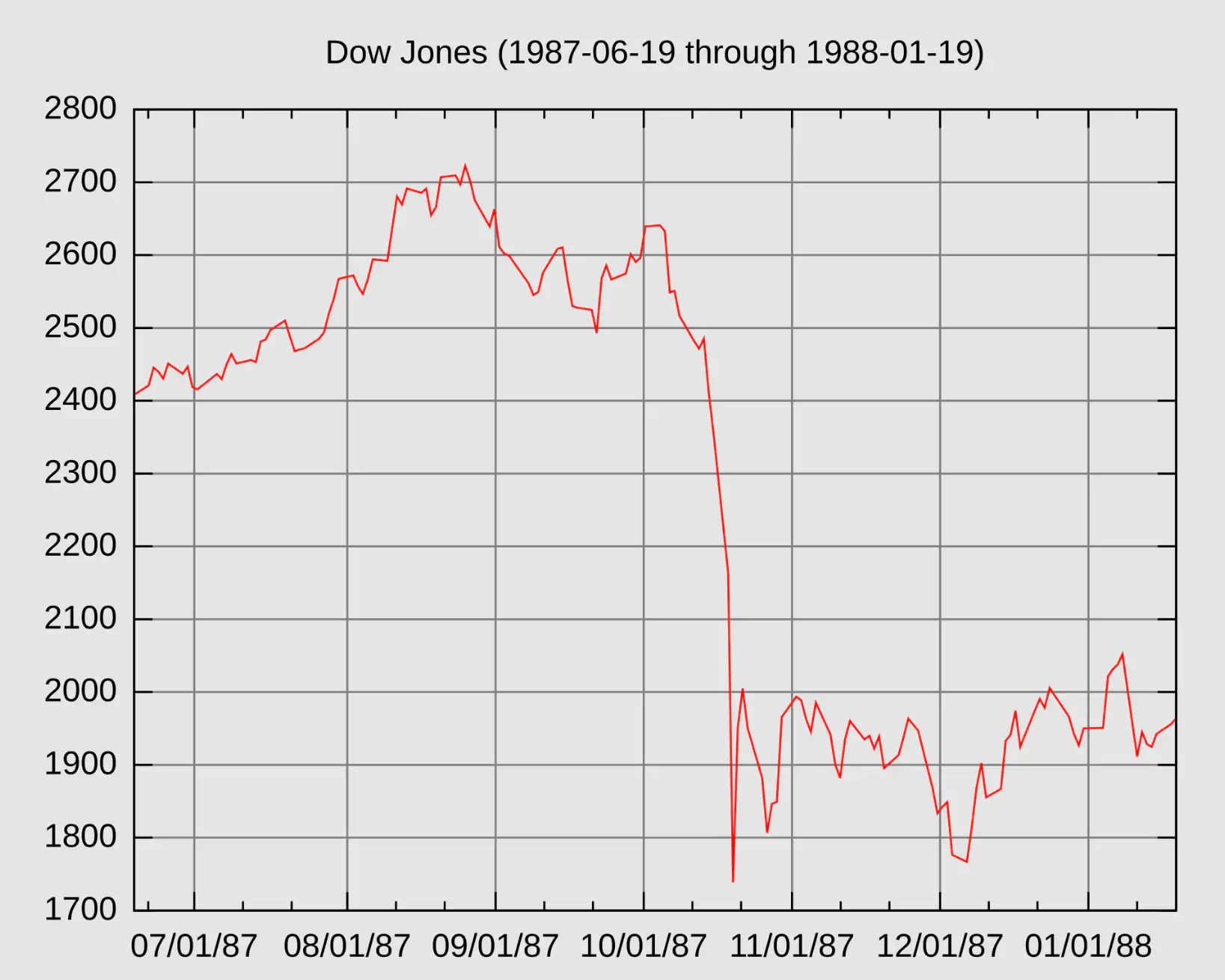

In the years leading up to 1987, the U.S. stock market experienced a steep and prolonged rally. From 1982 to August 1987, the Dow Jones Industrial Average more than tripled, raising concerns about overvaluation relative to corporate earnings. At the same time, the United States was dealing with both fiscal and trade deficits, along with rising interest rates, a weakening dollar, and currency instability — a combination of macroeconomic risks.

Program trading and portfolio insurance were newly adopted trading strategies at the time. These mechanisms were designed to automatically execute large-scale sell orders in the event of price declines. Especially in the futures and options markets, once the stock index fell past certain thresholds, automated selling was triggered, adding further downward pressure to the equity markets. This created a self-reinforcing cycle of selling pressure — a so-called “selling spiral.”

The price declines that began in mid-October created significant unease among investors. On the weekend of October 17, the U.S. Treasury Secretary's comments supporting a weaker dollar shook confidence in economic policy. As Asian markets fell ahead of the U.S. open on Monday, panic spread rapidly. Investors rushed to sell, and the resulting mass panic became one of the primary triggers of the historic crash.

On October 19, 1987, known as Black Monday, stock markets around the world plunged in a historically synchronized crash. The decline started in Asia, spread to Europe, and finally culminated in the collapse of the U.S. market. The following day, due to time zone differences, Japan and other Asian markets experienced their own versions of Black Monday.

Immediately following the crash, the U.S. Federal Reserve announced its commitment to provide liquidity to support the financial system. Through short-term interest rate cuts and guidance to commercial banks to continue lending, the Fed successfully prevented the crash from spilling over into a broader financial crisis or economic recession.

The SEC and CFTC allowed temporary trading halts and began investigating the structural vulnerabilities of the market. Reforms were introduced to regulate program trading, reduce settlement times, and better integrate cash and derivatives markets.

Following Black Monday, circuit breaker mechanisms were introduced to temporarily halt trading when indices decline beyond a certain threshold. These remain a critical part of market infrastructure today and are used globally to prevent panic-driven collapses.

Today’s financial markets reflect the lessons of Black Monday. Circuit breakers, price limits, and central bank intervention mechanisms have become standard. During the COVID-19 crash in 2020, circuit breakers were triggered multiple times to curb extreme volatility.

Black Monday revealed how poorly designed financial engineering — such as portfolio insurance — can exacerbate market crashes rather than mitigate them. The event led to greater awareness of systemic risk, as well as calls for ethical and regulatory oversight of financial products and risk models.

The crash demonstrated how tightly interconnected global markets are and how quickly technical and psychological factors can trigger systemic crises. Although modern safeguards exist, risks remain — including from algorithmic trading, excessive leverage, and systemic liquidity crunches.

Black Monday of 1987 was more than a stock market collapse; it was a turning point that exposed the structural weaknesses of modern financial systems, the unintended consequences of financial innovation, and the psychological drivers of market behavior. It remains a defining case study in systemic financial risk, and a catalyst for decades of regulatory and risk management reform.